What is a Fund?

A fund is an investment tool managed by a professional asset management company, where multiple investors pool their resources. Funds aggregate funds from various investors to invest in different financial assets such as stocks, bonds, money market instruments, and other financial products. Each type of fund represents different investment objectives, suitable for investors who may not have much time for research or are not adept at analysis. They allow for the diversification of investments with relatively low capital. However, investing in funds entails costs such as transaction fees, management fees, custody fees, and account fees, which indirectly impact investors' returns.

Types of Funds

There are various types of funds, each with its specific investment strategy and risk-return characteristics.

|

Stock Funds |

Primarily invest in the stock market with the goal of long-term capital appreciation. Due to their investments in stocks, these funds typically carry higher risk and volatility. |

|

Bond Funds |

Primarily invest in the bond market, including government bonds, corporate bonds, and other fixed-income products. The objective of bond funds is to provide stable income and capital protection. Compared to stock funds, bond funds generally have lower risk and volatility. |

|

Balanced Funds |

Invest in other funds. The drawback is that two management fees are charged. In addition to the management fee for the sub-funds held in the balanced fund, the balanced fund itself also charges management fees to investors. |

|

Mixed Funds |

Invest in both stocks and bonds. Mixed funds aim to balance risk and return, usually adjusting asset allocation ratios based on market conditions and the judgment of investment management companies. |

|

Money Market Funds |

Primarily invest in short-term, low-risk money market instruments such as time deposits, commercial paper, and government short-term bonds. The goal of money market funds is to provide liquidity and short-term returns, and they typically have lower risk. |

|

International/Global Funds |

Invest in stocks, bonds, or other financial assets in international markets. International/global funds provide investors with the opportunity to diversify their investments globally, allowing them to benefit from potential opportunities in international markets. |

|

Sector/Theme Funds |

Focus on specific industries or themes such as technology, energy, healthcare, green energy, etc. They aim to capture investment opportunities in specific industries or themes and adjust their portfolios based on the development trends of relevant industries or themes. |

|

Index Funds |

Index funds are a passive investment method that does not involve subjective judgments by managers in selecting investment targets. Instead, they select an index and establish an investment portfolio according to its rules. |

|

ETFs (Exchange-Traded Funds) |

Index stock funds also track the performance of a specific index and, like stocks, are listed on centralized markets, allowing investors to buy and sell them independently. For example, the popular "Yuanta Taiwan Top 50 Fund (0050)" in recent years tracks the top 50 stocks in terms of market value in Taiwan's stock market. Individual investors can invest in these large companies with small amounts of capital. |

How to Choose Funds?

● Step 1: Determine Asset Allocation Ratio

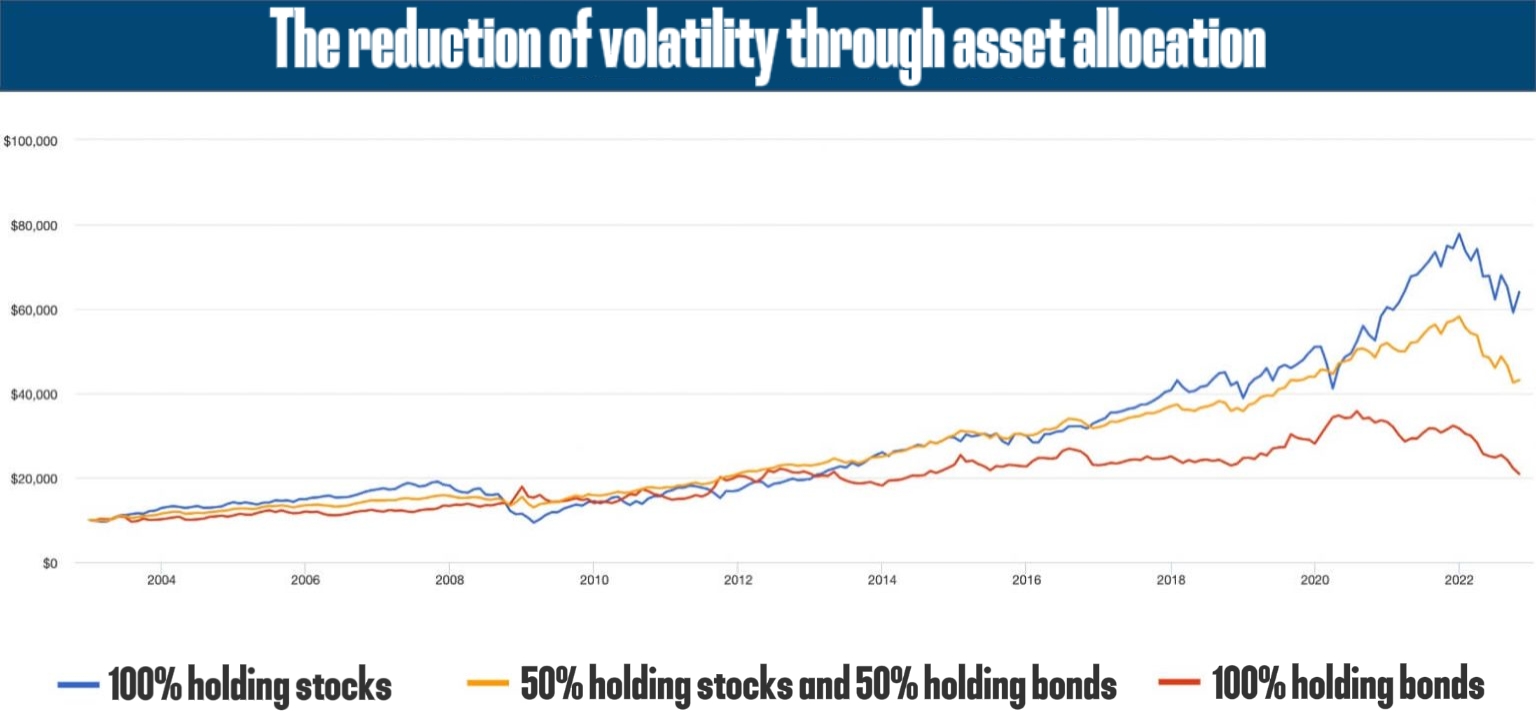

Before stepping into the field of fund investment, investors must first clarify their investment objectives. The primary purpose of determining asset allocation is to significantly reduce volatility while maintaining returns by investing funds into different types of asset classes (such as stocks, bonds), as shown in the diagram below.

(Source:Mr.Market,2022.12.01)

(Source:Mr.Market,2022.12.01)

Instead of concentrating investments in a single type of asset, diversifying asset allocation can mitigate the significant damage caused by black swan events in the investment market.

● Step 2: Determine Fund Diversification Level

In the fund selection process, determining the level of fund diversification is a crucial step. If investments are overly concentrated in specific industry categories, there may be cyclical risks. Even if you diversify holdings, they may still be concentrated within a specific range when an entire industry experiences a prolonged downturn.

Suppose you hold stocks of multiple energy companies, as well as bonds and REITs (Real Estate Investment Trusts) related to the energy industry in your investment portfolio. This portfolio may be considered diversified because you have multiple different assets within the energy sector.

However, in the event of a recent global decline in energy demand, such as a global economic slowdown or energy oversupply, it could impact the entire energy industry. In such a scenario, not only may the stocks of energy companies decline, but bonds and REITs related to the energy industry may also be affected. The value of bonds may decrease due to increased market credit risk for energy companies, while the value of REITs may decline due to reduced demand for assets such as data centers resulting from decreased demand from energy companies.

True diversification logic should include diversification at three levels:

(1) Asset Diversification: Holding different types of assets such as stocks, government bonds, investment-grade corporate bonds, gold, cash, etc.

(2) Industry Diversification: Avoiding the influence of a single specific industry cycle by investing in country or region-specific ETFs or funds, with investments typically spread across various industries within that country/region.

(3) Stock Holding Diversification: Investing in 1~2 different ETFs or funds of different natures, or creating a diversified investment portfolio oneself.

● Step 3: Understand Fund Expenses

When buying and selling funds, you may encounter the following main expenses, which can be found on the official website or in monthly reports:

|

Fund Fee Items |

Rates and Occurrence |

|

Transaction Fee |

Charged at purchase, 3% for equity funds, 1.5% for bond funds multiplied by any discounts from various channels |

|

Management Fee (Expense Ratio) |

Reflected in the net asset value, mostly between 1% to 2.5% per year, lower for bond funds than for equity, ETFs being the lowest |

|

Custodial Fee |

Reflected in the net asset value, approximately 0.2% |

|

Account Management Fee |

Also known as trust management fee, 0.2% per year, charged at redemption, only applicable when purchased through banks, not incurred when buying through fund platforms |

Be mindful of the related expenses of funds, as high fund expenses can potentially impact the fund's return rate.

● Step 4: Observe Fund Performance Indicators

1. The 4-4-3-3 Rule

The 4-4-3-3 rule, proposed by Professor Chien-Pei (Joseph) Ou and Professor Tsun-Siou Lee, experts in domestic fund evaluation, is a method for selecting funds. It aims to choose funds with excellent performance in the short, medium, and long term based on past performance. The specific steps are as follows:

(1) The first "4" involves selecting funds that rank in the top 25% in terms of one-year performance among funds of the same type.

(2) The second "4" involves selecting funds from the previous step that rank in the top 25% in terms of two-year, three-year, five-year, and year-to-date performance among funds of the same type.

(3) The first "3" involves selecting funds from the previous step that rank in the top 33% in terms of six-month performance among funds of the same type.

(4) The second "3" involves selecting funds that rank in the top 33% in terms of three-month performance among funds of the same type.

2. Stability: Risk Indicators

Common risk measurement indicators include "standard deviation" and "beta value." The "standard deviation" represents the volatility of the fund's returns and is generally used to measure the "total risk" of an investment. A higher standard deviation in a fund's returns indicates greater volatility and higher risk.

The "beta value" represents the magnitude of the fund's volatility relative to an index. For example, a beta value of 0.5 means that if the market rises (falls) by 1%, the fund will rise (fall) by 0.5%. A beta value of 1 indicates that the fund's returns will move in line with the market. A beta value of 1.5 means that if the market rises (falls) by 1%, the fund will rise (fall) by 1.5%. When considering beta values, it is important to also consider the actual returns. If the beta value is close to 1, it indicates that the fund's returns do not deviate significantly from the index, suggesting that the fund has no advantage.

3. Efficiency: Sharpe Ratio and Treynor Ratio

The Sharpe ratio and Treynor ratio use the concept of "return" divided by "risk" to measure the efficiency of an investment portfolio. They measure the "excess return" obtained per unit of risk borne by the portfolio over a certain period.

"Excess return" refers to the extent to which the portfolio's returns exceed a "certain benchmark." Both the Sharpe ratio and Treynor ratio compare the portfolio's returns to the "risk-free rate" to calculate the excess return. The risk-free rate represents the expected return that investors can obtain in a risk-free investment. It is usually considered as the benchmark rate for risk-free investment choices.

Sharpe Ratio = (Return Rate - Risk-Free Rate) / Standard Deviation. A higher Sharpe ratio indicates higher returns and lower volatility for the fund. An intermediate Sharpe ratio indicates lower returns and lower volatility for the fund. A lower Sharpe ratio indicates higher returns and higher volatility for the fund.

Treynor Ratio = (Return Rate - Risk-Free Rate) / Beta Value. A higher Treynor ratio indicates higher excess returns for the portfolio while taking on the same market risk.

Advantages and Disadvantages of Funds

Advantages:

1. Scale of Investment: Funds pool funds from multiple investors to form a large investment portfolio. This allows investors to achieve diversification without requiring a large amount of capital, thus reducing risk.

2. Professional Management: Funds are managed by professional fund management teams who possess expertise and experience in portfolio selection and management. This relieves investors from the need to individually select and monitor securities, saving time and effort.

3. Diversification: Funds typically invest in various asset classes and industries, achieving asset allocation diversification. This helps to reduce the risk associated with specific companies, industries, or markets and improves the overall stability of the investment portfolio.

Disadvantages:

1. Costs: Funds generally charge management fees, sales charges, and other related expenses. These costs can impact investment returns, especially for long-term investors.

2. Market Risk: Fund returns are influenced by market fluctuations, and when the market is unfavorable or asset prices decline, the net asset value of the fund may decrease. Investors need to bear market risk and have reasonable expectations for long-term investments.

3. Uncertainty: Investing in funds involves fund managers' investment decisions, and fund performance can be influenced by factors such as manager expertise and market conditions. Investors cannot predict the future performance of funds with certainty.

4. Capital Gains Distribution: Some funds may generate capital gains when buying and selling assets, and these gains need to be distributed according to relevant laws and tax regulations. Investors need to consider the impact of taxation on investment returns.