What is a fund?

A fund is a collective pool of funds contributed by multiple investors, which is then used to invest in various assets such as stocks, bonds, money markets, etc. It is managed by a professional team or fund manager. The fund manager, based on the fund's investment objectives and strategies, is responsible for selecting and managing the investment portfolio, aiming to achieve returns for the investors. Investors purchase units or shares of the fund, allowing them to share in the profits and risks associated with the fund's investment portfolio.

Advantages

of Investing in Funds

Professional Management

Funds are managed by professional teams or fund managers who make informed investment decisions based on market conditions and investment objectives. Their expertise and experience help optimize returns and effectively manage risks.

Diversification

Funds allocate investments across different asset classes such as stocks, bonds, currencies, etc., achieving diversification and hedging against various markets and industries.

Liquidity

Investors can buy and sell fund shares in the fund market as per their needs, providing relatively high liquidity and enhancing the flexibility of funds.

Small Investments

Funds typically allow investments with smaller amounts, making them suitable for various types of investors. Even with limited funds, investors can start building their investment portfolios.

Follow Smart

Developed by the uSMART Investment Research Team, the "Balanced Combination of Growth and Preservation" Asset Allocation Strategy.

Constantly monitor market dynamics

Real-time adjustmento f positions

Increase returns while reducing risk

Optional starting investment threshold

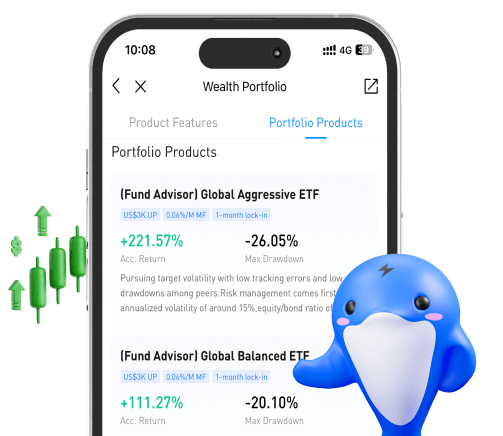

Why Choose

uSMART Investment Funds

Double Buying Power

Access 50% of your funds anytime to buy stocks, making portfolio turnover easier!

0 Transaction Fees

Trade without the burden of fees, have full control over your buying and selling!

No Lock-in Period for Funds

Flexibly buy and sell, with no restrictions on fund movements!

Starting from USD 100

Easily surpass the ultra-low threshold!

FAQs

How do I choose the right investment fund for myself?

What are the risks associated with investing in funds?

How do I evaluate the performance of an investment fund?

What expenses are included in fund fees?