騰訊控股(00700.HK)2020年Q3財報點評:Q3淨利同比增長89%,手遊市佔率持續提升,維持“買入”評級,目標價644.96港元

機構:東方證券

評級:買入

目標價:644.96港元

核心觀點

公司 Q3 營收 1254.47 億,同比增長 29.01%,環比增長 9.02%。同比增長主要系頭部遊戲營收增加推動,環比增長主要系金融科技與企業服務驅動。公司 Q3 毛利率 45.16%,同比增長 1.47pp,環比下降 1.15pp。IFRS 歸母淨利潤 385.42 億元,同比上升 89.10%,環比上升 16.42%。Non-IFRS 歸母淨利潤 323.03 億元,同比增長 32.32%,環比增長 7.13%。

增值業務:Q3 收入 698.02 億元,同比增長 37.87%,環比增長 7.38%。毛利率 52.6%,同比增長 0.8pp,環比下降 1.1pp。手機遊戲收入:391.73 億元,同比增長 61.21%,環比增長 8.85%。受公司遊戲業務端轉手紅利持續,我們預測 Q4 上線手遊將帶來 15 億預算增量,持續推動手遊收入的增長。PC 遊戲收入:116.31 億元,同比上升 1.13%,環比上升 6.59%。社交網絡收入:283.80 億元,同比增長 28.85%,環比增長 6.24%。

網絡廣告業務:Q3 收入 213.51 億元,同比增長 16.25%,環比上升 15.09%;毛利率 50.92%,同比增長 2.16pp,環比下降 0.52pp。因增加廣告位等產品開啟廣告變現,預計 Q4 小程序廣告將持續增長帶動社交廣告穩步提升。? 金融科技及企業服務業務:Q3 收入 332.55 億元,同比增長 23.28%,環比增長 27.88%。由於商業支付和理財平台業務持續快速增長,我們預測 Q4金融科技及企業服務收入將維持增長態勢。

財務預測與投資建議

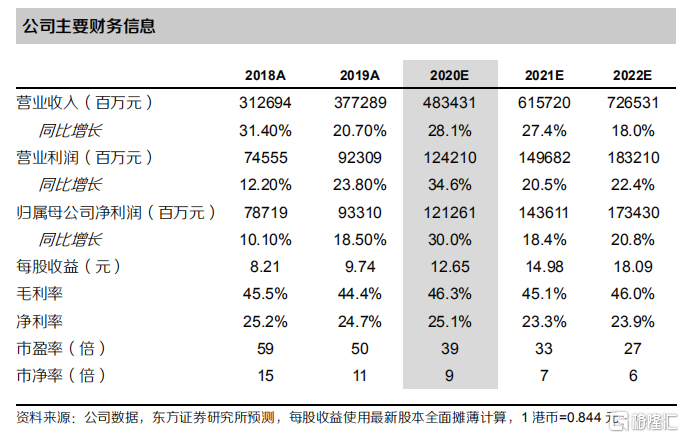

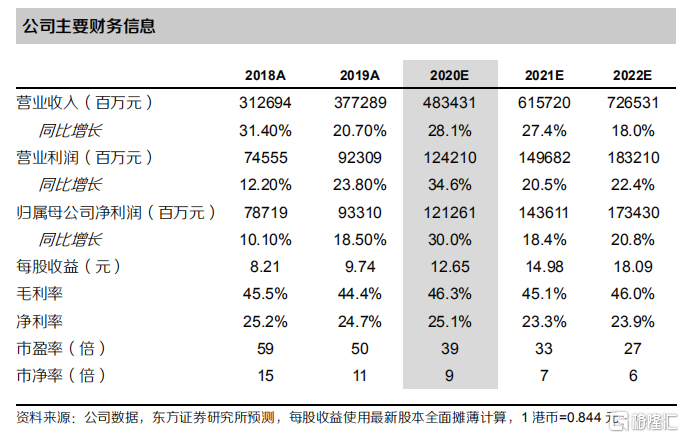

公司遊戲業務頭部手遊貢獻穩定收入、付費用户穩步提升,預計年底《CODM》、21 年《地下城與勇士》等高 DAU 端轉手遊的上線將進一步提振收入。廣告業務來看,受益於 21 年 S 級待播劇驅動品牌組招商,媒體廣告21年或能實現穩步增長。我們預計20/21/22年淨利潤為1213/1436/1734億元,對應 EPS 12.65/14.98/18.09 元,PE 39/33/27 倍。採用 SOTP 估值,給予目標價 644.96 港幣(544.22 人民幣),維持“買入”評級。

風險提示

政策風險、遊戲不達預期風險、組織構架變革帶來的不確定性因素、投資標的收益波動不確定性、經濟週期波動影響、遊戲淨利率波動較大。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.