巴菲特財富反超扎克伯格

uSMART盈立智投 01-28 20:26

聯儲鷹派表態重創科技股,導致硅谷最富有的人本週損失了約500億美元的財富。而沃倫•巴菲特的財富再度超越馬克•扎克伯格,彰顯了價值投資理念的持久力量。

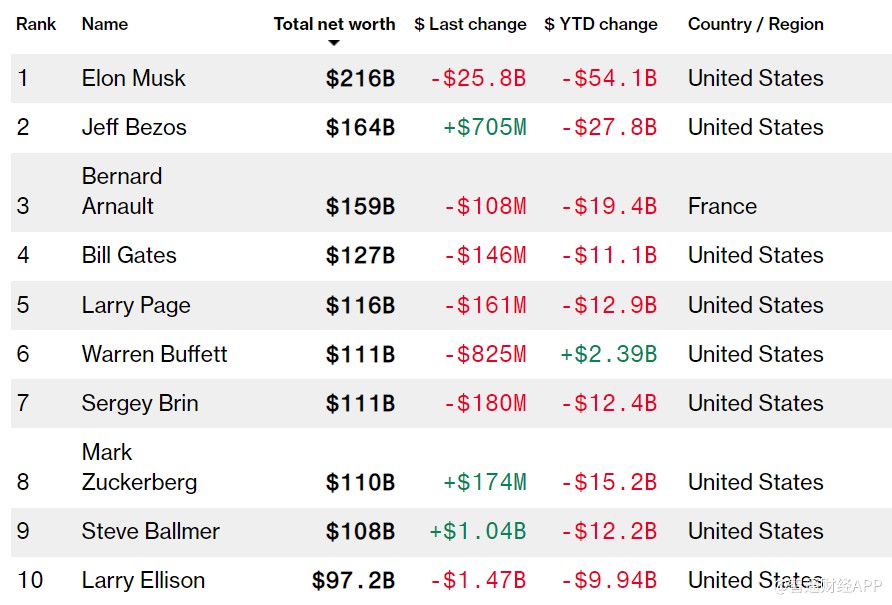

智通財經APP獲悉,彭博億萬富翁指數顯示,世界首富埃隆·馬斯克的淨資產週四暴跌258億美元,創下該指數歷史上第四大單日跌幅。 馬斯克今年損失了540億美元。 扎克伯格是Meta(FB.US)的聯合創始人,其財富在2022年下降了12%,約合150億美元。

巴菲特的淨資產今年增加了24億美元,達到1113億美元。 目前,他以10億美元的優勢超過了扎克伯格,位列彭博億萬富翁排行榜第6,爲去年3月以來的最高排名。

價值股是巴菲特投資哲學的基石,也是他旗下伯克希爾哈撒韋(BRK.A.US)的投資重點。今年年初以來,儘管價值股累計下跌4.2%,但其表現優於科技股(下跌15%)和標普500指數(下跌9.2%)。

91歲的巴菲特是全球十大富豪中唯一一個資產淨值今年迄今有所增長的人。 伯克希爾哈撒韋A類股佔其財富的98%,年初至今上漲了2.3%。

考慮到巴菲特多年來捐贈的資金數額,他在億萬富翁指數中一直名列前茅顯得尤爲重要:自2006年以來,他向比爾和梅林達•蓋茨基金會捐贈了價值近330億美元的伯克希爾股票。 只有蓋茨本人(目前以1270億美元的淨資產排名第四)進行過如此規模的慈善捐贈。

美國通脹率達40年高位之際,市場預期美聯儲將實施緊縮政策,導致全球股市波動加劇。受此影響,自今年1月1日以來,全球 500 位最富有的人總共損失了 6350 億美元。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.