Definition and Importance of Inflation

Inflation refers to the phenomenon where the purchasing power of currency decreases over a period of time, typically manifested by a general rise in prices. Inflation has significant implications for individuals' purchasing power, business decision-making, and overall economic stability. Understanding changes in inflation, the strategies and measures taken by policymakers, helps individuals make informed consumption and investment decisions, while also contributing to maintaining smooth economic operations.

Current Inflation Situation in the United States

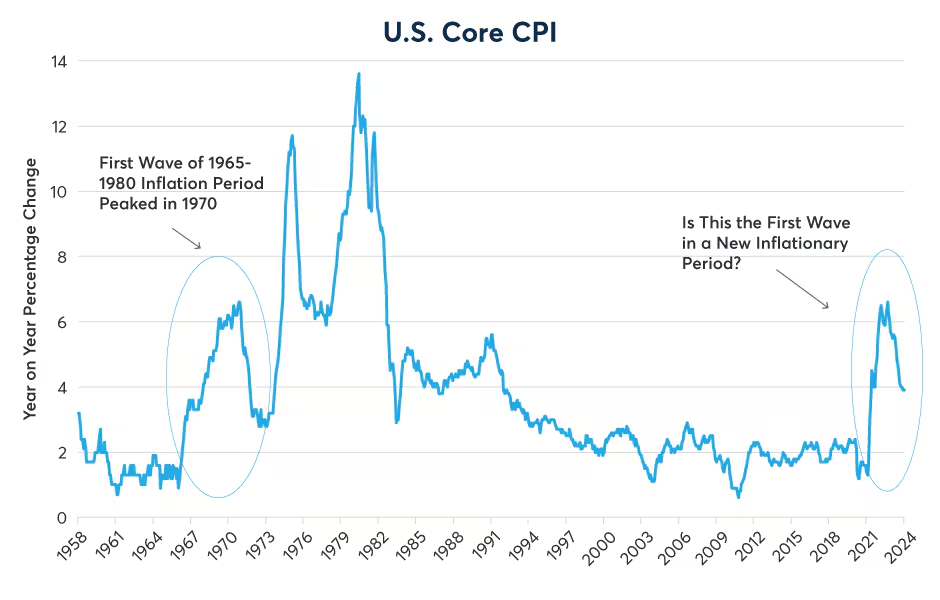

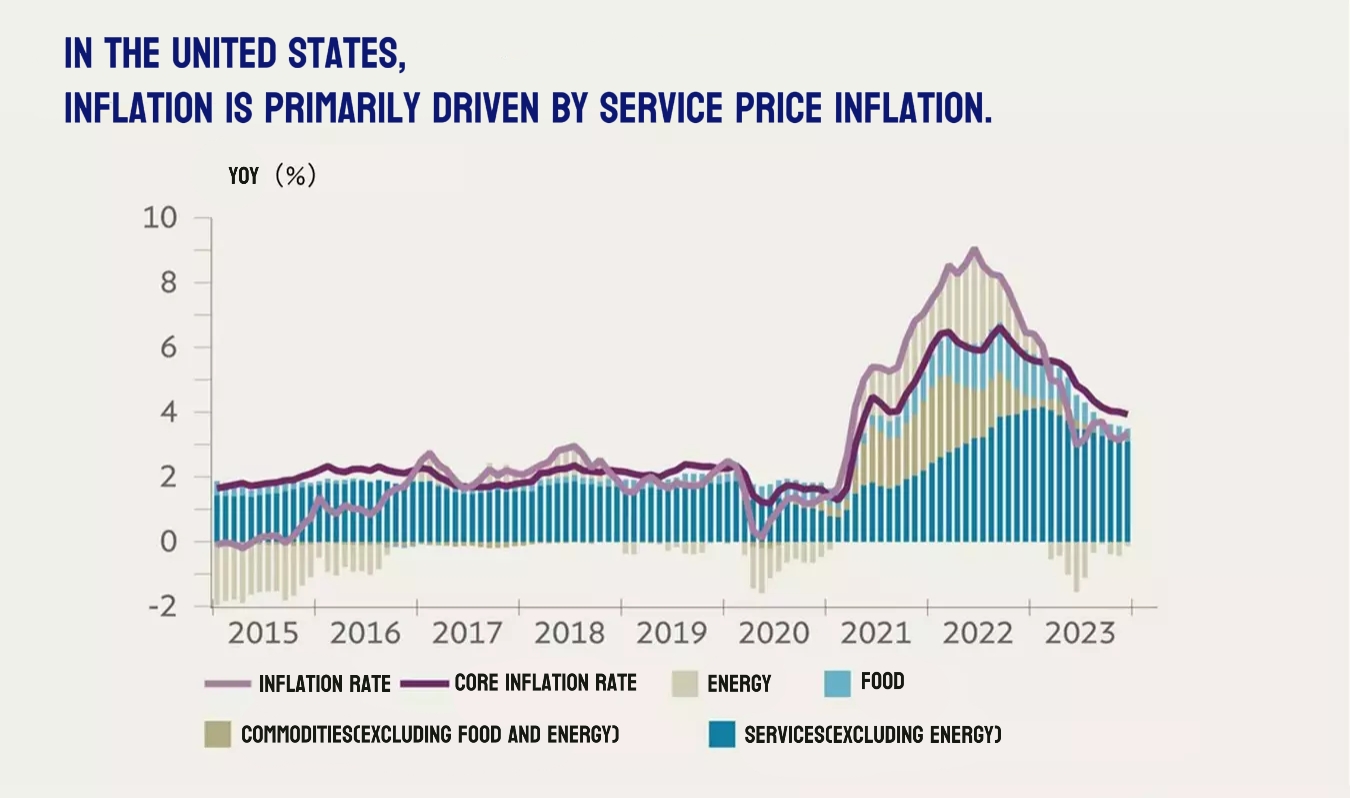

Since reaching a peak of 6.6% in September 2022, the year-over-year increase in the U.S. Core Consumer Price Index (CPI) has declined to 3.9%. Although this level is still roughly twice the average core inflation rate between 1994 and 2020, it remains higher than the Federal Reserve's target. Recent economic data released in the United States shows no signs of cooling down, whether it's the Consumer Price Index (CPI) or the Producer Price Index (PPI). At the same time, the U.S. Institute for Supply Management (ISM) Manufacturing Purchasing Managers' Index (PMI) has once again surpassed the 50 threshold, indicating expansion. This series of data sends a clear signal to the market and investors: inflation may be making a strong comeback.

During the period of January to March 2024, the U.S. core inflation maintained a sequential growth rate of 0.4%. From this perspective, U.S. core inflation appears to be continuing the rebound trend since August last year, and the gap between it and the Federal Reserve's 2% inflation target is widening.

(Source: Bloomberg Professional Service, CPI XYOY, February 25, 2024)

(Source: Bloomberg Professional Service, CPI XYOY, February 25, 2024)

· Factors Driving Inflation Upward

1.Elevated housing price inflation levels

2.Stagnant commodity prices, while food price inflation has slowed down

3.Tight labor market

4.Rise of protectionism and economic populism

5.Escalation of geopolitical tensions and increased military and infrastructure spending

(Source: Macrobond, Credit Suisse, January 16, 2024)

(Source: Macrobond, Credit Suisse, January 16, 2024)

The relationship between inflation and U.S. Treasury bonds can serve as an indicator of inflation pressure.

Impact of Inflation on U.S. Treasury Bonds and their Relationship

· Increasing inflation expectations lead to rising bond yields

1.Impact on real returns

Rising inflation reduces the real returns of fixed-rate bonds. Real returns refer to the bond yield minus the inflation rate. When inflation expectations increase, investors expect higher real returns to maintain or increase their purchasing power. Therefore, they may demand higher yields to purchase newly issued government bonds, resulting in an increase in bond yields.

2.Market demand and supply

When inflation expectations increase, investors may reduce their demand for government bonds. They may shift towards other asset classes such as stocks or commodities to cope with inflation pressures. This shift in demand may result in an oversupply of government bonds in the market, thereby pushing up bond yields.

3.Adjustments in monetary policy

Central banks typically respond to inflation and may adjust monetary policy to control it. If the central bank raises interest rates or tightens monetary supply, this will push up interest rate levels, including the yield of government bonds.

4.Expectation of risk premium

Increasing inflation expectations may raise investors' demand for future risk premiums. This is because inflation may lead to economic instability or increased uncertainty. Investors may require higher returns to compensate for this risk, which will push up bond yields.

· Inverse Relationship Between Bond Prices and Inflation

1.Fixed-rate characteristic

Most bonds are issued with fixed interest rates, meaning their coupon rates are determined and do not change over time. When the inflation rate rises, the future purchasing power of fixed-rate bonds is eroded. As investors consider this, they demand higher interest rates when purchasing bonds. This leads to a decrease in the market price of existing fixed-rate bonds to provide comparable real returns to newly issued bonds.

2.Shift in investor demand

Rising inflation may reduce investors' demand for fixed-income investments as the real returns from these investments may not be sufficient to counter inflationary pressures. Investors may shift towards other asset classes such as stocks or commodities to hedge against inflation. This shift in demand can result in an oversupply of bonds in the market, putting pressure on bond prices.

3.Adjustment in interest rate markets

When inflation rises, central banks may take monetary policy measures to control it, such as raising interest rates. Increasing interest rates affect both short-term and long-term rates. As bond prices have an inverse relationship with interest rates, rising interest rates have a negative impact on the prices of existing bonds.

Recommendations for Bond Allocation Considering Inflation Pressure

1.Short-term government bonds

Short-term government bonds typically have lower interest rate risk and shorter maturities, making them relatively resilient to inflationary pressures. The returns on short-term government bonds usually correspond to short-term interest rate levels, which may be influenced by central bank monetary policy. Therefore, short-term government bonds can serve as a hedge against inflation risk.

2.Floating-rate bonds

Floating-rate bonds (FRNs) have interest rates tied to benchmark rates (often short-term rates) and adjust accordingly as rates rise. This gives floating-rate bonds an advantage in the face of inflationary risk as their interest income increases correspondingly.

3.Inflation-protected bonds

Certain bond products, such as Inflation-Protected Securities (TIPS), are designed to mitigate inflation risk. TIPS adjust their principal and interest payments based on inflation indices to ensure that real returns are not affected by inflation. Therefore, investing in TIPS can provide some inflation protection.

4.Diversified portfolio

When facing inflation pressures, it is recommended to diversify the portfolio to spread the risk. This includes allocating funds to different types of bonds such as U.S. Treasuries, corporate bonds, municipal bonds, etc., and combining bonds with different maturities and interest rate characteristics. Diversifying the portfolio helps reduce overall bond portfolio exposure to risk and balances the performance of different bond types in the face of inflation pressure.