A股收评:沪指连跌5日,创业板指涨1.64%,抱团股超跌反弹,白酒板块集体走高

3月10日,受外围资本市场提振的影响,A股三大指数大幅高开,随后两市出现分化,截至收盘,沪指连跌五日,缩量收跌0.05%报3357点;深成指涨0.65%,报13563点;创业板指涨1.64%,报2676点。个股普跌,涨幅超9%个股仅40余家,市场赚钱效应较差。

盘面上,超跌抱团股集体反弹,山西汾酒、药明康德等大涨;白酒、锂电池、煤炭、碳中和、医疗等概念涨幅居前;油气采掘板块领跌,惠博普跌停;港口航运股集体下跌,渤海轮渡、中谷物流跌逾6%。染料概念大跌,浙江龙盛收跌4.4%;网络游戏、云计算、数字货币等概念表现低迷。

具体来看,白酒板块全天强势,山西汾酒因业绩超预期而强势涨停,金种子酒、青青稞酒大涨7%,ST舍得、酒鬼酒、泸州老窖、五粮液涨逾4%,白酒龙头贵州茅台收涨1.7%,老白干酒、金徽酒等跟涨。

(来源:wind)

煤炭概念涨幅居前,陕西黑猫、云煤能源、开滦股份等封板;大有能源、山西焦化涨逾8%;安源煤业、昊华能源、淮北矿业涨超3%。

(来源:wind)

动力电池板块集体反弹,恩捷股份、翔丰华、亿纬锂能、天赐材料涨超5%;宁德时代、比亚迪、当升科技上涨3%。除了隔夜美股大反弹的带动影响,在美上市的中国造车新势力蔚来、理想、小鹏被报道称计划最早于今年在港股上市,一定程度上增强了市场对新能源车的信心。

(来源:wind)

前期跌幅惨烈的医药生物板块亦开启反弹。览海医疗、紫鑫药业、通策医疗涨停封板;佐力药业、欧普康视、昭衍新药等大涨7%;片仔癀、药明康德、康龙化成、英科医疗、迈瑞医疗、爱尔眼科等细分领域龙头涨逾5%。

(来源:wind)

港口板块跌幅居前,宁波港领跌5.45%;北部湾港、上港集团、连云港下跌4%左右;青岛港、保税科技、日照港等个股纷纷跟跌。

(来源:wind)

能源设备板块大跌,惠博普跌停,准油股份大跌9%;海默科技、恒泰艾普、通源石油、杰瑞股份跌逾5%。

(来源:wind)

科创板方面,传音控股、恒玄科技、艾力斯-U涨逾7%,极米科技、奇安信-U等跟涨;而深科达、金盘科技领跌,跌超16%,华锐精密、普门科技、光云科技等均跌逾6%。

(来源:wind)

(来源:wind)

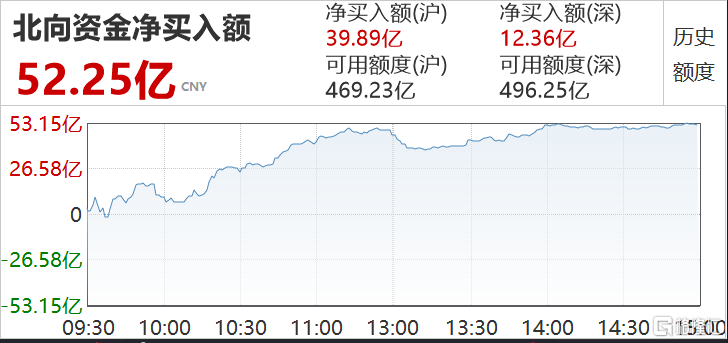

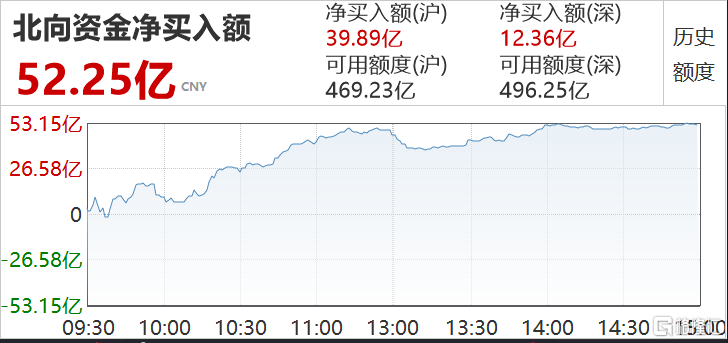

北向资金今日合计净买入52.25亿元,其中沪股通净流入39.89亿元,深股通净流入12.36亿元。

(来源:wind)

国盛证券认为,春节后的急速调整,只是抱团股价值趋向合理的正常走势,财政积极货币稳健宏观流动性并未全面收紧,场内杠杆率也并未处于异常水平,A股当前并不存在系统性风险,指数短线跌速快跌幅大,已出现情绪化特征,目前建议按兵不动。

国金证券表示,重点关注中盘股投资机会。全球经济复苏下,一方面沪深300等大盘成分股业绩增长优势不强,中盘股的成分股成长性更强;另一方面流动性收紧、利率上行的背景下,部分高估值的大盘股估值调整压力较大,中证500、中证1000等中盘指数安全边际凸显。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.