Impression Dahongpao Co., Ltd. (2695.HK), a leading cultural and tourism service provider, has launched its Hong Kong initial public offering (IPO). The subscription period runs from December 12 to December 17, 2025. The company plans to offer 36,100,000 H shares globally, with a 15% over-allotment option. The offer price ranges from HK$3.47 to HK$4.10 per share, with a board lot size of 1,000 shares and an estimated entry cost of approximately HK$4,141.35. Trading on the Main Board of the Hong Kong Stock Exchange is expected to commence on December 22. The joint sponsors are Xingzheng International Financing Limited and Kaisheng Capital Limited.

Impression Dahongpao: Leading Cultural and Tourism Service Provider in Fujian

Offering Structure: Hong Kong public offering accounts for approximately 10% (3,610,000 H shares, subject to reallocation), while international placing accounts for approximately 90% (32,490,000 H shares, subject to reallocation and over-allotment option).

Offer Price: HK$3.47–4.10 per share; 1,000 shares per board lot; estimated entry cost of approximately HK$4,141.35.

Offer Period: December 12–17 (pricing expected on December 18).

Listing Date: December 22.

Sponsors: Xingzheng International Financing Limited, Kaisheng Capital Limited.

Company Overview

Impression Dahongpao is a state-owned cultural and tourism service enterprise headquartered in Wuyishan, Fujian. According to the 2024 China Cultural and Tourism Performance Market Report, the company ranks eighth in terms of revenue from cultural and tourism performance programs. Its core business is the iconic "Impression Dahongpao" live landscape performance, which has been expanded to include new performances such as "Moon Reflection on Wuyi," cultural tourism town operations, and tea-based hotel businesses, creating a synergistic service ecosystem.

Financial Information

According to the prospectus, Impression Dahongpao recorded revenues of approximately RMB 63 million, RMB 144 million, and RMB 137 million for 2022–2024, respectively. Net profits for the same period were approximately RMB -3 million, RMB 48 million, and RMB 43 million. For the first half of 2025, the company posted revenue of about RMB 56 million and net profit of approximately RMB 7 million. Assuming the over-allotment option is not exercised, and based on the mid-point offer price of HK$3.79 per share, the company expects to raise net proceeds of approximately HK$110.4 million. The funds will be allocated as follows: approximately 23% for upgrading the iconic performance, approximately 29% for innovative cultural tourism town development, approximately 20% for acquiring another cultural tourism performance project, approximately 11% for brand promotion, approximately 7% for upgrading the ticketing system, and approximately 10% for working capital.

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$20 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 5 December 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

How to Subscribe for Impression Dahongpao via uSMART HK

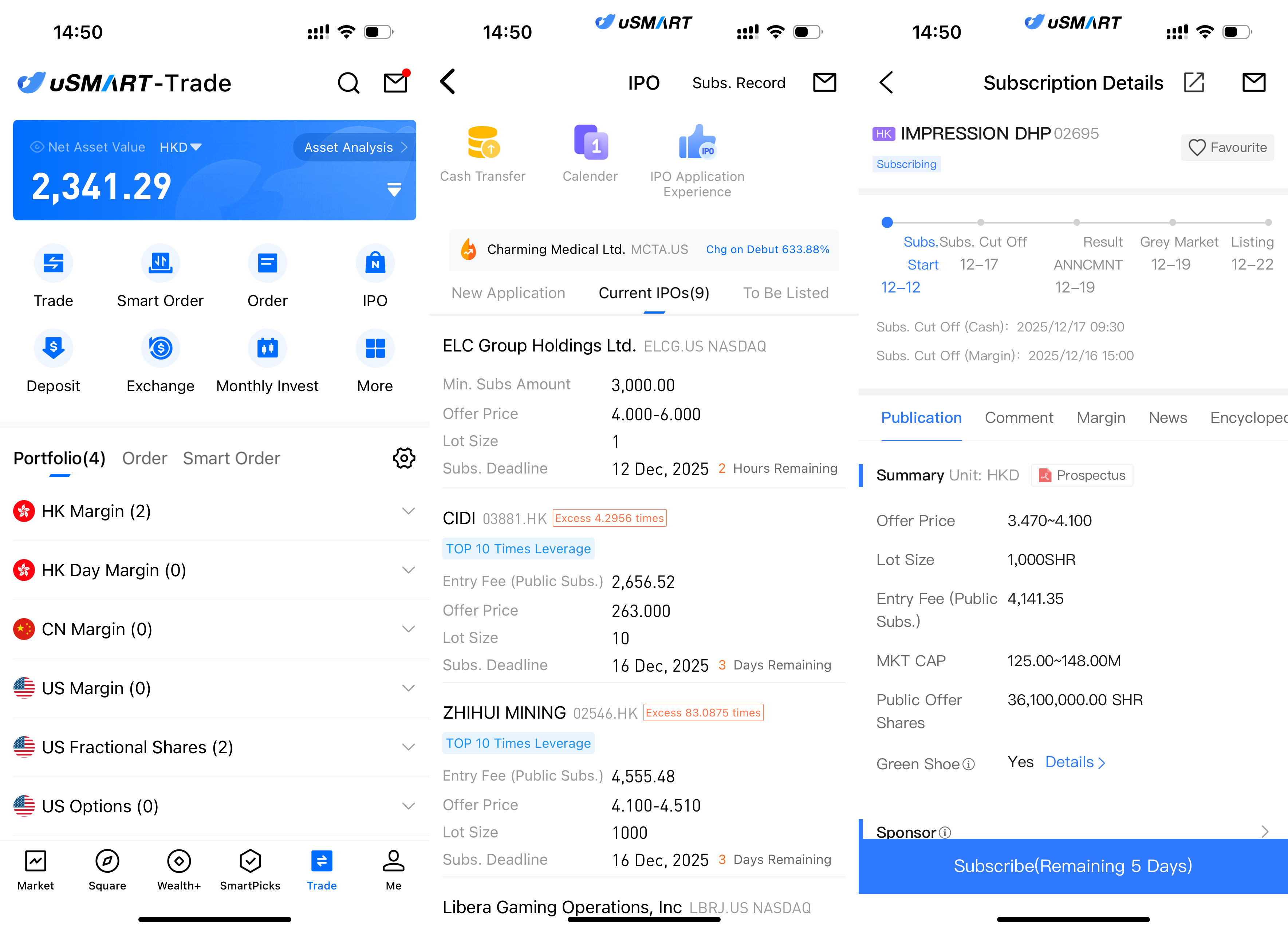

The uSMART HK App features an IPO Centre with exclusive perks, allowing clients to subscribe instantly to public offerings. After logging into the app, tap "Trade" at the bottom-right, go to "IPO Subscription," select Impression Dahongpao, tap "Public Offer," enter your subscription quantity, and submit your order.

(Image source: uSMART HK App)