On August 26, Pinduoduo released its financial report for the second quarter of 2024 as of June 30.

Key financial data

●Revenue: The company's second-quarter revenue was 97.06 billion yuan (approximately US$11.34 billion), a year-on-year increase of 86%, lower than market expectations of 99.99 billion yuan; the quarter-on-quarter growth rate slowed to 11.8%.

●Profit: Operating profit was 32.56 billion yuan, a year-on-year increase of 156%; net profit attributable to ordinary shareholders was 32.01 billion yuan (approximately US$440 million), a year-on-year increase of 144%; adjusted earnings per ADS was 23.24 yuan, higher than The market estimate was 20.52 yuan.

●Cash flow: Net cash generated from operating activities in the current quarter was 43.79 billion yuan, an increase of 87.2% from 23.396 billion yuan in the same period in 2023.

Main business performance

The two major figures of Pinduoduo’s revenue are “online marketing services” and “transaction services”. In the second quarter, the market expected "online marketing services" revenue to be 50.5 billion yuan, a year-on-year increase of 33%, with actual revenue of 49.12 billion yuan, 29% year-on-year; market expectations for "transaction services" revenue were 50 billion yuan, a year-on-year increase of 248.6%, with actual revenue of 47.9 billion yuan, a year-on-year increase of 234%.

Both major business results fell short of market expectations.

After the results were announced, Pinduoduo plunged nearly 30% overnight, the largest drop since its IPO. Lower-than-expected results and warnings from company executives dampened market confidence.

(Source: uSMART)

Profitability is under pressure and there will be no repurchase and dividends in the future

Chen Lei, chairman of Pinduoduo Group, said he was encouraged by the solid progress made in the past few quarters, but also saw many challenges in the future. Pinduoduo is prepared to endure short-term sacrifices that could lead to a decline in potential profitability.

"We are committed to transforming to high-quality development and cultivating a sustainable ecosystem. We will invest heavily in the trust and security of the platform, support high-quality merchants, and continuously improve the merchant ecosystem."Zhao Jiazhen, another co-CEO of Pinduoduo, also said that revenue growth in the second quarter slowed down quarter-on-quarter. Looking ahead, revenue growth will inevitably face pressure due to intensified competition and external challenges. "As we continue to invest resolutely, profitability will also increase." may be affected."

At the performance exchange meeting after the release of the financial report, Chen Lei said: "The company is still in the investment stage, and its multi-line businesses are facing fierce competition and uncertainty caused by the external environment. Therefore, I and other management are unanimous We believe that it is inappropriate to carry out capital-level repurchases or dividends at the current time. In the foreseeable future years of management, we also feel that there is no need for this.

Sacrificing short-term profits to cultivate a healthy ecosystem

Chairman Chen Lei said in the financial statement that due to the increasingly fierce competition in the e-commerce industry, in order to further deepen the ecological construction of the platform, the company will sacrifice part of its profits in exchange for long-term healthy growth and launch a transaction fee reduction plan, which will be reduced in the next year. 10 billion yuan in handling fees for high-quality merchants. Zhao Jiazhen added that the platform is committed to cultivating a healthy and sustainable ecosystem, allowing high-quality merchants to flourish, and "resolutely cracking down on low-quality merchants" to continuously build a healthy and sustainable ecosystem.

It is reported that Pinduoduo has introduced refundable benefits for resource technology service fees and promotion software service fees to merchants. Through a package of support policies, the goal is to continue to help merchants improve quality and efficiency.

The technical service fees that Pinduoduo charges from merchants mainly include four categories: basic technical service fees, category technical service fees, "tens of billions of subsidy" technical service fees and live broadcast technical service fees. The basic technical service fee is a fee generally charged to all settled merchants; the category technical service fee is an additional fee specifically charged for specific categories of merchants; the "Ten Billion Subsidy" technical service fee is applicable to merchants participating in the "Ten Billion Subsidy" activity ; The live broadcast technology service fee is a fee charged to merchants for orders completed through live broadcast channels.

It should be noted that if an order is refunded, the platform will not charge additional technical service fees when processing the refund, but the basic technical service fees already collected will not be refunded, while the other three service fees will be based on the corresponding Charge rules for refund processing. In addition, when calculating the refund amount proportionally, if the amount contains decimals, it will be rounded to the percentile. For example, if the refund amount is 1.239 yuan, the actual refund will be 1.23 yuan.

Severe negative reactions may stem from three aspects:

1. Before the financial report is released, investors’ expectations are very high. Pinduoduo's stock price has risen about 20% since the end of July as the market expected strong results. After the financial report came out, Pinduoduo’s second-quarter performance fell short of market expectations, causing investors to be bearish.

2. The growth of online marketing services showed signs of normalization for the first time, with year-on-year growth slowing to 29%, which was lower than market expectations. However, Goldman Sachs believes that Pinduoduo’s performance is still significantly better than Alibaba’s customer management revenue growth of 1% and Kuaishou’s mid-digit growth in e-commerce advertising.

3. Management’s comments undermined the market’s confidence in Pinduoduo. Management pointed out in the conference call that due to intensified competition, in order to seek long-term profitability, Pinduoduo will promote high-quality development in the future, thereby slowing down and sacrificing short-term profits; Pinduoduo plans to provide 10 billion yuan in support in the next 12 months. A high-quality merchant; as the whole business is still in the investment stage, Pinduoduo will not conduct buybacks or dividends in the next few years. These signals have raised concerns among investors about Pinduoduo’s future profitability.

Pinduoduo rating changes

Goldman Sachs lowered its forecast for Pinduoduo’s online marketing revenue growth and lowered its target price from $184 to $165, maintaining a “buy” rating.

Goldman Sachs also issued a downward warning for stock prices:

(1) Online marketing revenue may be lower than expected due to declining e-commerce ROI/increased sales-based advertising inventory, and narrowing GMV growth gap with the industry;

(2) Geopolitical headwinds may be greater than expected when Temu enters Europe and other developed markets with strong spending power;

(3) If Alibaba’s new low-price advertising initiative is successful, Douyin’s shelf-based low-price products will expand faster than expected, and competition may be more intense than expected;

Citi downgraded Pinduoduo (PDD.US) to "neutral" and lowered its target price to US$120; Bank of America Securities lowered its target price for Pinduoduo (PDD.US) to US$170; Morgan Stanley lowered its target for Pinduoduo (PDD.US) Price to $150.

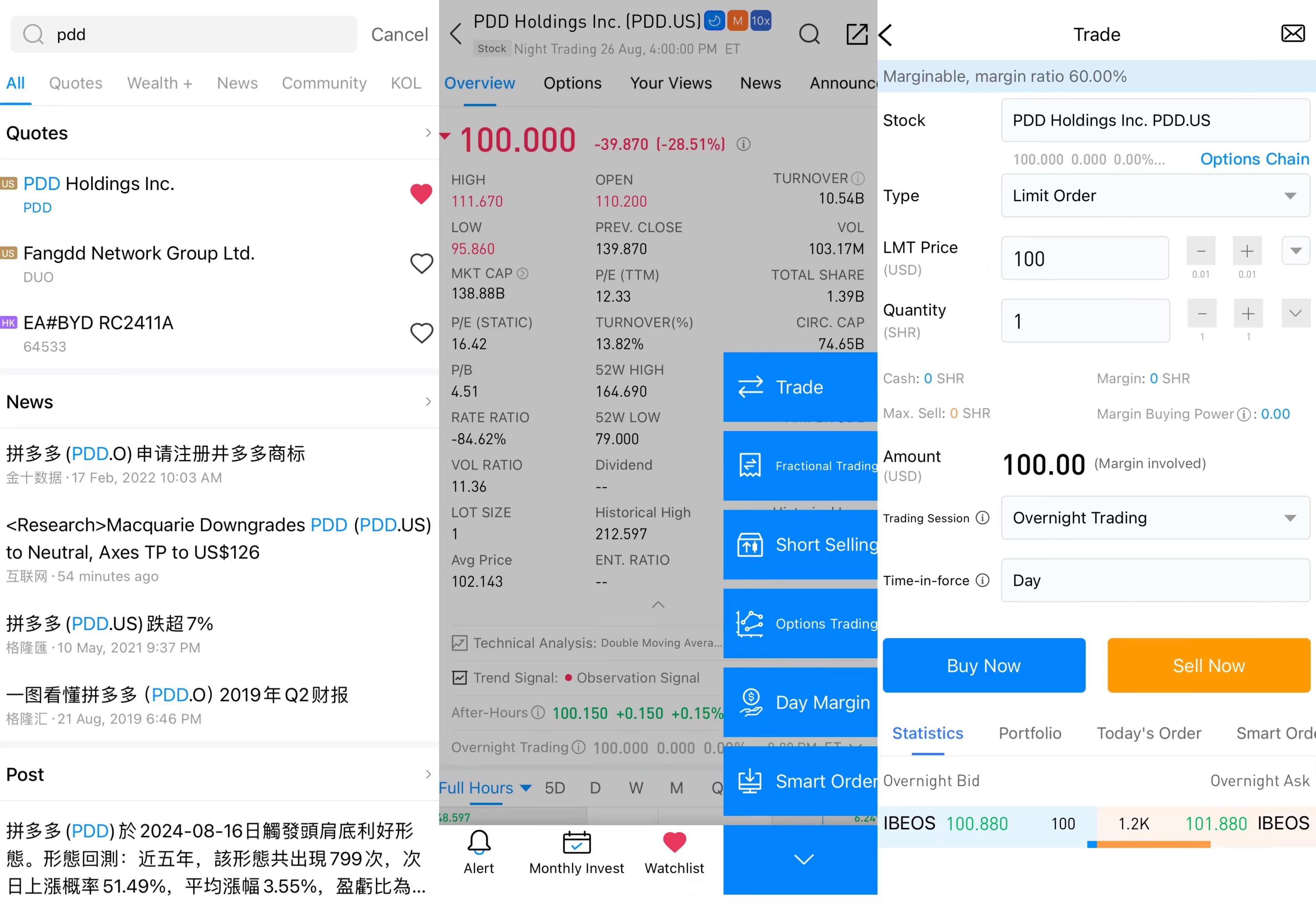

How to invest in Pinduoduo on uSMART?

After logging into uSMART HK APP, click "Search" from the upper right corner of the page, enter "PDD" or "Pinduoduo", you can enter the details page to learn about transaction details and historical trends, click "Transaction" in the lower right corner, and select "Buy/ "Sell" function, finally fill in the transaction conditions and send the order; the picture operation instructions are as follows:

This picture is for illustrative purposes only

This picture is for illustrative purposes only