At the beginning of the month, against the background of weak U.S. employment data, which revealed expectations of a recession, and the Japanese yen's interest rate hikes, "Black Monday" was staged again, and global stock markets were hit.Now, less than three weeks after the plunge at the beginning of the month, U.S. stocks have once again demonstrated their strong resilience. The S&P 500 and Nasdaq are about to return to historical highs, and technology stocks (NVDA.US), led by Nvidia, have bottomed out, leading the Nasdaq out of the correction range at a record speed.

(Source: uSMART)

Technology giants are still the main force in this round of U.S. stock market rebound. According to statistics, since August 5, the market value of the seven major technology giants has rebounded by more than 1.4 trillion US dollars, which is almost half of the US$3.2 trillion market value increase of the S&P 500 Index during the period. Among them, NVIDIA contributed about 7% increase.

Although U.S. stocks are doing well, there are still some interesting signs worth paying attention to. Aside from technology stocks that have been in the spotlight for a long time, some industries that have not been taken seriously for a long time seem to be making a fortune silently.

Defensive stocks rarely outperform tech stocksData shows that in the past month, the public utilities, daily consumption, and healthcare defensive stock sectors have rarely outperformed the information technology sector and recorded significant gains. All three major sectors are at weekly highs.

|

Rank |

Sector |

Increase |

|

1 |

Utilities |

5.84% |

|

2 |

Daily consumption |

4.76% |

|

3 |

Healthcare |

4.16% |

|

4 |

Real Estate |

2.73% |

|

5 |

Materials |

0.88% |

|

6 |

Finance |

0.44% |

|

1 |

Communication Services |

-2.39% |

|

2 |

Energy |

-1.65% |

|

3 |

Optional consumption |

-0.58% |

|

4 |

Industrial |

-0.32% |

|

5 |

Information Technology |

-0.02% |

(Source:uSMART HK)

Multiple sectors began to move forward together

It is worth noting that a key indicator, the S&P 500 equal-weighted index, which is an important indicator of the concentration of market gains, hit a new all-time high on Monday.

Robert Pavlik, senior portfolio manager at Dakota Wealth Management, commented: "This indicates that the market's rebound is broadening. After the "Big Seven" surged earlier this year, investors appear to be starting to look for opportunities in other areas of the market."

The high concentration of U.S. stocks has always been regarded by market participants as a potential risk, like the sword of Damocles hanging over their heads. However, it is certainly reassuring to see multiple sectors moving forward in unison. Broad-based earnings growth is widely seen as a positive sign, giving investors more options than just relying on a handful of tech stocks. This change makes the market more balanced and makes it more likely that investors will shift from large-cap stocks to higher-growth small-cap stocks or stocks that have previously underperformed.

In the long term, for the S&P 500 to continue hitting new highs, more stocks must join forces to drive its rise. Ryan Detrick of Carson Group noted: “Now that the performance of the stock market is no longer dependent on technology stocks alone, it is a positive sign for investors to see these more cyclical areas starting to lead.”

Craig Sterling, head of equity research at Amundi US, said technology stocks will no longer be the only winners in the coming months. If the U.S. is spared a recession, earnings growth for the Big Seven tech giants will begin to slow next year, while earnings growth for the rest of the S&P 500 will pick up.

Which sectors may help the market continue to rise in the future?

Now that the technology sector is no longer a standout, the following sectors may help the market continue to rise:

Utilities sector

The Utilities Sector is made up of companies that provide infrastructure services, which typically include electricity, natural gas, water, and other related services. Due to the stable and defensive nature of utility companies' businesses, the utility sector tends to show relatively stable characteristics during market fluctuations and is therefore considered a safe-haven sector.

Companies within this sector typically have stable cash flows and high dividend yields, attracting investors seeking stable returns and long-term gains.The utility sector's annual earnings growth will be at least 6% this year, and its 3.6% yield is competitive with interest rates. Dividends from utility companies will also continue to increase amid the rate-cutting cycle. Dividend yields combined with growth investment opportunities in renewable energy, AI data centers, and grid infrastructure make the risk-reward profile of these stocks more attractive.Data shows that since July, the Utilities Select Industry Index ETF-SPDR (XLU.US) has risen 8.51%, significantly outperforming the S&P 500 Index and the Nasdaq Index.

(Source: uSMART)

●Stocks to watch: The utilities sector provides exposure to a number of blue-chip utility companies with strong balance sheets, such as Southern Company (SO.US), Duke Energy (DUK.US), Sempra Energy ( SRE.US), American Electric Power (AEP.US) and Dominion Resources (D.US).

Consumer Staples Sector

Among the large U.S. companies in the S&P 500 Index, the consumer staples sector mainly includes companies in beverages, food, tobacco, household and personal necessities. These products and services are indispensable in people's daily lives, and consumer demand for these products remains relatively stable regardless of changes in the economic environment.

Since demand for consumer staples is relatively unaffected by economic cycles, this sector is often viewed as a defensive investment option. Even during an economic downturn, consumers still need to buy food, beverages and other daily necessities, so the consumer staples sector tends to be more stable during market fluctuations. Additionally, these companies often have solid financial performance and high dividend yields, attracting investors looking for stable returns.

In terms of size, the largest consumer staples ETF is the Consumer Staples Select Industry Index ETF-SPDR (XLP.US). Its tracking index is the "Consumer Staples Select Industry Index", which is selected from the large U.S. companies in the S&P 500. It mainly invests in people's livelihood necessities such as beverages, food, tobacco, household and personal daily necessities.

(Source: uSMART)

(Source: uSMART)

●Stocks worth noting: Many stocks in the consumer staples sector have jumped on the news. The share price of beverage giant Coca-Cola (KO.US) hit a record high overnight and has risen nearly 20% this year; essential retailer Walmart (WMT.US) ) has been trending even more strongly, rising more than 44% this year. It also hit a new high on Wednesday and its current market value has exceeded US$600 billion. Another retail giant, Costco (COST.US), has risen more than 34% this year.

Healthcare sector

The Healthcare Sector of U.S. stocks consists of companies involved in medical services, pharmaceutical products, medical equipment, biotechnology and health insurance. This sector covers various types of enterprises from pharmaceutical companies to hospitals, medical device manufacturers, biotechnology companies and health management companies.

The healthcare sector is considered one of the defensive sectors in the market. Because of its low correlation with the economic cycle, the healthcare sector's stock price performance usually outperforms the broader market during periods of economic volatility. Demand in the industry is very inelastic, and despite many external variables, demand for healthcare products and services remains very strong. In addition, the gross profit margin of most biopharmaceutical drugs is very high - the potential gross profit margin of many pharmaceutical companies' main products is as high as 95% or more, reducing the impact of inflation.

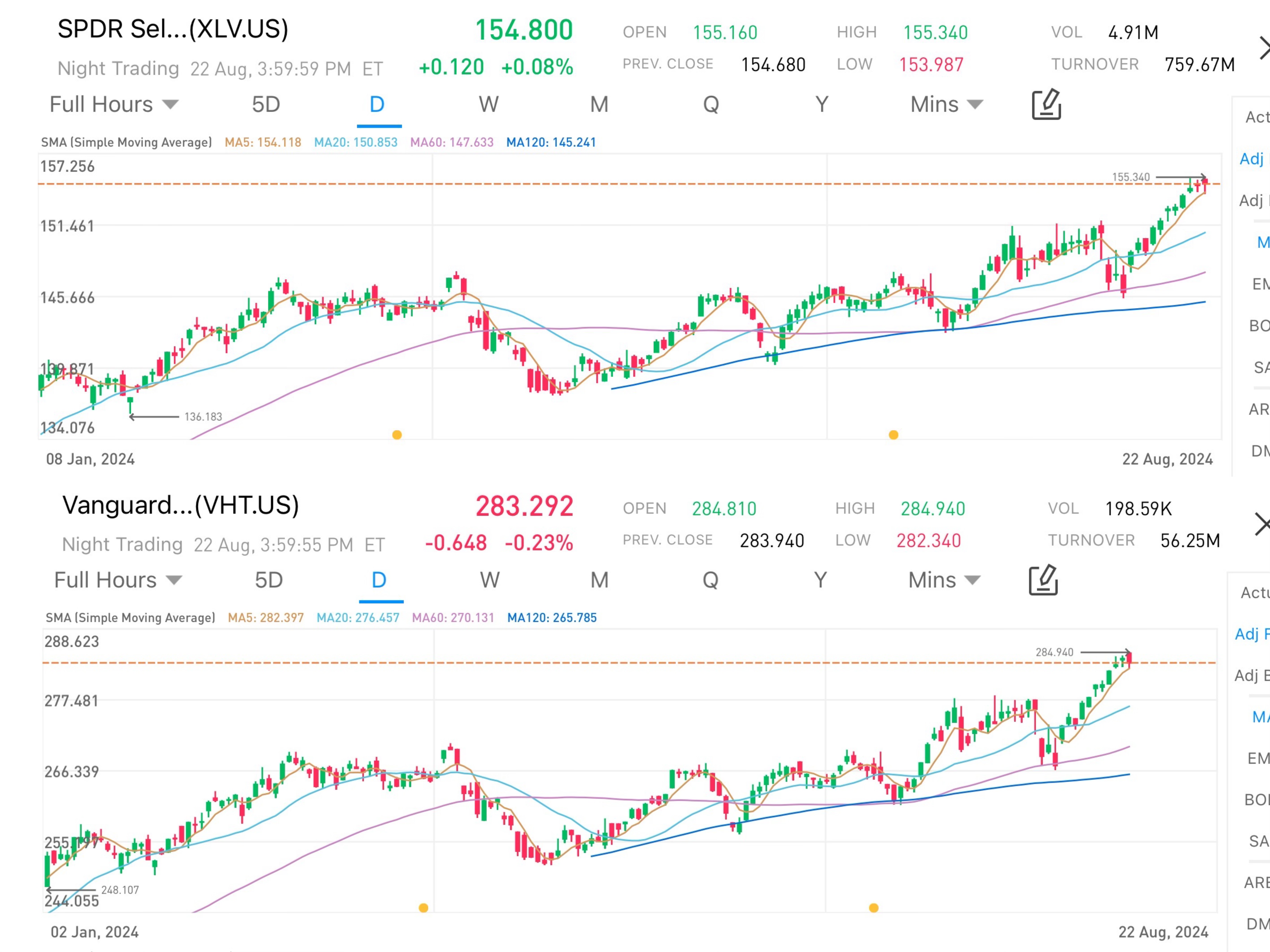

The more popular and large-scale healthcare ETFs include the Healthcare Select Industry Index ETF-SPDR (XLV.US) and the Healthcare Stock ETF-Vanguard (VHT.US). They have both recorded good gains this year, both rising by more than 14%.

(Source: uSMART)

(Source: uSMART)