Early on May 23rd, Beijing time, NVIDIA (NVDA.US) released its financial report for the first quarter of the 2025 fiscal year, ending on April 28th. During the reporting period, NVIDIA achieved record high total revenue and data center revenue, with year-on-year growth of several times. The revenue guidance for the next quarter also exceeded expectations. Additionally, NVIDIA announced a 1-for-10 stock split plan and significantly increased its dividend payout, raising the dividend per share from 4 cents in the previous quarter to 10 cents. With strong demand for AI and the push of the new generation chip Blackwell, NVIDIA's future prospects look promising.

Strong Financial Performance

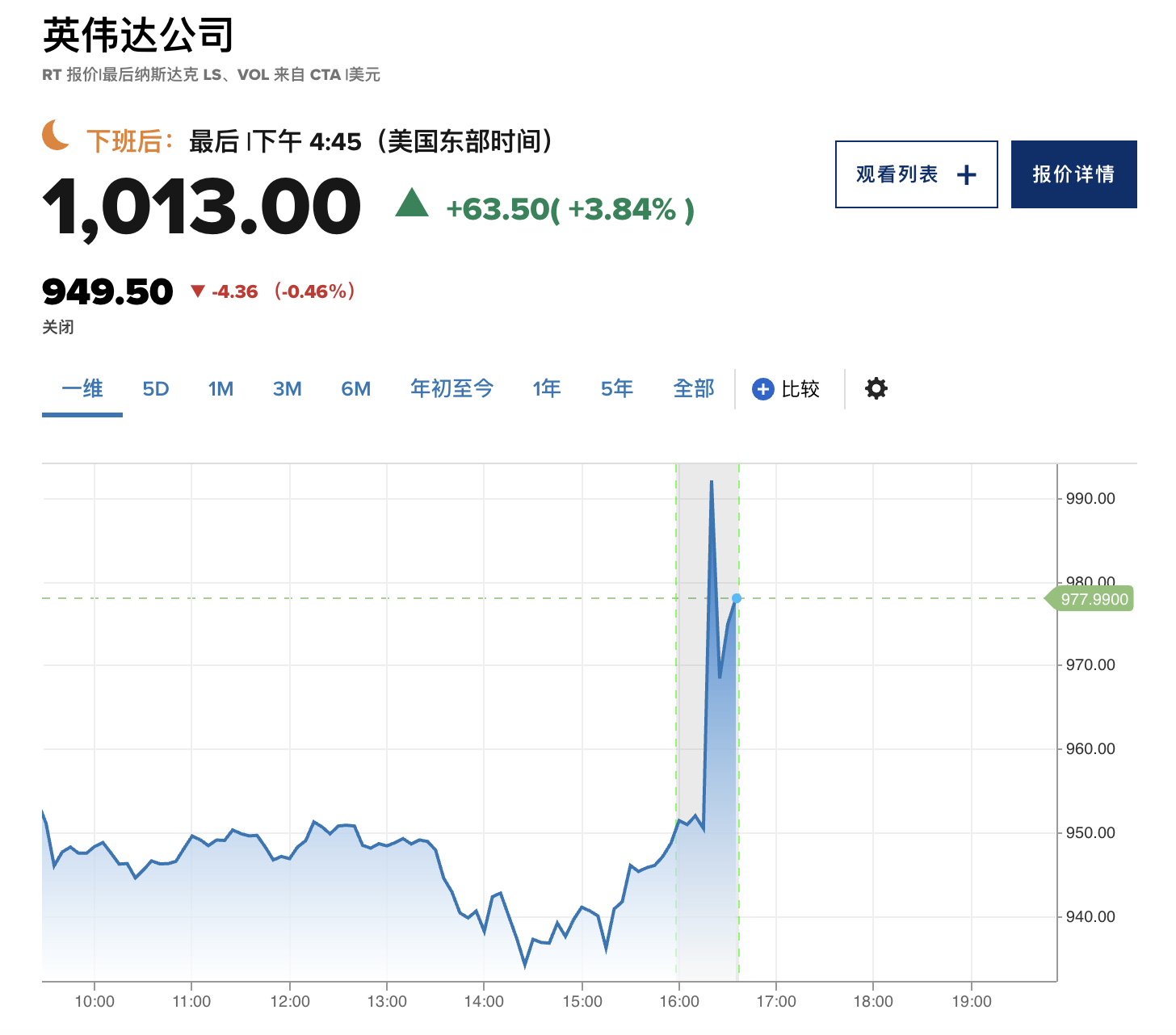

NVIDIA (NVDA) released its earnings report on Wednesday, showing first-quarter performance surpassing analyst expectations, driving a post-market surge of over 7% and crossing the $1000 mark for the first time. As of May 23rd, the stock has surged over 91% year-to-date.

NVIDIA's earnings per share stood at $6.12, exceeding the expected $5.59, with revenue reaching $26.04 billion, surpassing the expected $24.65 billion. The company anticipates current-quarter revenue to reach $28 billion.

(Source:CNBC,2024.05.23)

(Source:CNBC,2024.05.23)

Expenditure on AI Computing Remains Strong, Driven by AI Demand

NVIDIA's performance is considered a key indicator of the AI boom. The company's most watched data center business revenue reached $22.6 billion, a 427% year-on-year increase, hitting a new high. The growth in data center revenue is attributed to strong demand for generative AI training and inference on the Hopper platform. In addition to cloud service providers, generative AI has expanded to consumer internet companies as well as enterprise, sovereign AI, automotive, and healthcare customers, creating multiple vertical markets worth billions of dollars.

Over the past year, companies such as Google, Microsoft, Meta, Amazon, and OpenAI have purchased billions of dollars' worth of graphics cards from NVIDIA, driving strong sales of NVIDIA's Hopper graphics processors (H100 GPU), especially in collaboration with Meta. These GPUs are essential for developing and deploying AI applications.

In terms of chips, NVIDIA announced that its new chip, Blackwell, introduced in March this year, has been fully ramped up and will contribute to revenue growth later in 2024. While the supply situation for the GH100 has improved, there is still a shortage of GH200 supply. Demand for GH200 and Blackwell chips far exceeds supply, a situation that may persist into next year.

NVIDIA's leadership position in AI remains solid, with continued growth in overall AI demand.

Related chip concept stocks rise

1. Analog Devices

On May 22, before the US stock market opened, Analog Devices (ADI) announced its financial results for the second quarter of the fiscal year 2024. Despite a slight decline in revenue and profit compared to the same period last year, the results still beat Wall Street analysts' expectations. Additionally, the company forecasted revenue for the third fiscal quarter to be $2.27 billion, with a fluctuation range of $100 million. This exceeded the market expectation of $2.16 billion, outperforming analysts' estimates.

Boosted by the financial forecast, Analog Devices (ADI-US) rose nearly 6% in pre-market trading on the 22nd and continued its strong momentum with a 7.60% increase after the market opened. As of the 23rd, Analog Devices' latest price was $240.160.

2. Taiwan Semiconductor Manufacturing Company (TSMC)

On the 22nd, the stock price of Taiwan Semiconductor Manufacturing Company (TSMC, 2330) opened higher and continued to rise, once again leading the Taiwan Stock Exchange Weighted Index to a new high. The price surged to a high of NT$865 during the trading session, closing at NT$864, up 2.7% or NT$23, setting a new record. This contributed over 200 points to the overall market gain, with the company's market value surpassing NT$22.4 trillion, also reaching a new high. As of the 23rd, TSMC's temporary price per share was $156.150.

Some other concept stocks also saw increases:

|

Code |

Stock name |

percentage change |

|

ALGM |

ALGM Allegro Microsystems |

+5.11% |

|

ON |

ON Semiconductor Corporation |

+4.77% |

|

LSCC |

Lattice Semiconductor Corporation |

+4.38% |

|

QUIK |

QUIK QuickLogic Corp. |

+4.11% |

(The data is current as of May 23, 2024, during market hours.)