技術大牛 | 做多特斯拉止盈

uSMART盈立智投 05-31 15:47

作者:安德魯,平倉時間:2023,05,30

本文核心:

止盈平半倉,剩下半倉的止損線移到開倉價格。對應場內標的:TSLA、TSL、TSLL等。

實盤展示:

陰謀論:

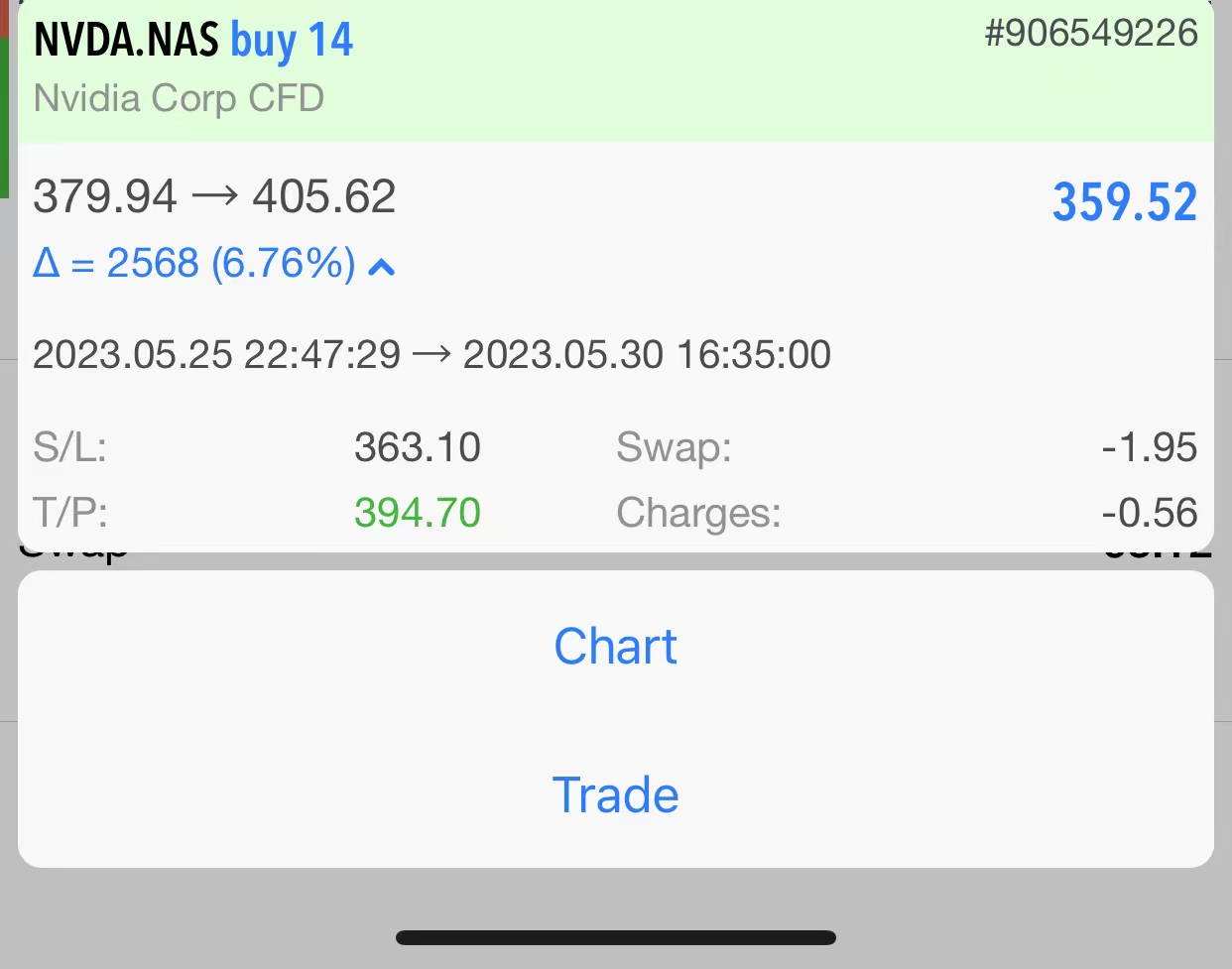

最近AI的狂熱助推了科技股的大幅反彈,本韭菜也在最近跟着趨勢入手了一些英偉達的股票,看下圖。

英偉達獲利止盈了一些,剩下的還繼續持有。這波美股上漲的趨勢似乎還能繼續走下去。

倉位管理:

先回顧一下我們的點位:Long點位:$193.21,第一目標止盈:$200.5,止損位置:$183.7。價格達到$200.5的時候平倉1%,剩下的1%倉位的止損線下移至開倉線$193.2。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.