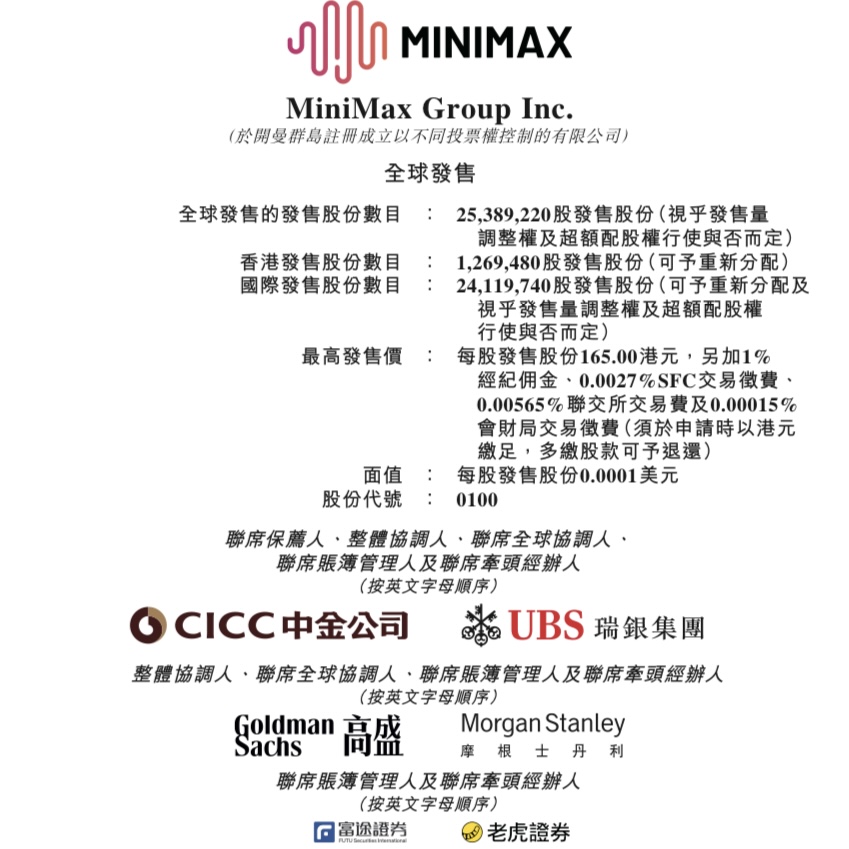

MiniMax: Global Top Ten Large-Model Technology Company (0100.HK)

Issue Ratio: Hong Kong public offering approximately 5% (1,269,480 shares), international placing approximately 95% (24,119,740 shares).

Issue Price: HKD 151.00—165.00; 20 shares per lot; entry fee approximately HKD 3,333.28.

Offer Period: December 31, 2025—January 6, 2026 (expected pricing date January 7, 2026).

Listing Date: January 9, 2026.

IPO Sponsors: CICC, UBS.

Company Overview

MiniMax is a global AI large-model company focused on multimodal model development and the creation of AI-native products. Its product portfolio includes the large language model MiniMax M series, video generation model Hailuo-02, speech generation model Speech-02, and AI applications for both individual and enterprise users such as MiniMax, Hailuo AI, MiniMax Voice, Talkie/Xingye, and open platforms. According to ZR Consulting, based on model-based revenue for 2024, MiniMax is the world’s fourth-largest pure-play large-model technology company, with a market share of 0.3%.

Financial Information

According to the prospectus, MiniMax's revenues for 2022–2024 were USD 0, USD 3.46 million, and USD 30.52 million, respectively. During the same period, the net losses were USD 73.73 million, USD 269.25 million, and USD 465.24 million. As of the nine months ending September 30, 2025, the revenue was about USD 53.44 million, with a net loss of USD 512.01 million. At a median price of HKD 158.00, assuming no exercise of the over-allotment option, the company is expected to raise a net amount of approximately HKD 3,818.3 million. The funds will be allocated for future R&D (approximately 90%, with 70% allocated to large-model development and 20% to AI-native product development and scaling) and working capital/general corporate purposes (approximately 10%).

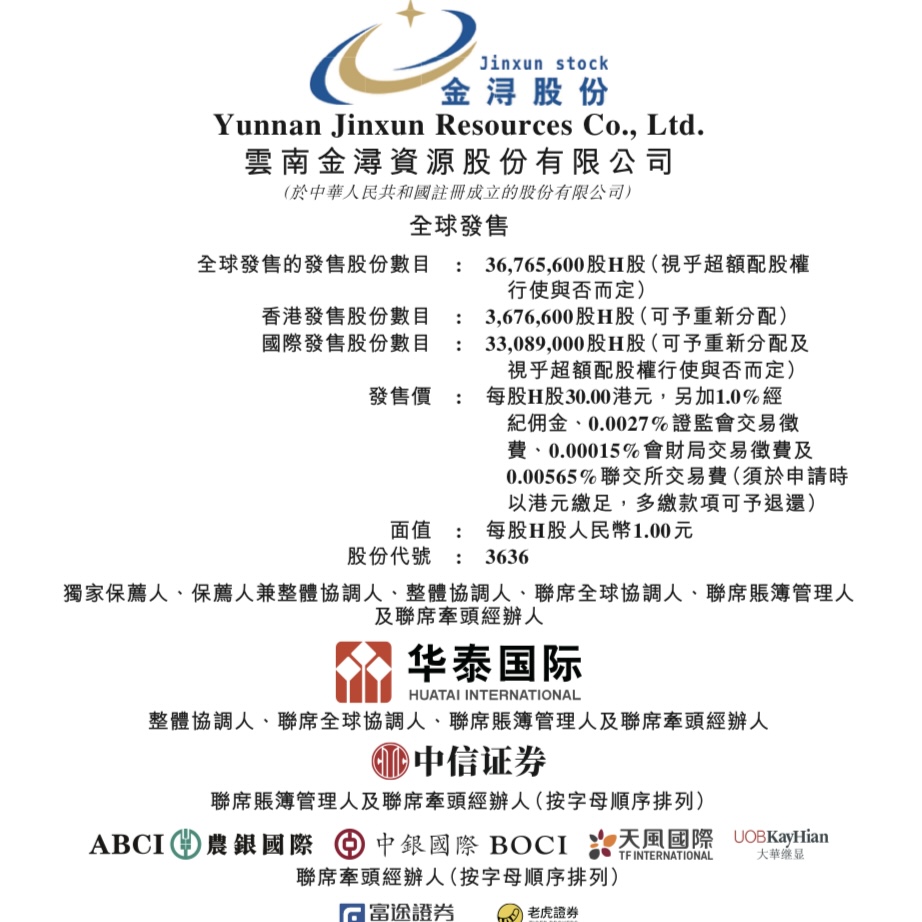

JinXun Resources: Leading Copper-Cobalt Producer in Africa (3636.HK)

Issue Ratio: Hong Kong public offering 10% (3,676,600 shares), international placing 90% (33,089,000 shares), subject to reallocation.

Issue Price: HKD 30.00; 200 shares per lot.

Offer Period: December 31, 2025—January 6, 2026.

Listing Date: January 9, 2026.

IPO Sponsor: Huatai International.

Company Overview

JinXun Resources specializes in the manufacturing of high-quality cathode copper, with operations in the Democratic Republic of Congo and Zambia. According to Frost & Sullivan, by the end of 2024, the company will be the fifth-largest Chinese cathode copper producer in these regions, and the only Chinese company in the top five in both areas. The business covers ore processing, smelting, copper product sales, and non-ferrous metal trading. The company is also actively expanding into the cobalt supply chain to enter the new energy materials field.

Financial Information

According to the prospectus, JinXun Resources' revenue for 2022–2024 was RMB 637 million, RMB 676 million, and RMB 1.77 billion, respectively. During the same period, net profits were RMB 84 million, RMB 29 million, and RMB 202 million. For the six months ending June 30, 2025, revenue was about RMB 964 million, with net profit of approximately RMB 135 million. At an issue price of HKD 30.00, assuming no exercise of the over-allotment option, the company is expected to raise a net amount of approximately HKD 1.043 billion. The funds will be used to expand core businesses, including capacity expansion, strategic acquisitions, and R&D center construction (approximately 80%), repaying bank loans (approximately 10%), and for working capital/general corporate purposes (approximately 10%).

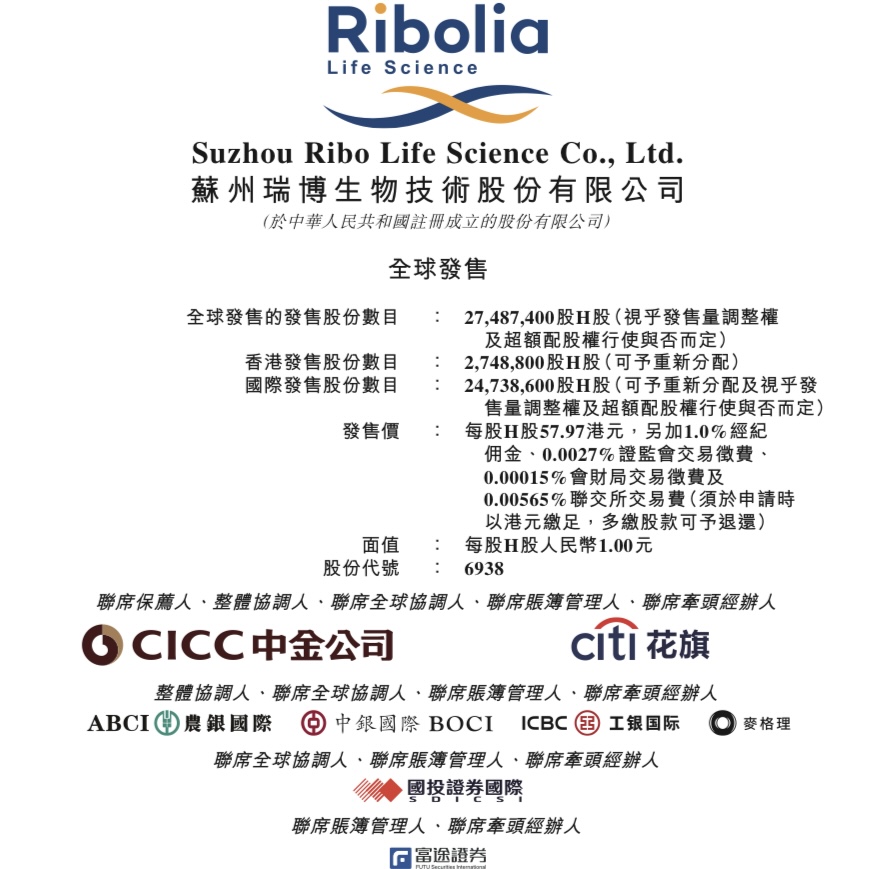

Ribolia: siRNA Therapeutics and Small Nucleic Acid Drug Developer (6938.HK)

Issue Ratio: Hong Kong public offering approximately 10% (2,748,800 shares), international placing approximately 90% (24,738,600 shares).

Issue Price: HKD 57.97; 200 shares per lot; entry fee approximately HKD 11,710.93.

Offer Period: December 31, 2025—January 6, 2026.

Listing Date: January 9, 2026.

IPO Sponsors: CICC, ABC International.

Company Overview

Founded in 2007, Ribolia is a biopharmaceutical company engaged in small nucleic acid drug research and development, particularly focused on siRNA therapies. The company’s core product is RBD4059 (siRNA targeting FXI) for thrombotic diseases. It has seven self-developed drug assets in clinical trials, targeting cardiovascular, metabolic, kidney, and liver diseases, with four in Phase 2 trials. The company has developed proprietary technology platforms such as RiboGalSTAR™, RiboPepSTAR™, and RiboOncoSTAR™ to advance liver-targeted and extra-hepatic organ drug development.

Financial Information

According to the prospectus, Ribolia's revenue for 2023 and 2024 was approximately RMB 44,000 and RMB 142.63 million, respectively, with net losses of RMB 437.30 million and RMB 281.49 million. For the six months ending June 30, 2025, revenue was approximately RMB 103.81 million, with a net loss of approximately RMB 97.77 million. At an issue price of HKD 57.97, assuming no exercise of the over-allotment option, the company is expected to raise a net amount of approximately HKD 1.473 billion. The funds will be used for the development of the core product RBD4059 (approximately 37.4%), RBD5044 (approximately 19.6%), RBD1016 (approximately 15.9%), the development of preclinical pipeline assets (approximately 10.1%), enhancing technology platforms and preclinical assets (approximately 8.9%), and working capital/general corporate purposes (approximately 8.1%).

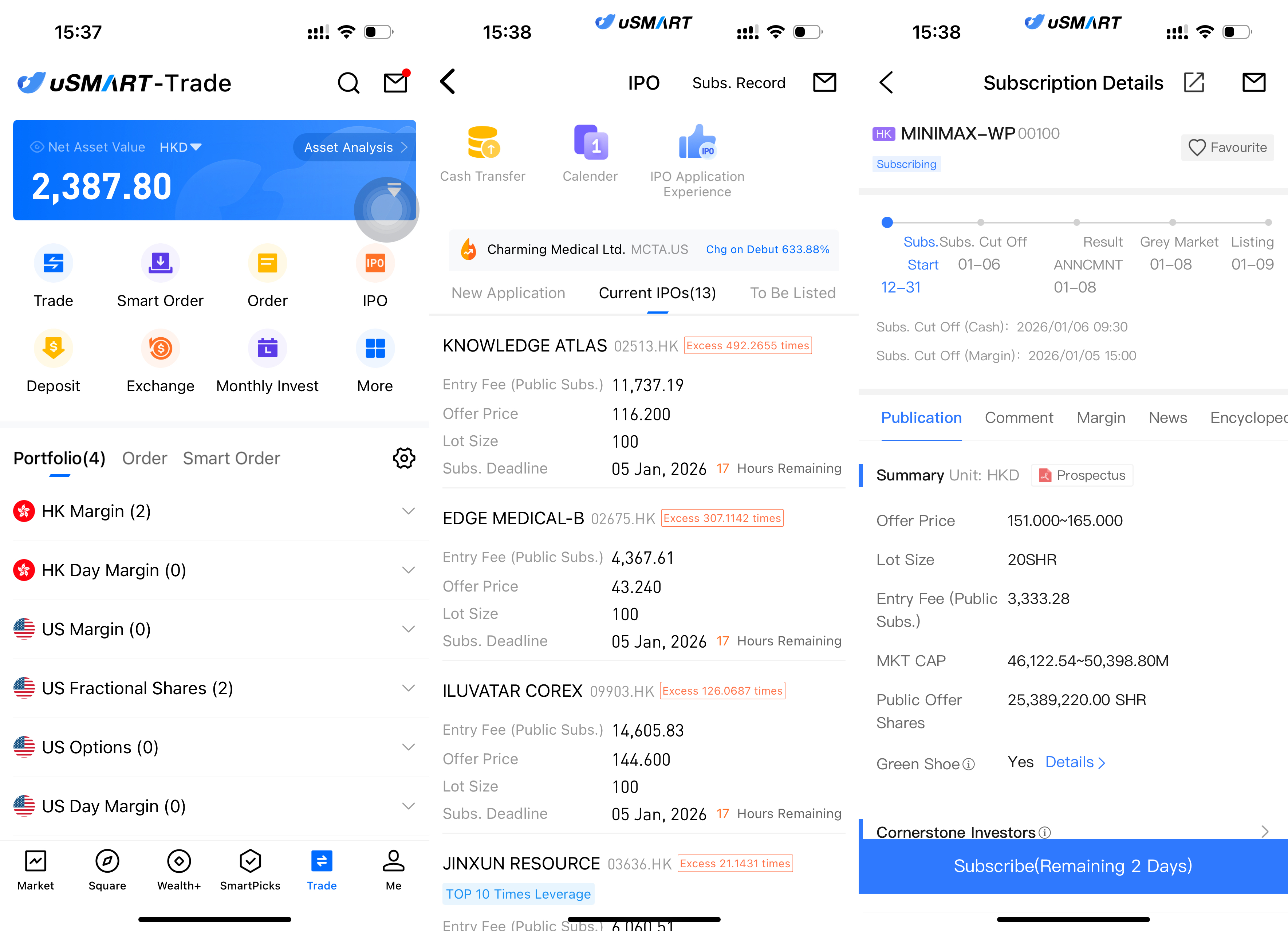

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$20 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 5 December 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

How to Subscribe for MiniMax/JinXun Resources/Ribolia via uSMART HK

The uSMART HK App features an IPO Centre with exclusive perks, allowing clients to subscribe instantly to public offerings. After logging into the app, tap "Trade" at the bottom-right, go to "IPO Subscription," select MiniMax/JinXun Resources/Ribolia, tap "Public Offer," enter your subscription quantity, and submit your order.

(Image source: uSMART HK App)