November 19, 2025 — Despite a strong third-quarter report, Xiaomi Group (01810.HK) faced significant pressure on the Hong Kong stock market, with its share price experiencing a sharp decline. The stock opened near HKD 40 but quickly fell below the previous day's closing price as selling pressure intensified, eventually closing at HKD 38.34, a nearly 6% drop on the day.

(Image source: uSMART HK App)

(Image source: uSMART HK App)

At one point, the stock touched a low of HKD 38.22, with total trading volume exceeding HKD 16.8 billion, indicating high market activity but a dominance of sell-side pressure. Analysts point to weaker macroeconomic conditions, investor profit-taking after recent gains, and concerns about rising supply chain costs as contributing factors to the stock's pullback.

Q3 Report Shows Balanced Growth Across All Business Lines, EV Unit’s First Profit Steals the Spotlight

Xiaomi's third-quarter results for 2025 revealed steady growth in both revenue and net profit. Notably, the company’s electric vehicle (EV) business achieved its first quarterly profit, marking a major highlight in the report. Below are the key figures from the report:

|

Metric |

Data |

Notes |

|

Revenue |

Approximately RMB 113.1 billion |

Growth across smartphones, IoT, and EV businesses |

|

Adjusted Net Profit |

Approximately RMB 11.3 billion |

Significant improvement in profitability |

|

EV Business Revenue |

Approximately RMB 28.3 billion |

First quarterly profit, notable expansion |

|

Smartphone Shipments |

Approximately 43 million units |

High-end strategy driving structural optimization |

(Source: Xiaomi Q3 2025 Financial Report)

The report highlighted Xiaomi's progress in its "Smartphone, Car, and Home Ecosystem" strategy, showing a more complete business loop. Smartphone sales remained stable, IoT device penetration continued to expand, and the rapid growth and profitability of the EV business injected new momentum into the company's growth for this stage. The management emphasized plans to continue investing in R&D and core technological breakthroughs while deepening integration across the ecosystem.

Industry Cost Pressures and Investor Caution Affect Short-Term Market Reaction

Despite the positive financial performance, the market reaction was relatively lukewarm. Analysts suggest that the smartphone industry is currently facing rising costs, particularly for core components like memory and chips, which may pressure Xiaomi's gross margin. Additionally, while the EV business has achieved profitability, it is still in the expansion phase, and future expenses related to production capacity, new model development, and channel expansion could introduce volatility to the company’s long-term profitability model.

As a result, even though Xiaomi's performance is solid, short-term market sentiment, influenced by external macroeconomic factors and industry cost pressures, has kept the stock's response to the earnings report from being strongly positive, leading to a divergence of "strong performance, weak stock price."

Long-Term Strategy Remains Clear, Ecosystem Expansion Continues, Xiaomi’s Business Lines Still Have Upside Potential

Looking ahead, Xiaomi's key growth drivers remain centered around three main areas: deepening the high-end smartphone strategy, expanding the AIoT ecosystem, and accelerating the growth of its EV business. Industry experts generally believe Xiaomi holds competitive advantages in software ecosystems, AI technology, and smart device interconnectivity, which will drive its transformation from a hardware manufacturer to a platform-based company.

As the EV business expands further, Xiaomi's revenue share and brand influence are expected to continue growing in the coming quarters. The performance of EV deliveries and IoT ecosystem expansion will be key factors for the market to watch.

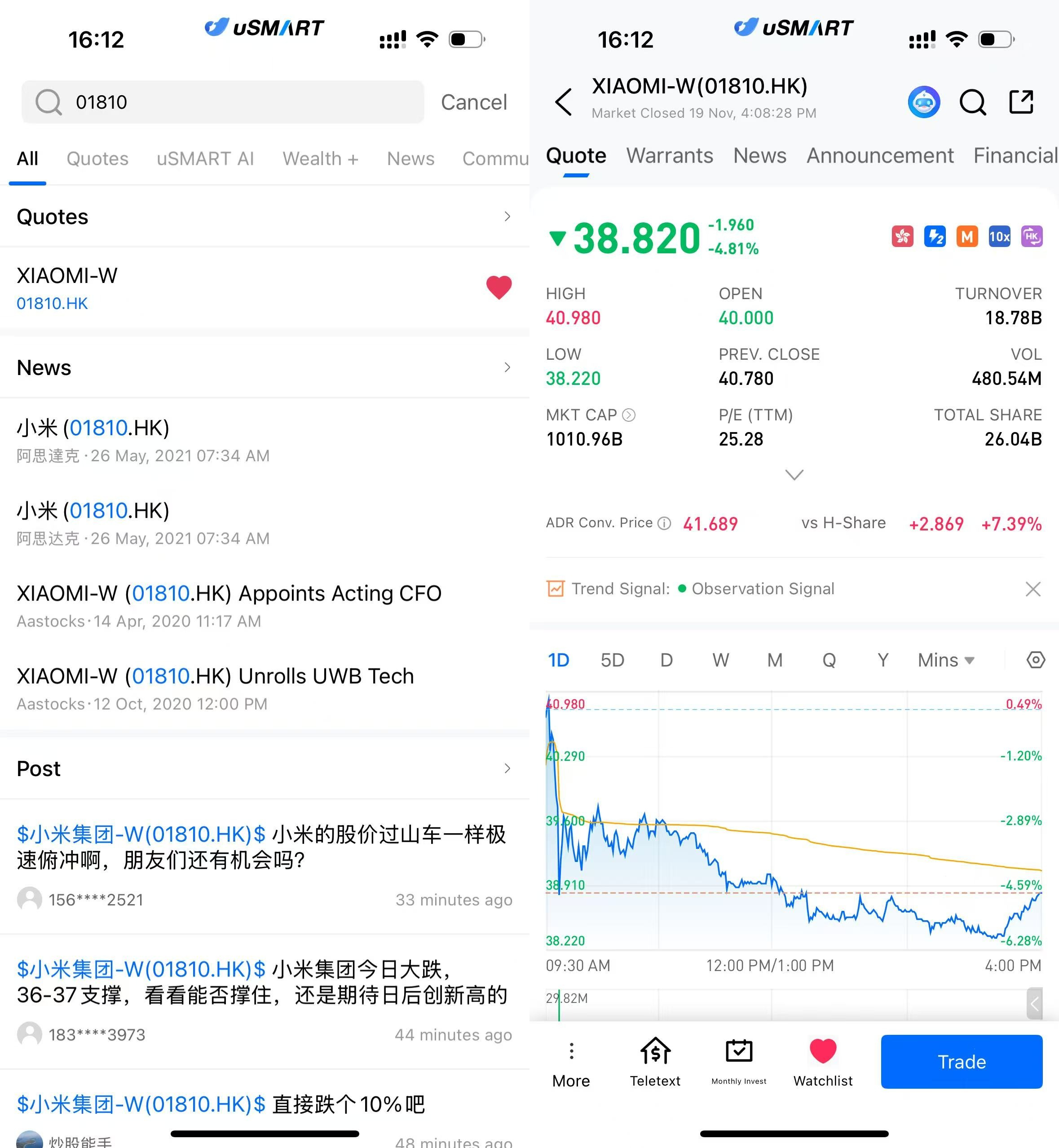

How to Buy XIAOMI via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (01810.HK), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)