You are browsing the Hong Kong website, Regulated by Hong Kong SFC (CE number: BJA907). Investment is risky and you must be cautious when entering the market.

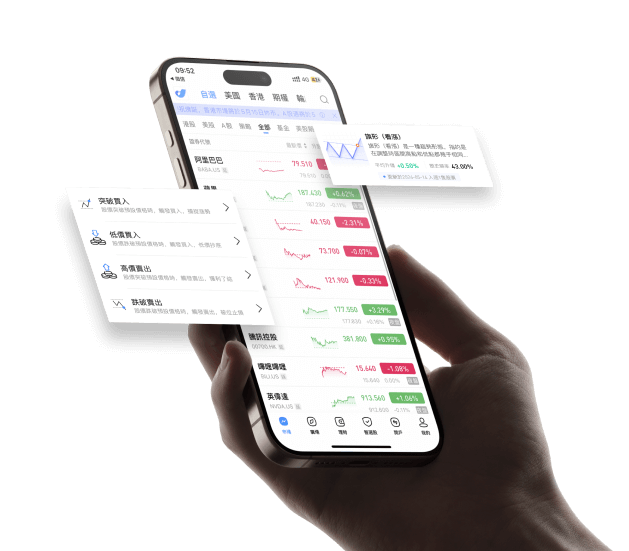

Trading

uSMARTPORT

English

返回

Hong Kong

Trading

uSMARTPORT

uSmart Securities Limited

is a licensed corporation approved by the Hong Kong SFC (CE number: BJA907) holding Type 1 Licence for Dealing in Securities, Type 2 Licence for Dealing in Futures Contracts, Type 4 Licence for Advising on Securities, Type 5 Licence for Advising on Futures Contracts, Type 6 Licence for Advising on Corporate Finance, and Type 9 Licence for Asset Management.

Low-Cost HK Stock Trading

Unlock your investment potential in HK stocks

Free HK ETF Trading*

Monthly Stocks Saving Plan

Real-Time Streaming Service

Instant deposit with eDDA or FPS

*T&C apply

Phone Number

+852

Verification code

Read and agree to Service Agreement and Privacy Policy

Hong Kong Stock Trading Products

Hong Kong Stocks

Includes blue-chip stocks, red chip companies, and H Shares.

Hong Kong ETFs

Trade diverse ETFs: Virtual Asset ETFs, Leveraged ETFs, Index ETFs, etc.

IPO (Initial Public Offering)

With up to 10x leverage.

Warrants

Seize opportunities and maximize investment returns.

Callable Bull/Bear Contracts (CBBC)

Risk hedging and Arbitrage.

Inline Warrants

Precisely lock in profits with targeted strategies.

Low-Cost for

Effortless Investing

Why uSMART

eDDA allowing users to deposit in a more secure, faster, and simpler way

Funds Held in Bank Trust Accounts for Safekeeping

Online Account Opening in Just 3 Minutes

Real-time Automatic Currency Conversion via the App (Supports HKD, USD, CNY, SGD)

Investor Compensation Fund: Protection of up to HK$500,000

FAQs

What are the trading hours for uSMART Hong Kong Stock Trading?

The Hong Kong stock market is open from Monday to Friday.

Pre-opening session: 9:00 am - 9:30 am,Morning trading session: 9:30 am - 12:00 pm,

Lunch break: 12:00 pm - 1:00 pm,

Afternoon trading session: 1:00 pm - 4:00 pm,

Closing auction session: 4:01 pm - 4:10 pm

What is the minimum trading unit for Hong Kong stocks?

Hong Kong stocks are traded in board lots and cannot be bought on a per-share basis. The minimum trading unit for Hong Kong stocks is typically referred to as "1 board lot," which can consist of 100 to 2000 shares, depending on the specific stock. For example, Tencent Holdings has a board lot size of 100 shares. The trading unit may vary for different stocks, and you can refer to the Hong Kong Stock Exchange for more details. Quantities less than one board lot are considered "odd lots."

What is the trading and settlement mechanism for Hong Kong stocks?

The Hong Kong stock market follows a T+2 settlement mechanism. This means that after buying or selling stocks on the current trading day (T0), the settlement of funds and stock delivery will take place on the second trading day (T+2).

What is the "Dual Counter" trading?

The Hong Kong Stock Exchange has introduced the "Dual Counter" trading, which allows investors to trade stocks in Renminbi (RMB) and enables cross-counter transactions. The initial list of stocks available for dual counter trading includes Tencent, Alibaba, China Mobile, and others, accounting for over one-third of the total market capitalization of Hong Kong stocks and contributing to around 40% of the daily trading volume. This move is beneficial for the internationalization of the Renminbi.

What are "Northbound" and "Southbound" flows?

When reading stock analysis and financial news, you may come across terms like "Southbound flows" and "Northbound flows," which can be confusing for novice investors. "Southbound flows" refer to Mainland Chinese investors buying Hong Kong stocks through the Stock Connect program, while "Northbound flows" represent foreign investors buying Mainland Chinese stocks through the same program. The terms "Northbound" and "Southbound" are used because Mainland China is located to the north of Hong Kong, and the term "water" symbolizes wealth. Additionally, many Hong Kong residents have their ancestral roots in Guangdong province, where Cantonese is spoken, hence the reference to "Northbound flows" for funds coming from the north.

Services

About Us

Agreement Statement

Headquarters

Sheung Wan

Address:

Room 2405-06, 24/F, 308 Central Des Voeux, Sheung Wan, Hong Kong

(3-mins walk from MTR Sheung Wan Station Exit A2)

Room 2405-06, 24/F, 308 Central Des Voeux, Sheung Wan, Hong Kong

(3-mins walk from MTR Sheung Wan Station Exit A2)

North District

Address:

1718-1721, Level 17 Landmark North, 39 Lung Sum Avenue, Sheung Shui, New Territories, Hong Kong

(Steps away from MTR Sheung Shui Station Exit A4)

1718-1721, Level 17 Landmark North, 39 Lung Sum Avenue, Sheung Shui, New Territories, Hong Kong

(Steps away from MTR Sheung Shui Station Exit A4)

Sheung Wan

Opening Hour: Trading Days: 09:00-18:00

Non-trading Days: Closed

North District

Opening Hour: 9am - 6pm (Mon - Sat)

Close (Sun and Public Holiday)

Investment Banking

Admiralty

Address:

Room 2602A, 26/F, Tower 1, Lippo Centre, 89 Queensway, Admiralty, Hong Kong

(Steps away from MTR Admiralty Exit B)

Room 2602A, 26/F, Tower 1, Lippo Centre, 89 Queensway, Admiralty, Hong Kong

(Steps away from MTR Admiralty Exit B)

Admiralty

Opening Hour: Trading Days: 09:00-18:00

Non-trading Days: Closed

uSMART Branches

Sheung Shui Headquarters

Opening Hour: 9am - 6pm (Mon - Sat)

Close (Sun and Public Holiday)

Lok Ma Chau Branch

Opening Hour: 9am - 6pm (Mon - Sat)

10am - 6pm (Sun and Public Holiday)

West Kowloon Branch

Opening Hour: 9am - 6pm (Mon - Sat)

10am - 6pm (Sun and Public Holiday)

Tsim Sha Tsui Branch

Opening Hour: 10am - 9pm (Mon - Sat)

10am - 6pm (Sun and Public Holiday)

Causeway Bay Branch

Opening Hour: 10am - 9pm (Mon - Sat)

10am - 6pm (Sun and Public Holiday)

Tsuen Wan Branch

Opening Hour: 10am - 7pm (Mon - Sat)

10am - 6pm (Sun and Public Holiday)

Tai Wai Branch

Opening Hour: 10am - 7pm (Mon - Sat)

10am - 6pm (Sun and Public Holiday)

Tuen Mun BranchComing Soon

Kai Tak BranchComing Soon

Mong Kok BranchComing Soon

uSmart Securities Limited

is a licensed corporation approved by the Hong Kong SFC (CE number: BJA907) holding Type 1 Licence for Dealing in Securities, Type 2 Licence for Dealing in Futures Contracts, Type 4 Licence for Advising on Securities, Type 5 Licence for Advising on Futures Contracts, Type 6 Licence for Advising on Corporate Finance, and Type 9 Licence for Asset Management.

Copyright © 2022 uSMART . All Rights Reserved.

Please login first