高瓴一季度美股持倉報告出爐:大筆減持逸仙電商、B站,重新建倉新能源車

uSMART盈立智投5月18日消息,高瓴的美股Q1持倉報告新鮮出爐,數據顯示,截至今年一季度末,高瓴在美股市場持有91家公司的股票,總市值爲101.2億美元,前十大重倉股合計持倉佔比爲66.26%。

總 結

①多賣出少買入:2月下旬是美股的轉折點,高瓴一季度整體而言是大舉賣出,清倉19只股票,其中4只系中概股(富途、好未來、一起教育科技、泰邦生物);減持29只股票,其中8只爲中概股,大筆減持Snowflake(-81%)、京東(-69%)、嗶哩嗶哩(-50%)、逸仙電商(-87%)。

②重新建倉新能源車:一季度重新建倉蔚來、小鵬汽車,其中,小鵬的倉位遠高於蔚來。

③繼續重倉中國:一季度新建倉14只股票,其中7只是中概股,繼四季度清倉阿裏巴巴後,一季度重新建倉阿裏巴巴;增持9只股票,其中有4只是中概股:房天下、天境生物、華住集團、貝殼。

持倉詳情

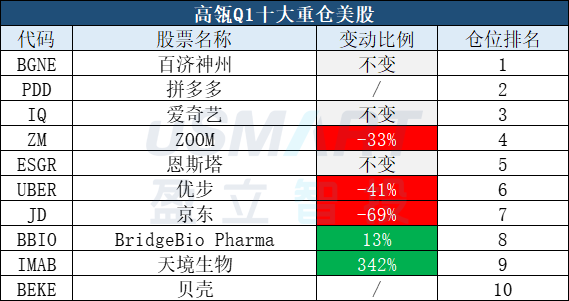

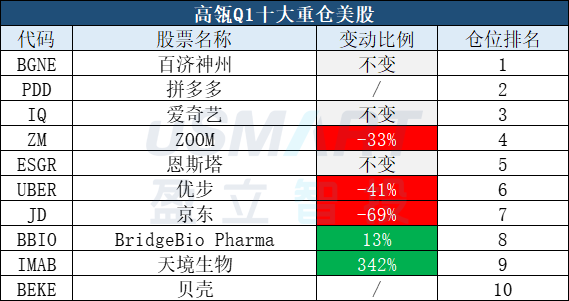

一季度前十大重倉美股

高瓴一季度前十大重倉美股分別爲:百濟神州、拼多多、愛奇藝、ZOOM、恩斯塔、優步、京東、BridgeBio Pharma、天境生物、貝殼。

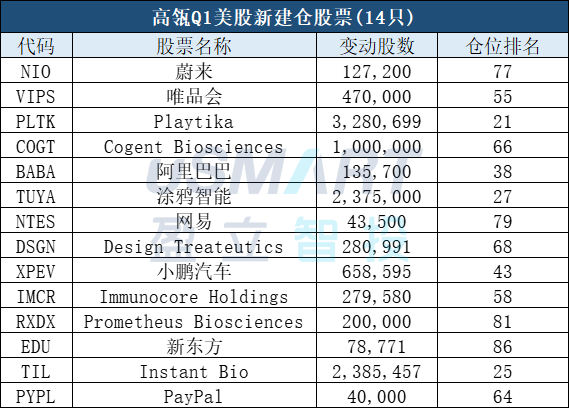

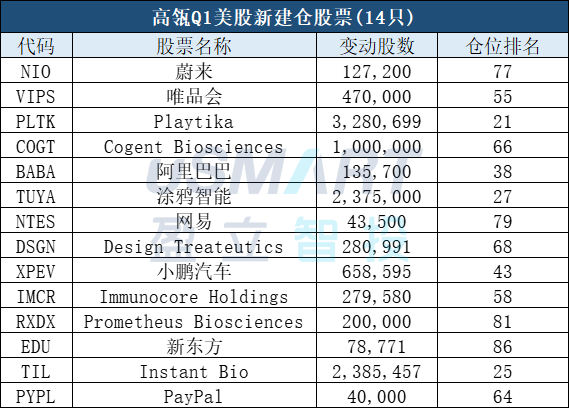

一季度新建倉14只美股

高瓴一季度新建倉14只美股:蔚來、唯品會、Playtika、Cogent Biosciences、阿裏巴巴、塗鴉智能、網易、Design Treateutics、小鵬汽車、Immunocore Holdings、Prometheus Biosciences、新東方、Instant Bio、PayPal。

一季度增持9只美股

高瓴一季度增持9只美股:房天下、天境生物、Dyne Therapeutics、DoorDash、BridgeBio Pharma、Salesforce、Acm Research、華住集團、貝殼。

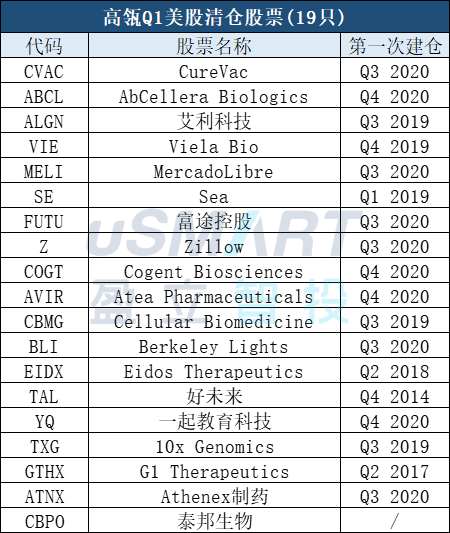

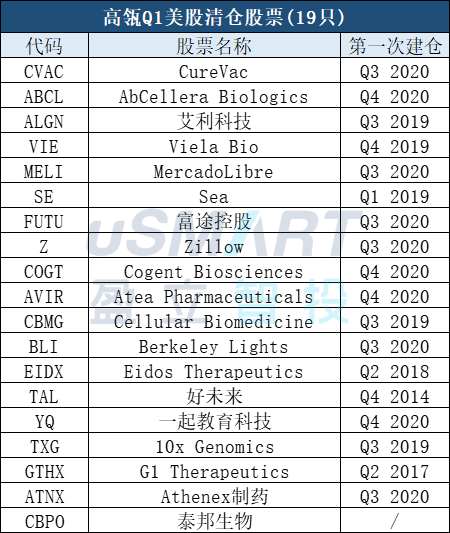

一季度清倉19只美股

高瓴一季度清倉19只美股,包括兩隻教育中概股,牙齒隱形矯正隱適美的母公司艾利科技,散戶大熱門富途控股。

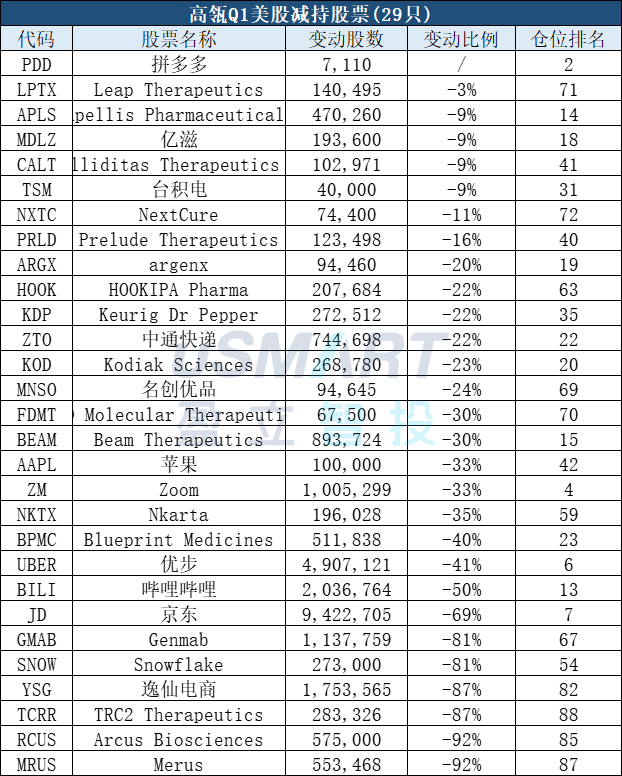

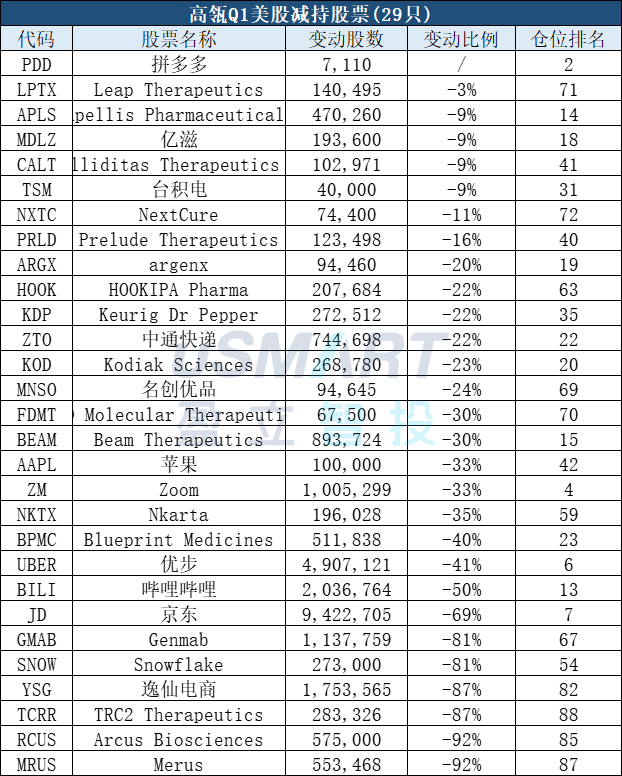

一季度減持29只美股

高瓴一季度減持29只美股,接近清倉式減持逸仙電商、Snowflake,將B站的倉位直接砍半。

延伸閱讀:

美國證監會(SEC)規定,管理股票資產超過1億美元的股權資產機構,需要在每個季度結束之後的45天之內,向證監會提供自己持有的美國股權,並提供有關資金的去向。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.