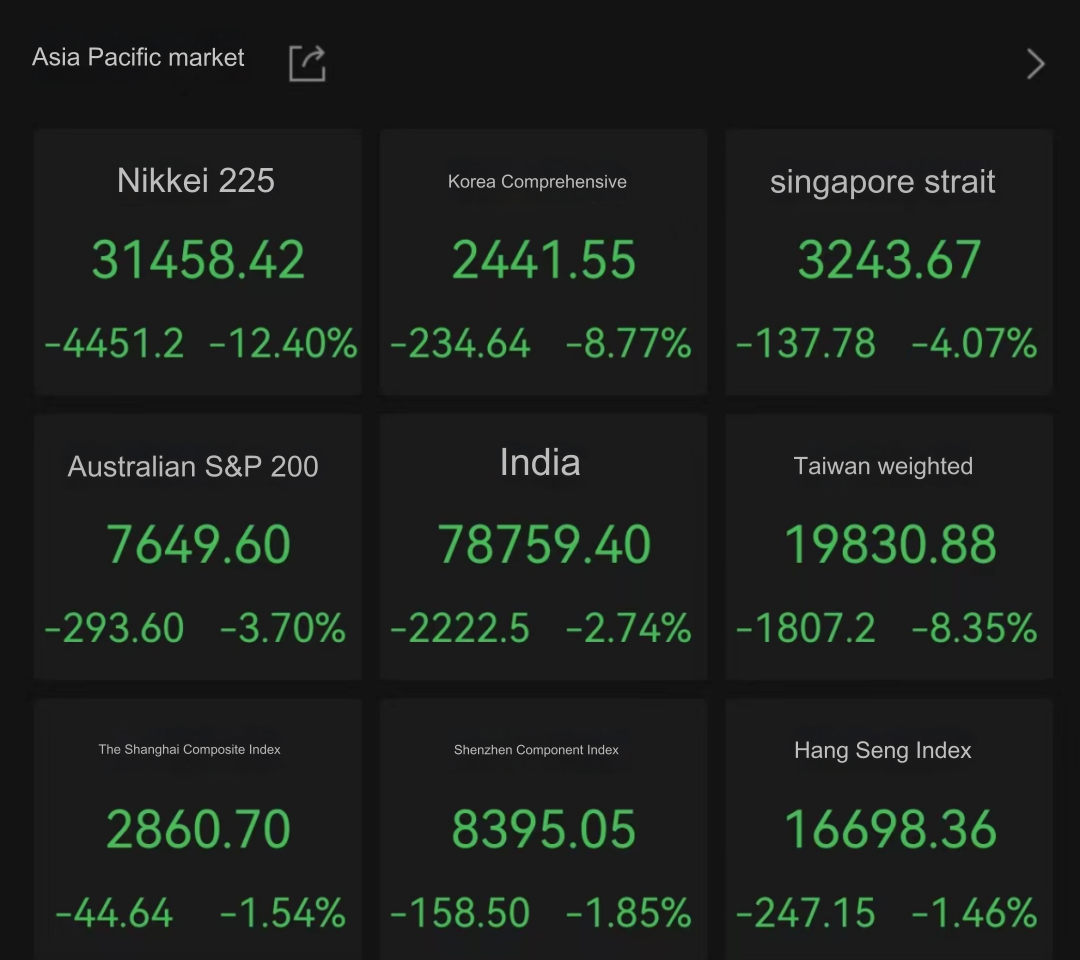

On August 5, the Nikkei 225 Index closed down 4,451.28 points to 31,458.42 points, the largest drop in history, with a drop of 12.4%. Nikkei 225 Index futures and Topix Index futures triggered the circuit breaker mechanism downwards, and trading was temporarily suspended. On the same day, this sentiment also spread to European and American markets. U.S. stocks suffered a critical hit, with the Dow Jones Industrial Average plummeting by thousands of points and the S&P 500 Index recording its largest single-day decline in the past two years.

Several brokerages stated that the market fluctuated greatly during the night trading period on August 5. Affected by the trading failure of the upstream service provider Blue Ocean, the U.S. stock night trading submitted between 1:45 a.m. and 4:00 a.m. Eastern Time on August 5 All orders were cancelled.

It is reported that system anomalies in the upstream U.S. stock market at night on August 5 caused the night trading orders of some clients of these brokers to be canceled due to upstream cancellations, and caused the accounts of some customers to be canceled due to night trading orders during normal trading hours. The reason was abnormal short selling orders, which resulted in huge losses.

What is Blue Ocean?

Blue Ocean was founded in 2016. Its main business is to allow global investors to trade outside of traditional U.S. securities trading hours, that is, during the U.S. overnight session (Sunday 8:00 pm to Friday 4:00 am Eastern Time) Match buy and sell orders for U.S. National Market System (NMS) stocks, enabling 24-hour U.S. stock trading.

Blue Ocean issued a statement on Tuesday saying that due to the surge in U.S. stock trading volume, the trading system encountered a problem at 1:45 a.m. Eastern Time on August 5, so from that time to the company shutting down the matching engine (3:06) All transactions are cancelled.

Blue Ocean further revealed to the media that the problems encountered by the platform are related to capacity. It is reported that before the incident, the company had started migrating its system to the Member Exchange (Members Exchange) jointly established by many top traders such as JPMorgan Chase, Goldman Sachs, and Morgan Stanley. A company spokesperson said that the new system is designed to cope with the challenges of higher trading volume and volatility and will be launched at the end of August.

U.S. stocks open night trading

Night trading of U.S. stocks is actually a product that has only gradually become mainstream in the past two years. Inspired by the round-the-clock trading of cryptocurrencies, traders on Wall Street are also beginning to explore the potential of "early morning trading." Blue Ocean's alternative trading system was established in 2019 and has been gradually adopted by brokerages around the world in recent years.

U.S. stock market night trading session

U.S. stock market night trading refers to the period during which trading continues after the regular trading hours of U.S. stock exchanges. This special trading session provides investors with an opportunity to continue trading U.S. stocks.

|

|

Eastern Time |

Beijing (Hong Kong) Time |

|

Daylight Saving Time |

20:00-04:00 |

08:00-16:00 |

|

Winter time |

20:00-04:00 |

09:00-17:00 |

Issues related to US stock market night trading

●Only valid limit orders for the day are supported during the current night session. Please note that unfilled night trading orders will automatically expire at the end of the night trading session.

●Short selling is not supported in night trading.

●Night trading does not currently support placing orders in advance. Currently, it only supports submitting night trading orders during the night trading time period.

●Night trading is the T+1 period and belongs to the next trading day. For example, the night trading on Monday night, Eastern Time, belongs to Tuesday's trading day.

Advantages of night trading

●Extended trading hours: Investors can execute transactions outside of regular trading hours to capture changes in global markets and important company announcements.

●Market reaction is rapid: Since night trading can be conducted immediately after the company releases financial reports or major news, investors can quickly adjust their investment portfolios.

●Convenience: For those who do not have time to pay attention to the market during the day, night trading provides additional opportunities to make investment decisions. At the same time, it facilitates investors from other countries to invest in U.S. stocks in terms of time.

Risks of night trading

●Lower liquidity: Due to fewer participants, the liquidity of night trading is usually not as high as during regular hours, which can result in larger bid-ask spreads.

●High price fluctuations: Low liquidity may lead to drastic price fluctuations, causing transaction prices to deviate from expectations.

●Information asymmetry: During night trading hours, market information may not be as transparent as during regular hours, and investors face increased risks of information asymmetry.

●Capital flight: The establishment of night trading may cause more global funds to flow into the US stock market, weakening the attractiveness of other global securities markets.

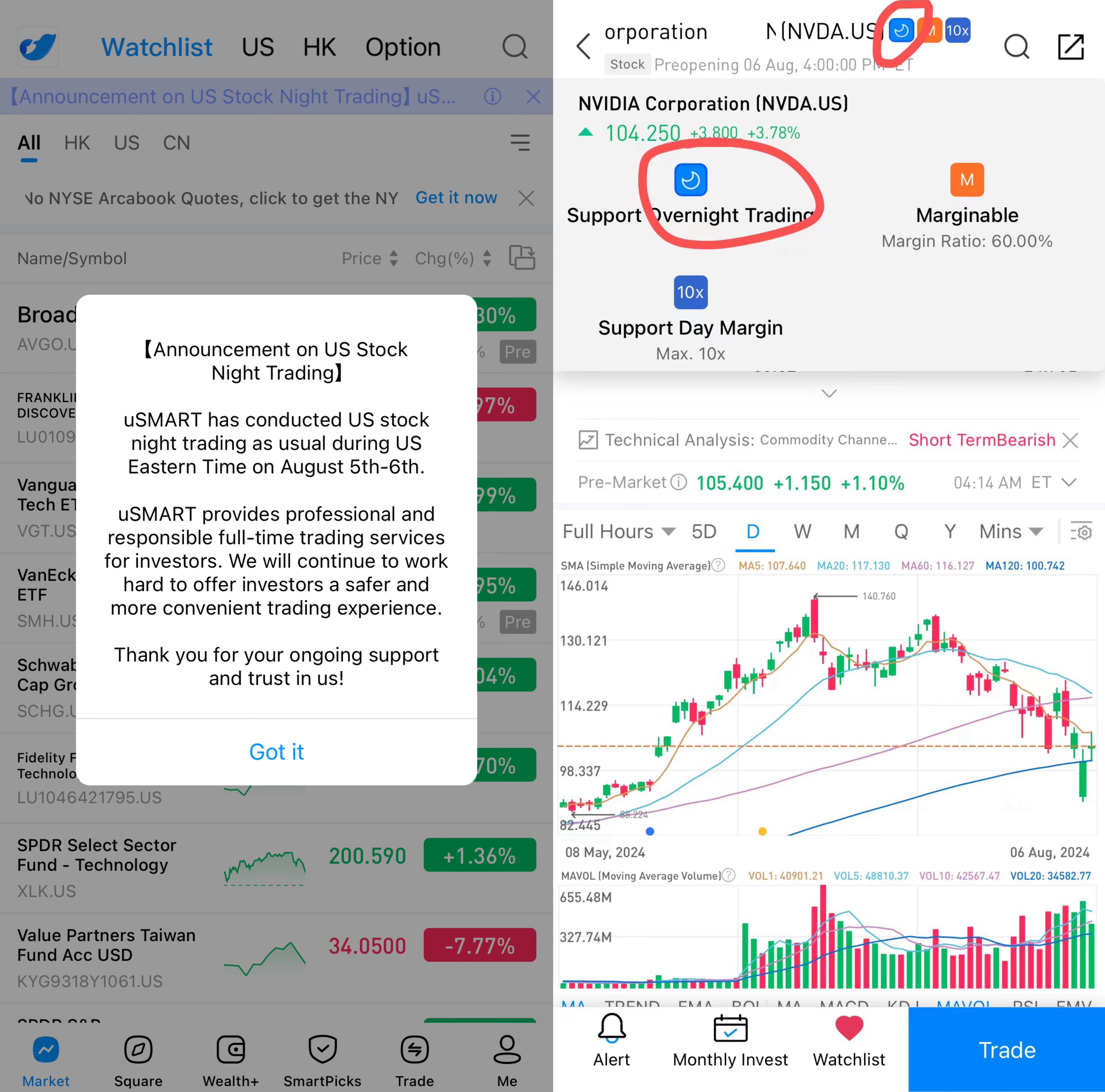

Under the impact of "Black Monday", uSMART still protects investors' rights to conduct night trading of U.S. stocks

uSMART has conducted US stockniaht trading as usual during USEastern Time on August 5th-6th.

uSMART provides professional andresponsible ful-time trading servicesForinvestors,We wil continue to workhard to offer investors a safer andmore convenient trading experience.

Thank you for your ongoing supportand trust in us!

(Source: uSMART)