蘋果要如何提振股價?

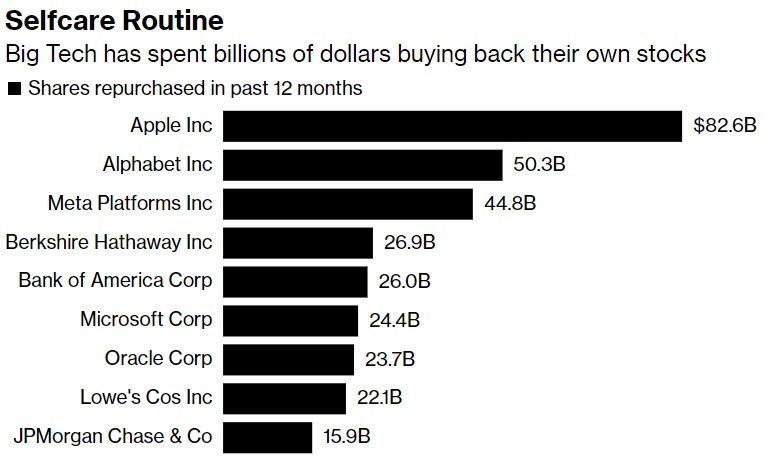

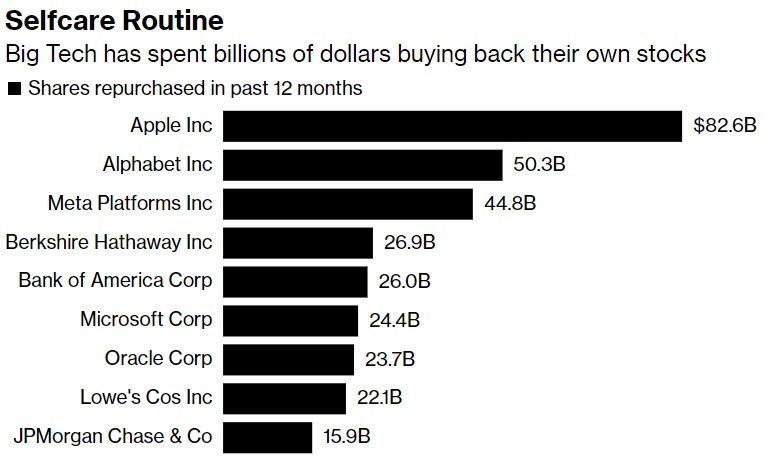

本月是全球金融危機以來大型科技公司表現最糟糕的一個月,對被視爲FAANG集團中避風港的蘋果公司(AAPL.US)的投資者來說,大規模回購股票可能還不夠。

花旗預計將在週四盤後公佈季度業績時宣佈高達900億美元的股票回購計劃。但僅憑這一點可能還不足以提振股價。

以谷歌母公司Alphabet(GOOG.US)爲例,蘋果也需要大幅盈利才能推高股價。儘管Alphabet宣佈將回購700億美元的A類和C類股票,該公司的股價在週三盤前交易中下跌。相反,投資者關注的是季度每股收益不及預期、歐洲廣告營收放緩以及Youtube表現黯淡。

對蘋果來說,回購已成爲投資理由的核心部分,在科技股動盪時期尤爲重要。投資者喜歡回購計劃,因爲這可以減少公司的股票數量,從而提振收益和股價。

Trim Tabs資產管理公司首席投資官Bob Shea表示:“蘋果的自由現金流和回購無疑比同行更有力地支持了該公司。現在一切都面臨壓力,投資者正在尋找高質量和可持續的自由現金流盈利能力的公司。蘋果是最受歡迎的。”

但伯恩斯坦公司分析師Toni Sacconaghi稱,由於市場已經預期蘋果可能會進行大規模回購,投資者最關注的可能是這家iPhone製造商的前景。他指出,蘋果面臨着幾個新的不利因素,包括國內疫情影響、該公司從俄羅斯撤出、美元升值以及歐洲消費者受到擠壓。

他寫道:“儘管蘋果正在進行的回購有可能推動每股收益強勁增長,但我們認爲,蘋果的市盈率將主要取決於其營收增長。我們認爲,隨着時間的推移,營收增長可能處於中低個位數。”

不過,如果回購規模超過去年4月宣佈的900億美元,可能會提振股價。Evercore ISI分析師Amit Daryanani表示:“有足夠的火力加速提高資本回報。資本回報仍是看好蘋果的關鍵因素,因此,好於預期的回購授權可能會推動蘋果財報公佈後出現一些上漲。”

科技股投資者當然希望可以聽到一些好消息。截止至週二,納斯達克100指數4月下跌12%,爲2008年以來最大單月跌幅,原因是奈飛(NFLX.US)的業績令人失望以及利率上升和地緣政治緊張局勢導致投資者對成長型股票不感興趣。而蘋果股價4月份下跌11%,是自2020年2月以來表現最差的一個月。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.