Quantum Computing Inc. (QUBT.US), a rising star in the quantum computing space, saw its stock price surge significantly following the release of its third-quarter earnings report, with after-hours trading jumping more than 5%. The stock briefly surpassed the $11 range, with a notable increase in daily trading volume. Investors widely view this quarter's performance as a key signal of the company's accelerating commercialization path, driving heightened market interest in the quantum computing sector. The stock price movement reflects a reassessment of the company's future growth expectations, with the earnings report serving as a major catalyst for the upward trend.

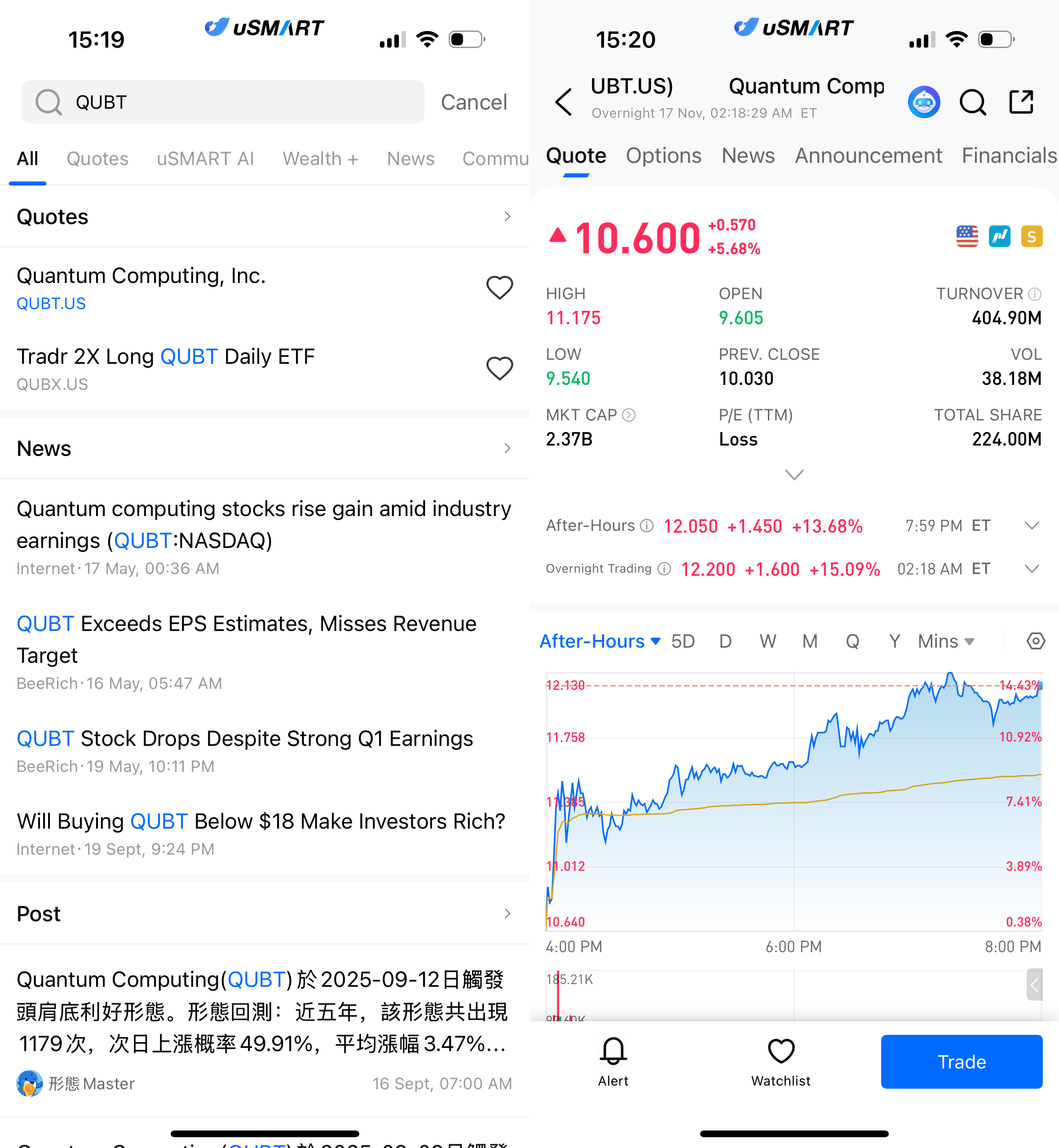

(Image Source: uSMART HK app)

Revenue Soars, Demonstrating Quantum Business Feasibility

In Q3, the company reported explosive revenue growth, nearly tripling year-over-year. This surge came from multiple business lines, including enterprise-level quantum software services, custom hardware system deployments, and computational power support orders for research and industrial clients. After years of relying on R&D expenditures, Quantum Computing is now entering a crucial phase where "technology turns into revenue," signaling its transition from conceptual to early-stage commercialization.

|

Financial Metrics |

Q3 2025 |

Q3 2024 |

Change |

|

Revenue |

$380,000 |

$100,000 |

Multiple-fold increase |

|

Gross Margin |

Over 30% |

Under 10% |

Business structure optimization |

|

Net Profit |

Profit |

Loss |

Turned profitable |

|

Cash Reserves |

Over $300 million |

— |

Strong capital position |

(Data Source: Quantum Computing Inc. Q3 Earnings Report)

Improved Gross Margin, Early Profitability

In addition to revenue growth, the company's gross margin improved significantly, rising from a low single-digit percentage to over 30%. This improvement indicates better cost control, pricing strategies, and delivery efficiency in its quantum solutions. More importantly, the company posted a net profit for the quarter, albeit driven in part by changes in derivative financial assets and interest income. Nevertheless, this result signals the tangible effects of Quantum Computing's commercialization efforts reflected in its financial performance.

Substantial Cash Reserves Fuel Strategic Expansion

As disclosed in the earnings report, the company holds over $300 million in cash and cash equivalents, in addition to significant long-term investment assets. This gives Quantum Computing a strong financial position to continue its R&D investments, hardware upgrades, quantum cloud platform enhancements, and strategic commercial partnerships. Management indicated that the company would continue pushing for breakthroughs in both algorithms and hardware, with a focus on deploying quantum applications in manufacturing, energy, and government sectors.

Market Sentiment Positive Yet Cautious

Following the earnings release, several market research firms stated that while Quantum Computing's growth is still in its early stages, the revenue growth reflects that industry demand is no longer in the experimental phase. However, quantum computing remains a long-term investment track where returns significantly outpace short-term profits. Future growth potential will depend on technology maturity, industry penetration, and customer reliance on quantum computing power. Investors will closely monitor upcoming quarters to see whether the company can maintain revenue growth, improve operating cash flow, and build stronger competitive moats within the quantum ecosystem.

Summary: Earnings Mark a Key Turning Point, Stock Price Reflects Improving Fundamentals

This quarter's performance not only showcases Quantum Computing's milestone in commercialization but also provides a solid foundation for accelerating its quantum technology industry development. From improved gross margins to turning profitable and building substantial cash reserves, the company is transitioning from a "technology concept" to "growth validation." The post-market surge in stock price directly reflects the capital markets' response to these developments, and whether Quantum Computing can continue to deliver on its growth and expand its application range will determine the next direction for its stock price and valuation.

How to Buy Quantum Computing via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (QUBT.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)