美元成今年唯一避風港

當下,美元升值是唯一可能的對衝手段,以應對全球金融危機以來股市遭受的最大損失。

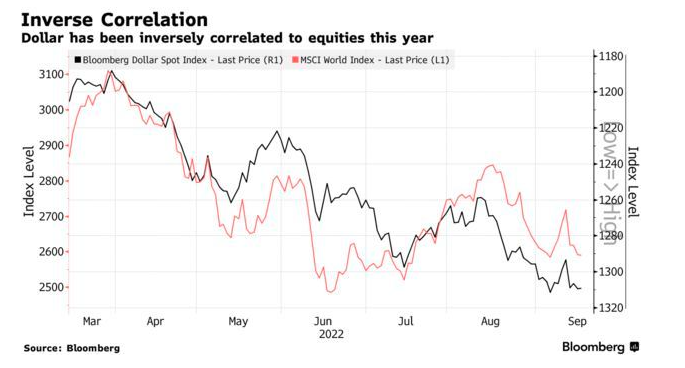

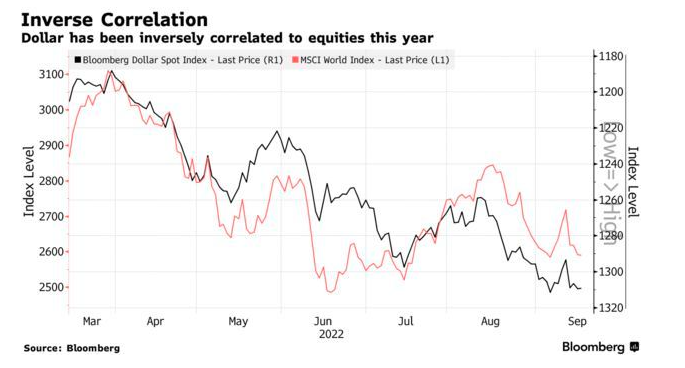

花旗集團的數據顯示,鑑於今年以來全球股市已累計損失23萬億美元,美元與風險資產的反向關係使美元成爲至少在2022年剩餘時間裏唯一的避風港。

包括Jamie Fahy和Adam Pickett在內的花旗策略師週四表示:“唯一的避風港就是美元。”他們表示,只有出現“深度衰退”,美國通脹纔會大幅下降,這意味着在美聯儲政策轉向之前,企業利潤和股市將出現長期下跌。

追蹤美元兌全球10種貨幣的彭博美元現貨指數今年以來已飆升逾11%,創下該指數自2004年開始編制以來的最佳年度表現。

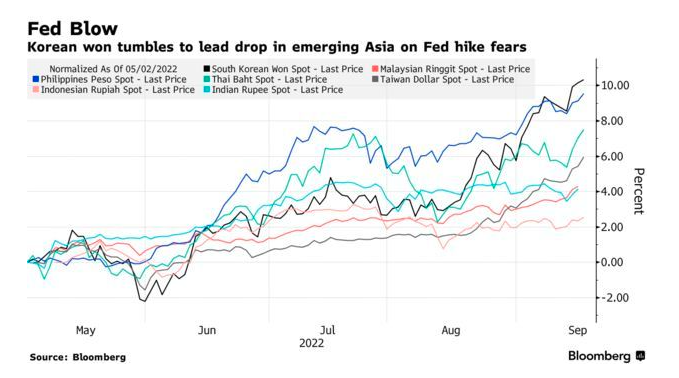

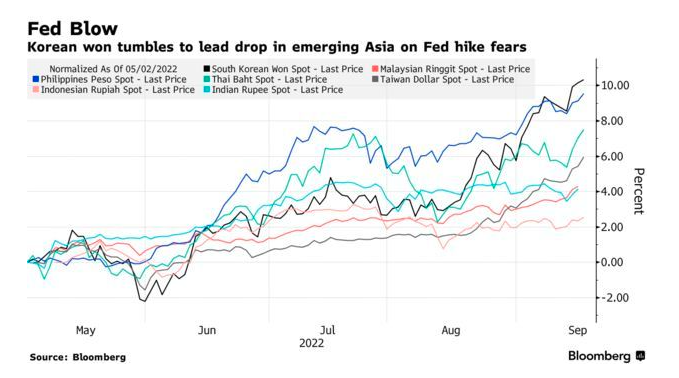

在週二公佈的美國8月通脹數據超出預期之後,交易員再次加大了對美聯儲激進加息的押注。美元走強之下,非美貨幣多數走弱。日元兌美元匯率繼續徘徊在24年來低點,距離備受關注的1美元兌145日元這一重要關口僅一步之遙;加拿大元兌美元的匯率則跌至近兩年來最低水平;澳元兌美元也處於多年來新低的邊緣。

分析人士表示,美元的強勢目前還不太可能有放緩的跡象。Brown Brothers Harriman匯市策略主管Win Thin表示:“市場對美聯儲收緊貨幣政策的重新定價,可能令美元在短期內保持全線買盤。”“正如我們在近期美元連續回調時所說的那樣,從根本上來說,一切都沒有真正改變,全球背景繼續有利於美元。”

加拿大帝國商業銀行也認爲,現在就押注美元見頂還爲時過早。該行外匯策略主管Bipan Rai表示:“實際政策利率仍處於深度負值,金融環境過於寬鬆。”“市場已經消化了其中的部分因素,但對於利率終點在哪裏還存在許多不確定,這應該會讓美元得到良好的支撐。”

花旗策略師認爲:“美元牛市的結束要麼需要美聯儲政策轉向,要麼需要全球增長預期觸底。”“這些有可能在2023年發生,但不會在短期內發生。”

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.