Nanhua Futures Co., Ltd. (02691.HK), a leading futures company in China, has launched its Hong Kong initial public offering (IPO). The subscription period runs from December 12 to December 17, 2025. The company plans to offer 107,659,000 H shares globally, subject to the over-allotment option. The offer price is set between HK$12.00 and HK$16.00 per share, with a board lot size of 500 shares and an estimated entry cost of approximately HK$8,080.68. Trading on the Main Board of the Hong Kong Stock Exchange is expected to commence on December 22. CITIC Securities (Hong Kong) Limited is the sole sponsor of the offering.

Nanhua Futures: A Leading Futures and Derivatives Service Provider in China

Offering Structure: Hong Kong public offering accounts for approximately 10% (10,766,000 shares, subject to reallocation), while international placing accounts for approximately 90% (96,893,000 shares, subject to reallocation and over-allotment option).

Offer Price: HK$12.00–16.00 per share; 500 shares per board lot; estimated entry cost of approximately HK$8,080.68.

Offer Period: December 12–17 (pricing expected on December 18).

Listing Date: December 22.

Sponsor: CITIC Securities (Hong Kong) Limited.

Company Overview

Nanhua Futures is a leading futures company in China, providing a comprehensive range of global financial services including domestic futures brokerage, risk management, wealth management, and overseas financial services. According to a report by Frost & Sullivan, the company ranked eighth among all futures companies in China in terms of total revenue for 2024, and first among all non-financial institution-related futures companies. Since its establishment in 1996, Nanhua Futures has built a diversified business network and a technology-driven risk control system covering both the Chinese and international markets.

Financial Information

According to the prospectus, Nanhua Futures recorded annual profits of approximately RMB 246 million, RMB 403 million, and RMB 458 million for 2022–2024, respectively, with a compound annual growth rate (CAGR) of 36.5%. For the first half of 2025, the profit was approximately RMB 231 million. Based on the mid-point offer price of HK$14.00 per share, and assuming the over-allotment and reallocation options are not exercised, the company expects to raise net proceeds of approximately HK$1.41 billion. The funds will be used to increase the capital base of the Group’s operations in Hong Kong, the UK, the US, and Singapore (approximately 90% of the funds), and for general corporate purposes and working capital (approximately 10%).

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$20 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 5 December 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

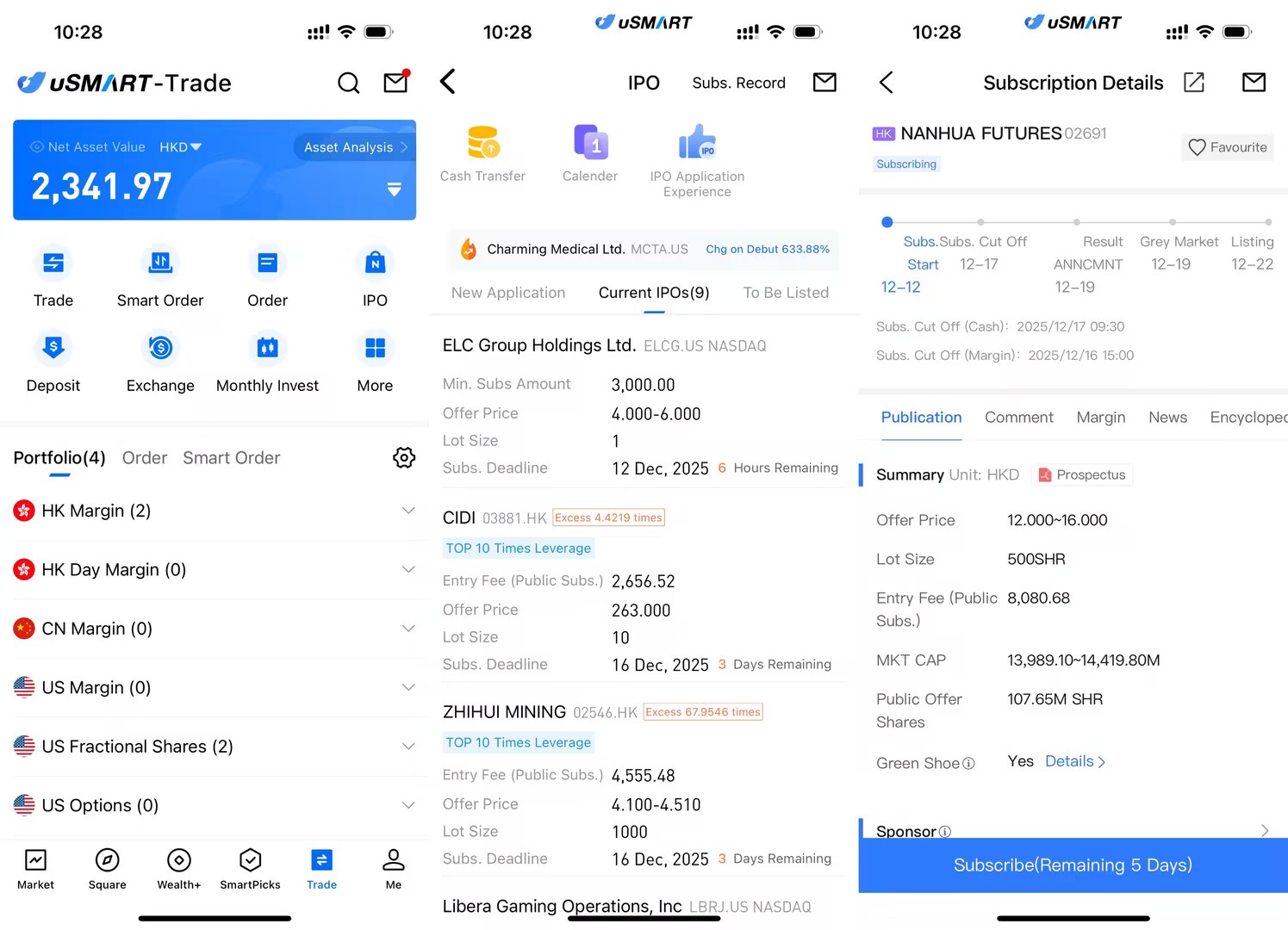

How to Subscribe for Nanhua Futures via uSMART HK

The uSMART HK App features an IPO Centre with exclusive perks, allowing clients to subscribe instantly to public offerings. After logging into the app, tap "Trade" at the bottom-right, go to "IPO Subscription," select Nanhua Futures, tap "Public Offer," enter your subscription quantity, and submit your order.

(Image source: uSMART HK App)