BBSB: One of Malaysia's Top Ten Bridge Engineering Subcontractors(08610.HK)

Issue Ratio: 10% for Hong Kong Public Offering (12,500,000 shares), 90% for International Placement (112,500,000 shares)

Issue Price: HKD 0.60–0.70 per share; 4,000 shares per lot; entrance fee approximately HKD 2,828.24

Offer Period: December 31, 2025 – January 8, 2026 (Expected Pricing Date: January 9, 2026)

Listing Date: January 13, 2026

IPO Sponsors: Lego Corporate Finance Limited

Company Overview

BBSB International Limited is a civil engineering contractor with over 16 years of experience in Malaysia, specializing in bridge engineering services for large-scale transportation infrastructure projects owned by the government or government-related companies. The company has expanded into flood control engineering. According to a report by ZhiShi Consulting, BBSB ranks 10th among bridge engineering subcontractors in Malaysia, with a market share of approximately 2.5%. The company holds the highest-level G7 qualification from the Malaysian Construction Industry Development Board, allowing it to undertake civil and structural engineering projects without contract value limitations.

Financial Information

For the fiscal years 2023, 2024, and the first six months of 2025, BBSB's revenue was approximately MYR 76.8 million, MYR 133.0 million, and MYR 74.0 million, respectively. The net loss/net profit for the same periods were MYR -14.5 million, MYR 26.2 million, and MYR 3.2 million, respectively. At the median issue price of HKD 0.65 per share, assuming no exercise of the greenshoe option, the company expects to raise a net amount of approximately HKD 56.0 million, which will be used for enhancing financial strength to cover potential project upfront costs (approximately 65.2%), expanding the workforce to support growth (approximately 19.8%), upgrading information systems and internal process digitalization (approximately 5.0%), and general working capital (approximately 10.0%).

Hongxing Cold Chain: Leading Cold Storage and Store Leasing Service Provider in Central China and Hunan(01647.HK)

Issue Ratio: 10% for Hong Kong Public Offering (2,326,500 shares), 90% for International Placement (20,936,500 shares)

Issue Price: HKD 12.26 per share; 500 shares per lot; entrance fee approximately HKD 6,191.83

Offer Period: December 31, 2025 – January 8, 2026

Listing Date: January 13, 2026

IPO Sponsors: CCB International, ABC International

Company Overview

Hongxing Cold Chain is a comprehensive service provider offering frozen food storage and frozen food store leasing services, headquartered in Changsha, Hunan. By combining cold storage and store leasing services, the company connects wholesale and retail businesses in the frozen food supply chain. According to ZhiShi Consulting, the company is the largest frozen food storage service provider in Central China and Hunan, with a market share of 2.6% and 13.6%, respectively. It is also the second-largest provider of frozen food store leasing services in Central China and the largest in Hunan.

Financial Information

For 2022–2024, Hongxing Cold Chain's revenue was approximately RMB 237 million, RMB 202 million, and RMB 234 million, respectively. Net profit for the same periods was approximately RMB 79 million, RMB 75 million, and RMB 83 million. For the first half of 2025, the company achieved revenue of approximately RMB 118 million and net profit of RMB 40 million. At the issue price of HKD 12.26 per share, assuming no exercise of the greenshoe option, the company expects to raise a net amount of approximately HKD 252 million. The funds will be used for building new processing plants and expanding cold storage (approximately 57.5%), upgrading equipment and IT infrastructure (approximately 12.8%), seeking strategic acquisitions and partnerships (approximately 19.7%), and supplementing working capital (approximately 10%).

GigaDevice: Leading Multi-Chip Design Company in China

Issue Ratio: 10% for Hong Kong Public Offering (2,891,600 shares), 90% for International Placement (26,024,200 shares)

Issue Price: HKD 132.00–162.00 per share; 100 shares per lot; entrance fee approximately HKD 16,363.38

Offer Period: December 31, 2025 – January 8, 2026 (Expected Pricing Date: January 9, 2026)

Listing Date: January 13, 2026

IPO Sponsors: CICC, Huatai Financial Holdings (Hong Kong) Limited

Company Overview

GigaDevice is a multi-chip integrated circuit design company operating under a fabless business model. It specializes in the design and R&D of Flash, niche DRAM, microcontrollers (MCUs), analog chips, and sensor chips. According to Frost & Sullivan, GigaDevice is the second-largest NOR Flash supplier globally and the largest in mainland China by sales in 2024. The company also ranks highly in various segments, including SLC NAND Flash, niche DRAM, and MCU in both the global and Chinese markets.

Financial Information

For 2022–2024, GigaDevice's revenue was approximately RMB 8.13 billion, RMB 5.76 billion, and RMB 7.36 billion, respectively. Net profit for the same periods was approximately RMB 2.05 billion, RMB 161 million, and RMB 1.10 billion, respectively. For the six months ended June 30, 2025, the company achieved revenue of approximately RMB 4.15 billion and net profit of RMB 588 million. At the median issue price of HKD 147.00 per share, assuming no exercise of the greenshoe option or over-allotment option, the company expects to raise a net amount of approximately HKD 4.18 billion. The funds will be used to enhance R&D capabilities (approximately 40%), strategic industry-related investments and acquisitions (approximately 35%), global strategic expansion and strengthening global influence (approximately 9%), improving operational efficiency (approximately 6%), and working capital and other general corporate purposes (approximately 10%).

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$20 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 5 December 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

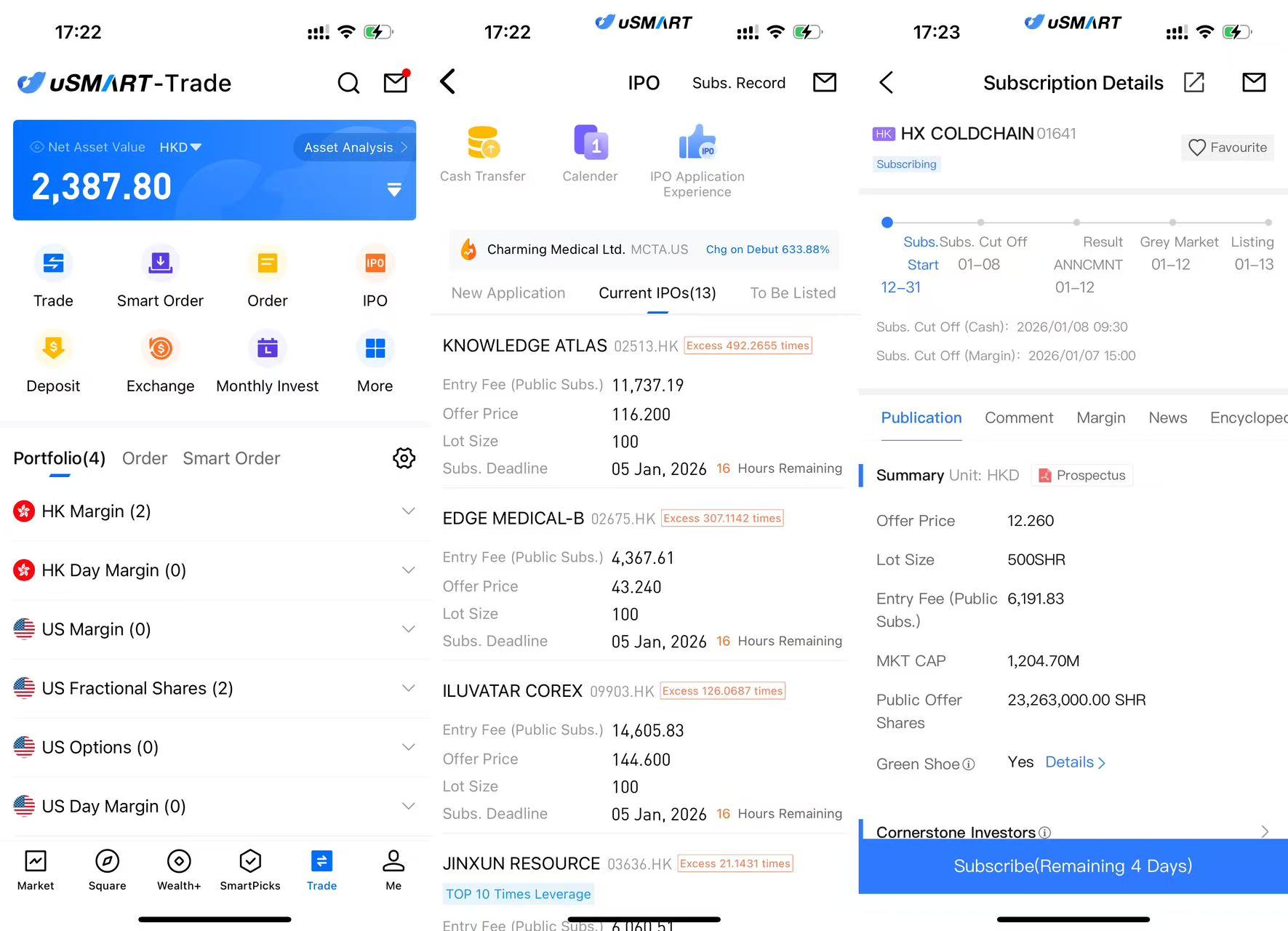

How to Subscribe for BBSB/Hongxing Cold Chain/GigaDevice via uSMART HK

The uSMART HK App features an IPO Centre with exclusive perks, allowing clients to subscribe instantly to public offerings. After logging into the app, tap "Trade" at the bottom-right, go to "IPO Subscription," select BBSB/Hongxing Cold Chain/GigaDevice , tap "Public Offer," enter your subscription quantity, and submit your order.

(Image source: uSMART HK App)

More Content