January 20, 2026 — Pop Mart (09992.HK) saw a notable rally in its share price, opening higher and extending gains throughout the morning session. The stock rose nearly 9% at one point, trading around HK$190 intraday, with turnover expanding significantly as market attention quickly returned.

(Image Source: uSMART HK app)

HK$251 Million Share Buyback Helps Stabilize Market Expectations

On January 19, Pop Mart announced that it repurchased approximately 1.4 million shares on the secondary market, with a total consideration of about HK$251 million. The buyback prices ranged from HK$177.7 to HK$181.2 per share. This marked the company’s first share repurchase since early 2024. Following a period of share price correction, the move is widely seen as a meaningful signal of management confidence and an effort to stabilize market sentiment.

From a price perspective, Pop Mart’s shares had been under pressure since reaching a recent high in late August 2025, making the timing of the buyback particularly notable in terms of market support.

Institutions Focus on Long-Term Growth and Strong Cash Position

Several international institutions noted that the buyback could help refocus attention on the company’s fundamentals, especially at a time when the market has been waiting for clearer catalysts. According to these views, Pop Mart’s growth drivers remain intact, with IP operations and overseas expansion continuing to form the core of its long-term strategy.

Public forecasts suggest that Pop Mart’s earnings are expected to maintain relatively fast growth in 2025, while its solid net cash position provides a strong financial foundation for ongoing shareholder returns. It is worth noting that the company has not set a fixed size or timeline for the current buyback program, opting instead for a flexible approach based on market conditions.

Buyback and Sentiment Recovery Support Short-Term Momentum

Overall, the share buyback and the rebound in sentiment have worked in tandem to lift Pop Mart’s share price in the short term. That said, after the recent sharp move, the market is likely to continue monitoring the sustainability of the buyback, the sales performance of core IPs, and the pace of earnings delivery, all of which may influence the stock’s near-term trading dynamics.

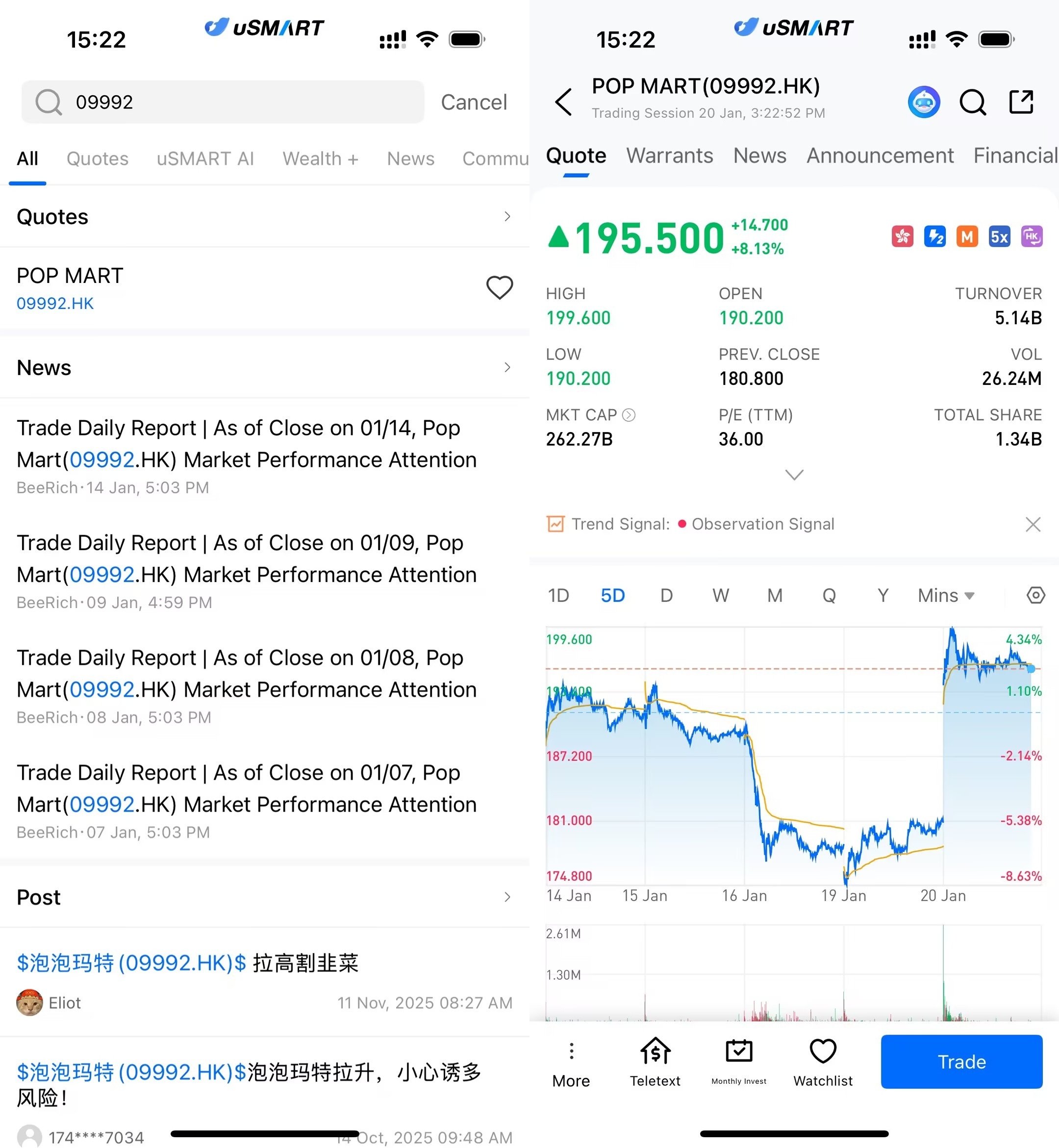

How to Buy Pop Mart via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (09992.HK), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)

More Content