December 5, 2025 — Baidu (BIDU.US) shares posted a strong rebound today, closing at $125.66, up 5.85%. Buying sentiment remained robust throughout the session, with the overall trend showing solid strength. Investor confidence was further lifted by the company’s latest strategic developments, particularly renewed discussions around the potential listing of its AI chip subsidiary, Kunlun Chip, which sharply boosted Baidu’s market attention.

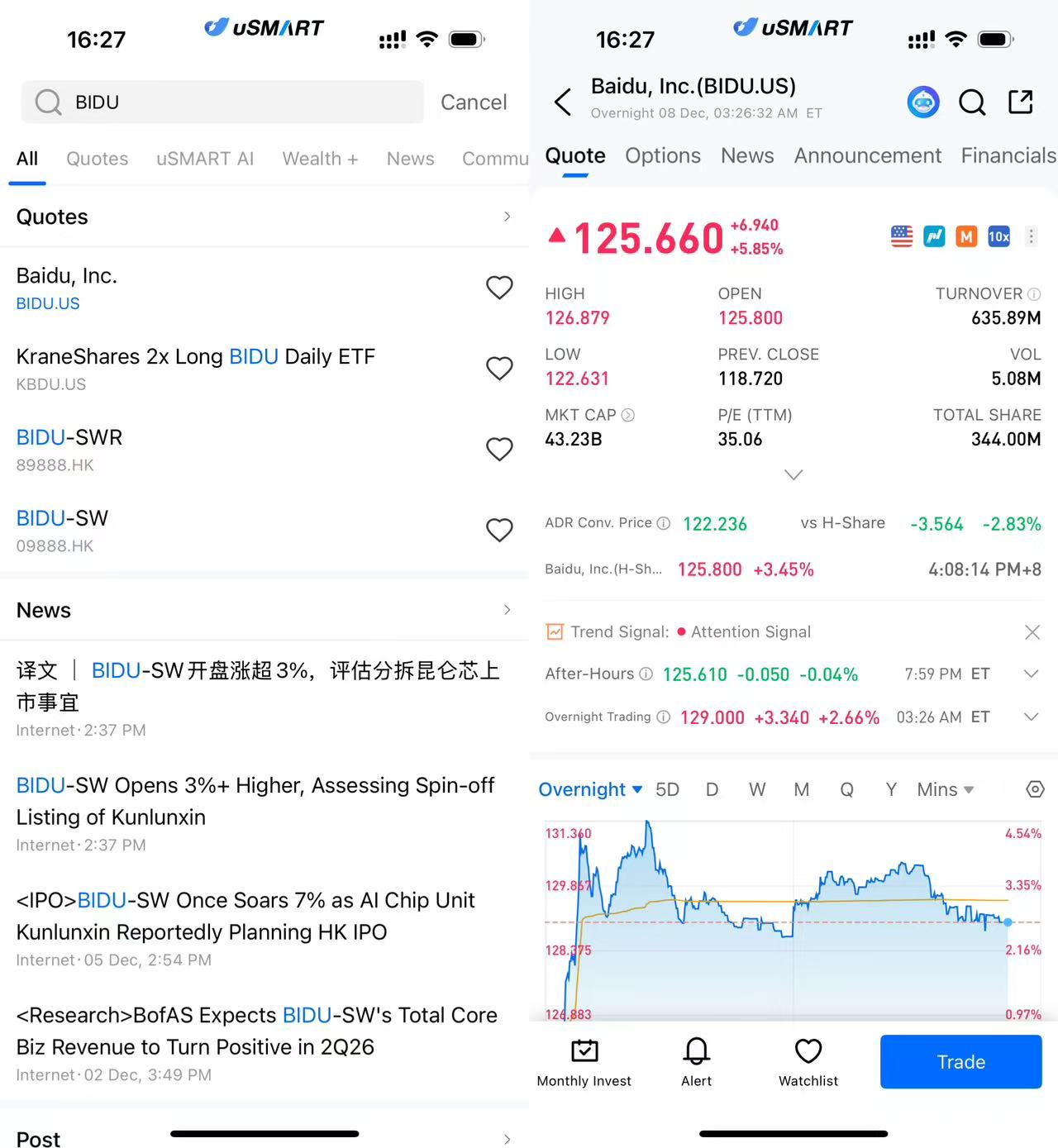

(Image source: uSMART HK app)

Kunlun Chip Spin-off Plan Comes Into View

Recent reports indicate that Baidu is evaluating the feasibility of spinning off its flagship AI semiconductor unit, Kunlun Chip, for an independent listing. According to publicly available information, the company has confirmed that assessments are underway but emphasized that no final decision has been made. This has sparked broader expectations regarding the subsidiary’s valuation potential and the possible restructuring of Baidu’s overall business profile.

As Baidu’s most critical investment in AI infrastructure, Kunlun Chip has served as the central force behind the company’s self-developed AI accelerators since formally separating from Baidu’s internal chip division in 2021. From chip architecture to deployment scenarios, Kunlun Chip continues to advance in areas such as inference, training, and multimodal large-model computing. With the domestic AI chip industry expanding rapidly amid policy support and rising demand for self-reliant R&D, Kunlun Chip’s strategic position has significantly strengthened, adding a fresh layer of growth expectations to Baidu’s valuation.

AI Chip Boom Drives Strategic Re-rating of Baidu

Amid the global surge in artificial intelligence, AI chips have become the core battleground for major tech firms. With limited access to overseas high-end chips, domestic demand for high-performance AI semiconductors has intensified. This gives Kunlun Chip’s potential listing a broader industrial foundation and a favorable policy backdrop.If Kunlun Chip successfully enters the capital market, it would not only receive an independent valuation system but also help Baidu better showcase the value of its underlying AI technology stack. This could accelerate Baidu’s transformation from an “internet search company” to an “AI infrastructure platform.” Many in the capital market believe that once the listing path becomes clearer, Baidu may undergo a new wave of valuation re-assessment.

Uncertainties Remain as Market Stays Cautious

Despite the positive reaction, Baidu has clearly stated that the spin-off and listing plan remains under evaluation, with no guarantee of implementation. The competitive landscape of the AI chip sector—marked by rapid technological iteration and shifting regulatory conditions—may also influence Kunlun Chip’s future profitability and valuation prospects.For Baidu, a successful listing would mark a major step in the company’s AI strategy. However, delays or adjustments to the plan could also affect market expectations. Investors are currently adopting a “positive but cautious” stance, waiting for further announcements from the company.

A New Chapter in Baidu’s Valuation Story

Overall, the recent gain in Baidu’s share price reflects not only immediate reactions to Kunlun Chip’s potential listing but also the market’s renewed focus on Baidu’s long-term value in AI infrastructure and domestic semiconductor development. As Baidu continues advancing in large models, cloud services, and AI chips, its growth profile is undergoing profound transformation. The progress of Kunlun Chip’s listing is poised to become one of the most critical catalysts for Baidu in the year ahead.

How to Buy Baidu via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (BIDU.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)