Overview of the US Treasury Bond Market

The US Treasury bond market is vast, with a total issuance exceeding twice the country's Gross Domestic Product (GDP). It includes various types of bonds such as Treasury bonds, Treasury notes, and Treasury bills. US bonds are considered one of the safe-haven assets in the global financial market, known for their high liquidity and credibility. The yield and price fluctuations of US bonds are widely used as reference indicators in global financial markets, influencing global interest rates, monetary policies, and stock markets extensively.

Seizing the Opportunity: Why is now a good time to buy US bonds?

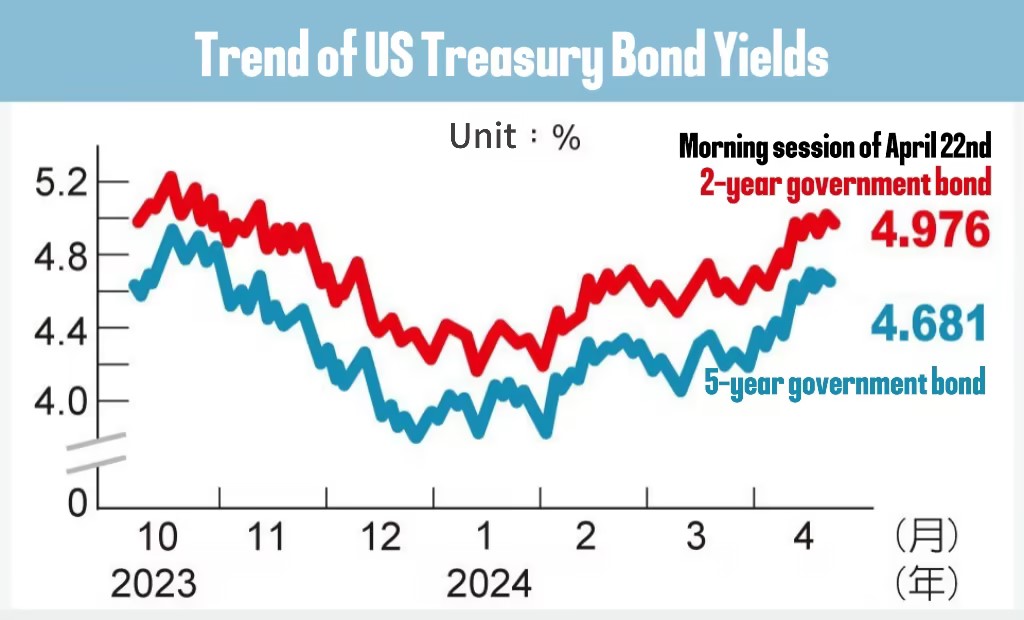

The recent rise in the US dollar and US bond yields is driven by changing expectations regarding monetary policies, influenced by economic data. This month, due to the resilience shown by the US economy, the market has repeatedly pushed back expectations of interest rate cuts by the Federal Reserve (Fed), which has stimulated a surge in US bond yields. With the delay in implementing accommodative monetary policies, US bonds have experienced a new wave of selling pressure, causing the 2-year Treasury yield to surpass 5%. Investors have not seen interest rates this high in over a decade.

(Source: Pengbo Information, 2024.04.23)

(Source: Pengbo Information, 2024.04.23)

Advantages of Investing in US Bonds in a High-Interest Rate Environment

In a high-interest rate environment, long-term bond investments offer several advantages. Firstly, due to higher yields, as long as most central banks refrain from further interest rate hikes, the upward pressure on bond prices will be reduced, allowing investors to solidify their yield advantage. Secondly, even in the event of future interest rate cuts, the yield advantage of bonds does not disappear, and prices are buoyed by the rate cuts. Therefore, positioning bonds during a high-interest rate period allows investors to enjoy the dual advantages of "price" and "yield".

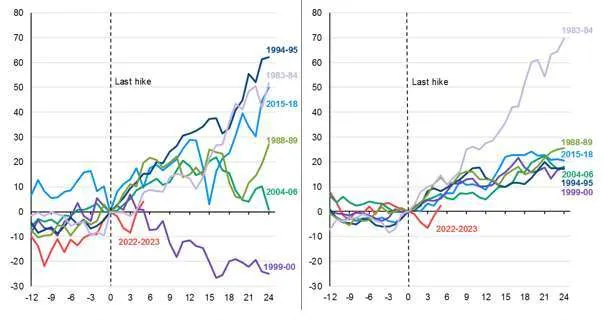

Furthermore, as observed in Chart 1 (right figure), within two years after interest rates peak, even defensive government bonds show comprehensive positive returns. At the same time, when comparing the performance with stock assets during the same period (left figure), it can be noted that bond assets' returns within two years are comparable to stocks in five out of seven instances (1983-1984, 1988-1989, 1999-2000, 2004-2006, 2022-2023), and sometimes even surpass stocks. This indicates that after interest rates enter a plateau phase, it is actually a favorable time to buy US bonds.

(Source: FactSet, Federal Reserve, S&P Global, LSEG Datastream, Morgan Asset Management, 2023.12.31)

(Source: FactSet, Federal Reserve, S&P Global, LSEG Datastream, Morgan Asset Management, 2023.12.31)

In addition to high yields, investing in US bonds has several other advantages:

· Safe-haven asset: US bonds are widely regarded as safe-haven assets, especially during times of increased market uncertainty or decreased risk appetite. In a high-interest rate environment, investors may be more inclined to seek relatively lower-risk investment options, and US bonds, being government bonds, are generally considered safer investments.

· Capital preservation: In a high-interest rate environment, bond prices typically decline. However, the characteristics of US bonds allow them to better preserve their value during rising interest rates. Due to their high liquidity and good creditworthiness, US bonds offer investors greater flexibility when they need to sell them prematurely.

· High liquidity: The US bond market is one of the largest and most active bond markets globally, with high liquidity. This means that investors can more easily buy and sell US bonds and quickly convert them into cash when needed. High liquidity provides investors with greater flexibility and opportunities.

You can purchase US bonds on uSMART HK

Currently, uSMART HK allows the purchase of US bonds. Please stay tuned for the latest information.

By purchasing US bonds on uSMART, you can enjoy the following advantages:

1. Low commissions and low-cost trading

2. Low investment threshold

3. 24/7 trading availability

4. Intelligent investment tools