In the realm of investment, Real Estate Investment Trusts (REITs) are gradually becoming the darlings of investors. With their unique investment model, REITs provide investors with a fresh approach to investing in real estate, achieving a perfect balance between asset liquidity and profitability.

What are REITs?

In simple terms, REITs are a type of financial instrument that converts real estate into securities with high liquidity. They gather funds from numerous investors through the issuance of trust certificates or fund shares, which are then invested in various real estate projects such as commercial, residential, and industrial properties. This investment generates rental income and potential capital appreciation. Investors in REITs can enjoy stable returns from real estate investments while avoiding the high costs and low liquidity associated with direct property ownership.

Operation of REITs

1. Public Offering: REITs raise funds by issuing trust certificates or fund shares to a wide range of investors.

2. Fund Allocation: The management team utilizes these funds to invest in various real estate projects, conducting professional operation and management.

3. Revenue Distribution: The income of REITs primarily comes from rental income and the appreciation of real estate values, which are distributed to investors according to certain proportions.

Types of REITs

REITs can be classified into different types based on the type of properties they invest in or their operational structures:

· Equity REITs: Own and manage properties, generating income from rental and property appreciation.

· Mortgage REITs (mREITs): Invest in mortgage loans or mortgage-backed securities rather than directly in properties.

· Hybrid REITs: Combine features of both equity and mortgage REITs.

· Publicly Traded REITs (PTRs): Traded on major exchanges, allowing investors to buy and sell shares like any other stock.

· Private REITs: Not publicly traded, typically open only to qualified or institutional investors.

· Debt REITs: Primarily provide mortgage loans to developers or real estate managers, with interest income or returns from securities investments as the main sources of income.

It is worth noting that debt REITs are mainly found in the US market, accounting for less than 10% of the total REITs market, while hybrid REITs have an even smaller share. Outside the US, REITs are mostly equity-based, indicating the dominance of equity REITs in the global market.

Additionally, REITs can also be classified based on the type of real estate they invest in, such as commercial, residential, industrial, or specialized properties.

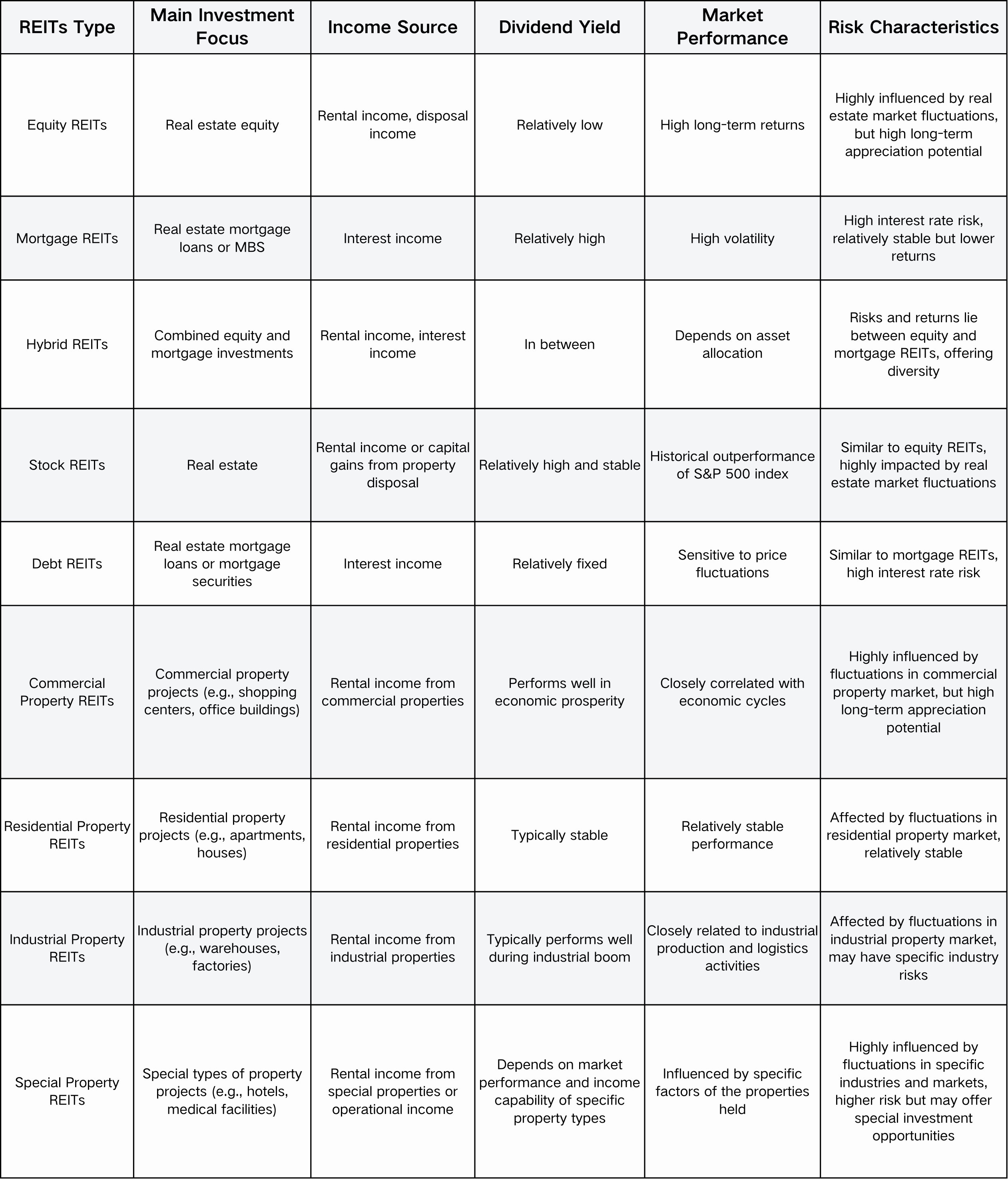

Differences Among Various Types of REITs

Advantages of Investing in REITs:

· Strong liquidity: Investors can easily buy and sell REIT shares on the securities market without facing liquidity issues commonly associated with direct property ownership.

· Good risk diversification: REITs typically invest in multiple real estate projects, reducing the risk of single-project investments.

· Stable income: Rental income from real estate properties tends to be stable, providing investors with a consistent cash flow.

● Risks of Investing in REITs:

· Market fluctuations: REITs are subject to market risks that can affect their stock prices and dividend payments, similar to other investments.

· Interest rate risk: Changes in interest rates can impact the value of REITs, with mortgage REITs being particularly sensitive to interest rate fluctuations.

· Property-specific risks: REITs may face risks associated with the specific properties they own, including location, property type, and tenant stability.

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.