安踏体育(02020.HK):Q3持续加速增长,显龙头强大品牌力,维持"优于大市"评级

机构:海通证券

评级:优于大市

投资要点:

公司发布 2020Q3 运营数据表现。2020Q3 安踏主品牌低单位数正增长,Fila实现 20%-25%增长,其他品牌(Descente/Kolon Sport/Sprandi/Kingkow)实现 50-55%正增长。

主品牌 Q3 增速首次回正,Fila 延续高增长。安踏主品牌与 FilaQ3 零售增速均显逐季显著改善趋势,其中,安踏 Q1-Q3 零售增速分别为同比下滑20%-25%/低单位数负增长/单位数正增长,Fila 则为中单位数负增长/10%-20%低段增长/20%-25%增长,我们认为电商高增和学生稳定复学带来的儿童系列增长均为重要动力。淘数据显示,安踏和 FilaQ3 天猫全网同比增速分别为 41%、80%。

Descente、KolonSport 步入快速成长通道。以 Descente 和 Kolon Sport为核心的其他品牌 Q2(25%-30%+)和 Q3(50%-55%)均实现高速增长,我们认为作为在中国仍处成长阶段的两大品牌(Descente2016 年与公司成立合资公司,Kolon2017 年被收购),其在疫情之下回暖强劲且快速发展的原因主要为①两大品牌已积累悠久品牌文化和专业性口碑(Descente 和 Kolon 分别已创立 85、47 年),②安踏运用其丰富渠道和品牌运营经验,通过着重优越地段开设门店,完整产品线使其更为符合中国消费者需求。

国庆复苏强劲,Q4 冷冬利好冬季产品销售。淘数据显示,国庆期间(10/1-10/7),安踏和 Fila 天猫全网销售分别同比增 95%、586%,我们认为主要由于①疫情控制更为稳定,带动假期出行消费进一步提振,②国庆期间平均气温降幅度明显,提升消费者换季服饰需求。今年北京 9/15 入秋,是2016 年以来最早,上海 10/4 入秋,是 2012 年以来最早,同时 2021 农历新年晚于去年同期,我们认为节前消费时段长,亦有利于公司冬季产品的销售。

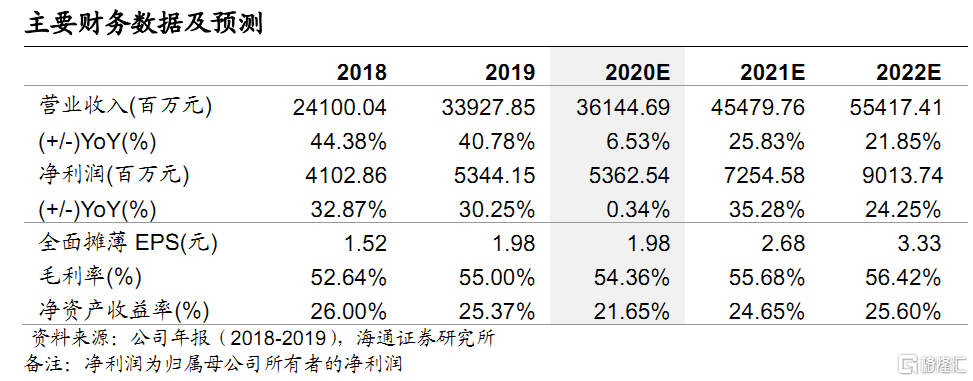

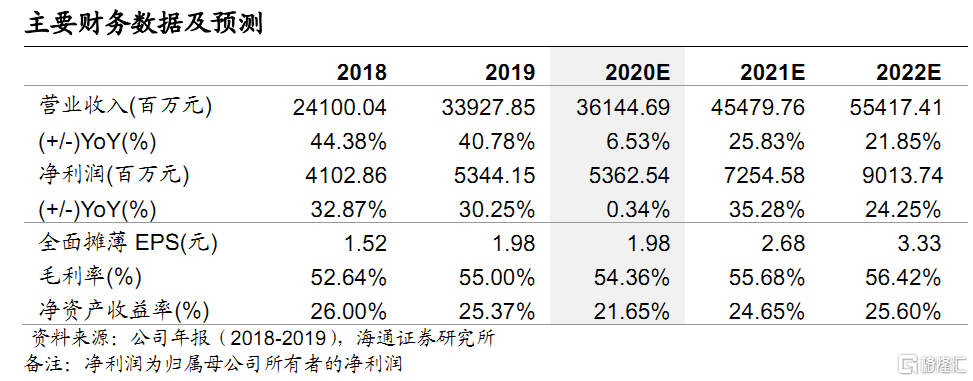

盈利预测与估值。我们认为安踏主品牌龙头地位稳定,童装业务快速发展, Fila 品牌影响力持续提升,以及我们预计 AmerSports2020H2 冬装业务带来的正面贡献,我们预计公司2020/2021 年收入361.4/454.8 亿元,同比增6.5%/25.8%,净利润 53.6/72.5 亿元,同比增 0.3%/35.3%,我们给予 2021 年 PE 估值区间 33-35X,按照 1 港元=0.88 元人民币换算,对应合理价值区间 100.50-106.59 港元/股,维持“优于大市”评级。

风险提示。零售环境疲软,新品牌收购整合不达预期,店铺拓展进程放缓等。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.