What is bond?

Bond is basically a standard written acknowledgement of debt. Subject to different debtor, bond can be classified into government bond, urban construction investment bond, corporate bond and asset-backed securities, and so on. In the absence of default, bond holder would be able to receive interest payment as promised, and collect the principle at maturity.

US government bond is the government debt issued by US Treasury, guaranted by US national credit, and is considered an ultra-low risk financial product.

Advantages of investing in US bond

Fixed income

US bond provides stable annual

Interest payment, ensuring creditors

Receive predictable return

High liquidity

the largest bond market in the

world, convenient buy&sell, fast cashflow

Top safety

guaranted by US government, low default risk,

A safe asset recognized globally

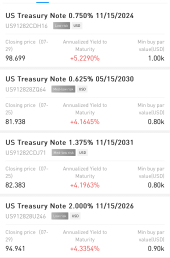

High return potential

benefited by FED's monetary policy,

the highest return surpass 5.0%. *

Hedging

as safe haven, US bond contributes to a risk-balanced portfolio

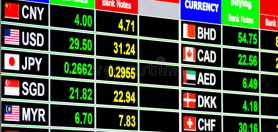

Exchange rate return

strong US dollar provides extra opportunity to gain from

Exchange rate for non-USD investors

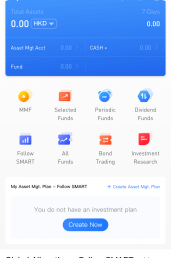

Investing US bond in uSMART

Low entrance barrier

0 Means Test

1000 USD entrance

Various forms

different forms

Convenient investent

0 lock-up period

0 revenue cap

Safety ensured

high security and relatively

High risk premium

How to trade US Treasury bonds on uSMART

1

2

3

4

5

Open uSMART app

Click "Wealth+" in the bottom section of the app

Select "Bond trading"

Choose the US bonds you like, then click "buy"

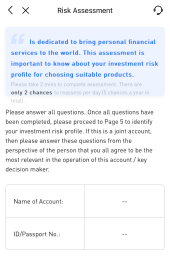

Take about 2 minutes to finish the Risk Evaluation Test and show your acknowledgement to the risk of US bonds

FAQs

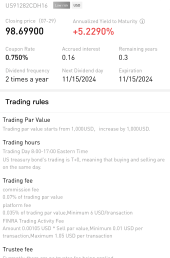

How much is the interest payment and how to receive payment?

How is the security of US bond? Is the principal and return guaranted?

Who is suitable to investing in US bond?

What are the rules of trading US bond?

Do I have to hold the bond until maturity?