药明生物(02269.HK):下半年起业务强劲复苏,新冠项目进度大超预期,维持“增持”评级,目标价 256.6 港元

机构:中泰国际

评级:增持

目标价:256.6 港元

下半年新增订单总额超越预期,未来 3 年强劲增长可期

药明生物于 10 月 20 日晚间召开业务更新会议。公司下半年获得大量新增订单,10 月底在手订单总额从 6 月底的约 94.64 亿美元增加到约 102.7 亿美元,与 2019 年年底相比更是已经翻倍,其中将于 3 年内完成的订单总额也从约 6 月底的 9.25 亿美元提升到 10 月底的 14.4 亿美元,将支撑未来 3 年业绩的强劲增长。考虑到优于预期的新增订单情况,公司上调 2021 年收入增长指引,预计将至少增长 50%。值得注意的是,公司新增的 72 个项目中,有 10 个是从其他公司转入药明生物的项目,而且其中有 3 个是三期临床项目。公司在疫情环境中能从竞争对手获得项目并扩大市场份额,表现出强大的竞争力。我们认为如欧美疫情持续导致部分竞争对手经营出现问题,公司还可能获得更多订单。

中和抗体与疫苗双轮驱动,新冠项目落地速度大超预期

公司目前未完成订单中,包括约 5.28 亿美元新冠项目,涵盖新冠中和抗体与疫苗。公司于上半年与 GSK 签订新冠中和抗体项目,药明生物提供研发外包服务,公司管理层预期该中和抗体如进展顺利可能于 2021 年上半年上市。另外,公司新签项目中包含约 1.5 亿美元的新冠疫苗项目,而且如对方有需求疫苗的订单总额也可能最多增加到 4 亿美元,总体来看公司新冠项目落地速度大超预期。国务院今早公布今年年底国内新冠疫苗产能将达 6.1 亿剂,明年将在此基础上继续加大。我们认为在流感季来临之际新冠疫苗需求强大,而且目前的情况疫苗研发将获得全球政府支持。药明生物是全球领先的生物药研发服务(CXO)提供商,如市场有需求公司还有能力获得更多订单。

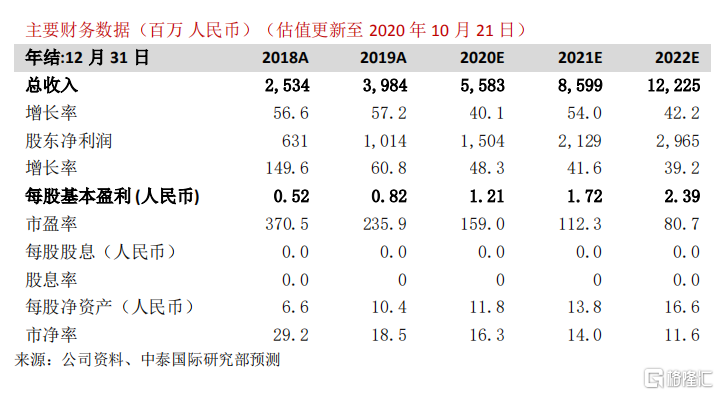

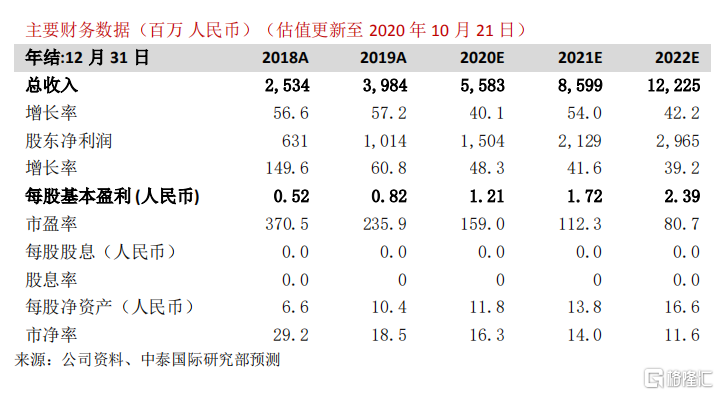

重申“增持”评级,上调盈利预测与目标价

我们早前考虑到疫情对欧美市场的影响,而且也不确定公司能否迅速获得新冠疫苗订单,因此做了保守预期。考虑到公司获得订单的速度与能力显著强于预期,在疫情的情况下能从竞争对手获得订单,而且收费较高的Ⅱ期临床与Ⅲ期临床项目总数从 6 月底的51 个增加到 57 个,后期项目的增加将提升公司利润率。长期看,获得订单的能力加强也有利于公司进一步提升在 CXO 行业的竞争力和市场份额。考虑到这些因素,我们将反应核心业务盈利的 2020E-22E 经调整净利润分别上调 0.6%/11.9%/11.8%。我们重申“增持”评级,将目标价从 195.6 港元提升至 256.6 港元,以反应公司盈利增长加快与人民币汇率提升的因素。我们的目标价对应 128.1 倍 2021E PER。

风险提示:(一)新冠疫情反复导致公司生产受影响;(二)新冠疫情反复导致公司客户经营受影响被迫减少研发支出;(三)项目进展中出现问题可能导致中断。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.