1. Overview of Chinese Enterprises going to the US in May

According to uSmart Capital, as of May 31,2024, a total of 4 Chinese concept stocks completed their IPO in the US market. During the same period, 6 IPOs were completed in HKEX, which increased by 50% as compared to the previous month, and the momentum picked up.

|

Listing overview of Chinese concept stocks in 2024 |

||||||

| (As of May 31,2024) | ||||||

|

No. |

Stock Code |

Chinese Name |

IPO Date |

Exchange |

First day Performance |

IPO Amount (USD) |

|

1 |

ROMA |

罗马绿色金融 |

2024-01-09 |

Nasdaq |

-27.50% |

12.3 million |

|

2 |

CCTG |

承创科技 |

2024-01-18 |

Nasdaq |

92.50% |

5.6 million |

|

3 |

JL |

即亮 |

2024-01-24 |

Nasdaq |

48.80% |

7 million |

|

4 |

SUGP |

荣志集团 |

2024-01-24 |

Nasdaq |

0.00% |

5 million |

|

5 |

YIBO |

星图国际 |

2024-01-25 |

Nasdaq |

-30.25% |

5 million |

|

6 |

HAO |

浩希数字科技 |

2024-01-26 |

Nasdaq |

32% |

9.6 million |

|

7 |

AS |

亚玛芬 |

2024-02-01 |

NYSE |

3.08% |

1,365 million |

|

8 |

WETH |

伟大奇科技 |

2024-02-21 |

Nasdaq |

-59.33% |

11 million |

|

9 |

LGCL |

罗科仕 |

2024-03-05 |

Nasdaq |

-9.75% |

6 million |

|

10 |

INTJ |

慧悦财经 |

2024-03-20 |

Nasdaq |

25% |

7.5 million |

|

11 |

LOBO |

萝贝电动车 |

2024-03-21 |

Nasdaq |

-13.25% |

5.5 million |

|

12 |

UBXG |

有家保险 |

2024-03-28 |

Nasdaq |

-18% |

10 million |

|

13 |

ZBAO |

致保科技 |

2024-04-02 |

Nasdaq |

-7.50% |

6 million |

|

14 |

TWG |

富原集团 |

2024-04-16 |

Nasdaq |

-51.50% |

8 million |

|

15 |

JUNE |

奥斯室内设计 |

2024-04-17 |

Nasdaq |

1.50% |

8 million |

|

16 |

CDTG |

城道通环保 |

2024-04-18 |

Nasdaq |

-17.50% |

6 million |

|

17 |

MTEN |

铭腾模具 |

2024-04-18 |

Nasdaq |

-12.50% |

5.1 million |

|

18 |

TRSG |

同日科技 |

2024-04-19 |

Nasdaq |

48.75% |

5 million |

|

19 |

MFI |

移动财经 |

2024-04-22 |

Nasdaq |

173.11% |

7.5 million |

|

20 |

NCl |

思宏国际 |

2024-04-23 |

Nasdaq |

137.50% |

9.28 million |

|

21 |

ZK |

极氪汽车 |

2024-05-10 |

NYSE |

34.57% |

441 million |

|

22 |

JDZG |

课标科技 |

2024-05-15 |

Nasdaq |

104.42% |

8 million |

|

23 |

RAY |

雷特控股 |

2024-05-15 |

Nasdaq |

5.75% |

6 million |

|

24 |

HDL |

特海国际 |

2024-05-17 |

Nasdaq |

38% |

52.67 million |

Under changes of the overall market environment and economic factors, during the first quarter of 2024, Chinese enterprises raised nearly 1.5 billion dollars for IPO in the US, the amount increased by about 150% year on year, a significant growth. Since May, the momentum of Chinese enterprises listing in the US slightly slowed, but considering the overall scale of the same period from January to May, it still increased significantly as compared to last year.

2. Industry Distribution and Capital Raised by U.S Bound Chinese Enterprises

In terms of industry distribution, most of the Chinese companies listed in the United States in May came from consumer services and industrial sectors, and these companies were more active in U.S IPO activities. The details are shown as follows:

|

Dimension |

Consumer Services Sector |

Industrial Sector |

Education Sector |

|

Number of IPO |

1 |

2 |

2 |

|

IPO fundraising |

$52.67 million |

$447 million dollars |

$8 million |

Zeekr is undoubtedly the most prominent U.S-listed Chinese Stock in May in May. It is an electric car brand under Geely Auto and has a state-owned capital background. For more information on Zeekr, please refer to previous article on uSmart Capital’s public website: share price soared 38%! Zeekr landed in NYSE, becoming the fourth largest new car maker in the U. S. stock market.

This year, the number of Chinese IPOs listed in the United States increased by about 20% as compared to the same period last year, and the amount of capital raised increased by about 2.6 times as compared to the same period last year, which is a promising trend.

|

Comparison between 2023 and 2024 til May |

||

|

Year |

Number of IPOs |

IPO Amount (USD) |

|

2023 |

20 |

600 million |

|

2024 |

24 |

2,410 million |

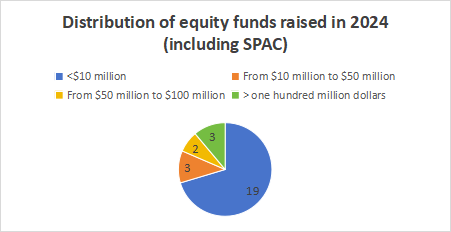

In addition, from the perspective of the amount fundraised, the average level of concept stocks in 2024 is generally low, mostly 5 million to 6 million US dollars, but the overall situation is good. According to the statistics of uSmart Capital, in 2024, there were 19 enterprises with debt fundraising of less than $10 million, accounting for 70%; 3 enterprises with fundraising of more than $100 million, including the newly listed Zeekr Auto in may, and the other two are Amer Sports and Lutus Technology, both of which are well-known brands in China.

Analyzing from the aspect of industry distribution, as of May 31, Chinese US UPOs were highly diversified, mainly in the service sector, supplemented by the development structure of electronics and industrial structure. In addition, the listed companies are also involved in new energy vehicles, insurance and financial services, food and catering, advertising and marketing, and clothing design and processing fields.

3. Causes for Resurgence of Chinese Concept Stocks in the U.S

1) Policy Support

On November 27 last year, the People's Bank of China, the State Administration of Financial Regulation, the China Securities Regulatory Commission and other departments jointly issued the “Notice on Strengthening Financial Support Initiatives to Help the Development and Growth of the Private Economy”, which explicitly proposed to support the listing of qualified private enterprises abroad, utilizing two markets and two types of resources. In addition, on April 12 this year, the new "Nine Articles" once again mentioned broadening the financing channels of overseas listing, improving the quality and efficiency of overseas listing filing management, strengthening the regulatory capacity under the condition of openness, and deepening the international cooperation in securities supervision.

2) Tightening on A-share Listings

In order to thoroughly implement the new "Nine Articles" of the capital market, the Shanghai and Shenzhen Stock Exchanges revised relevant supporting business rules and openly solicited public opinions from the market, showing the improvement on listing standards of the main board and the Growth Enterprise Board. The listing threshold applicable to general enterprises has been increased to varying degrees, and the listing conditions of the Main Board and Growth Enterprise Market (GEM) have been optimized, with moderate increases in indicators such as net profit, net cash flow, operating income and market value.

3) Normalization of Overseas Listing Filings

The filing of overseas listing of domestic enterprises has been normalized. According to the public news on the official website of the Securities and Futures Commission, since the implementation of the new rules on filing, as of the end of May 2024, the total number of enterprises that have passed the filing system since its establishment reached 156, and the number of entrepreneurs that are still in the filing process is 101 at present. The number of approved filings of domestic enterprises for overseas listing has increased significantly, and the filing review process has been accelerated.

4. 101 Chinese Companies in line or Oversea Listing

As of May 30, a total of 61 enterprises have been approved by the CSRC to go public in the U.S. this year. Among them, 35 enterprises have been notified of the filing this year, in addition to the successfully listed Lutece Technology, there are still 101 enterprises waiting in line to be listed, the specific list and details as shown on the official website of the CSRC: Domestic Enterprises Issuing Securities Overseas and Listing Filing Status Table (Initial Public Offering and Full Circulation) (as of May 30, 2024)

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMARTCommunity to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.