全球股市進入調整、美國抵押貸款基金現淨流出

本週市場回顧

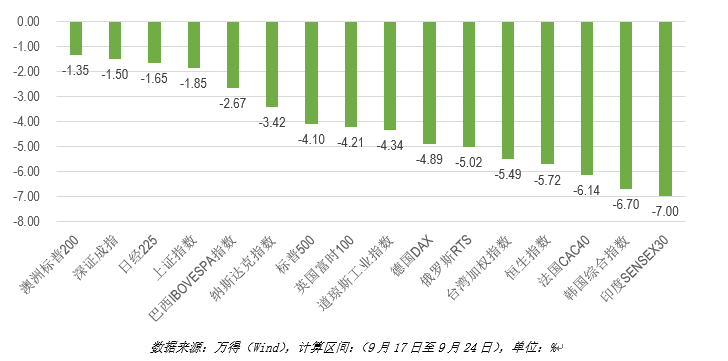

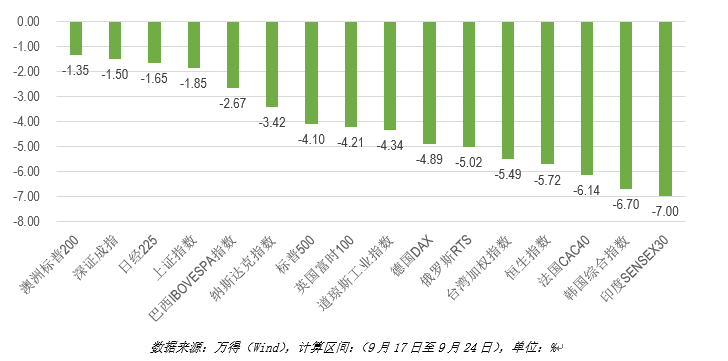

9月17日到9月24日間,全球主要股指全線下挫。其中,A股股市、日本股市相對較爲抗跌。美國、歐洲股市均有更大程度跌幅。而截止9月25日,A股和港股周漲跌幅與上述區間行情一致。全球投資者風險偏好均轉弱的原因,可能包括對股市估值出現泡沫的擔憂、歐洲二次疫情爆發的不確定性、以及對未來經濟復甦央行貨幣政策收緊的預期等。

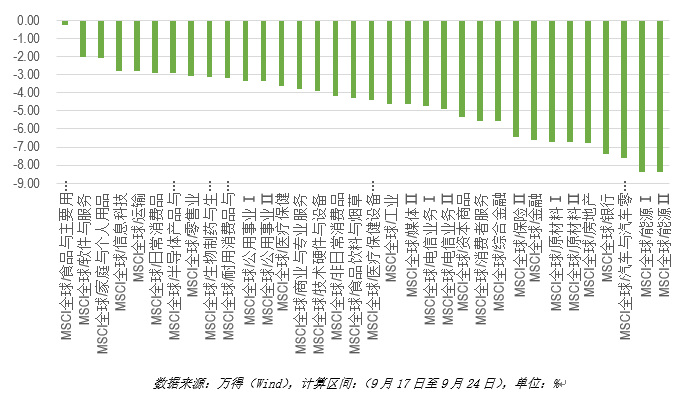

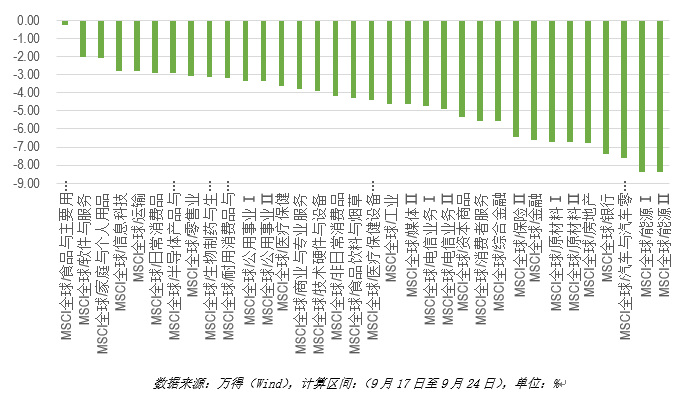

行業指數方面,與前周漲跌互現的情況不同,9月17日至24日間,MSCI全球行業指數均出現不同程度的下跌。全球股市進入新一輪短期調整階段。

uSMART智選基金觀點

本週消息面上,美國衆議院官員稱民主黨已開始起草一份規模爲2.4萬億元的財政刺激計劃,期望與兩黨重啓談判。貨幣政策方面,美聯儲主席鮑威爾當地時間9月24日在參議院銀行委員會的證詞中表示,美聯儲正尋求讓美國平均通脹達到2.0%,這可爲美聯儲提供更多降息空間。但寬鬆的貨幣政策需要財政刺激計劃的支持。低利率的環境下極易導致美國住房抵押貸款違約,這可能讓本身陷入衰退的美國經濟雪上加霜。財政刺激可促使人們重返勞動力市場,振興經濟,違約風險則會大幅降低。兩黨此前因爲刺激方案的資金數額產生分歧,導致談判陷入停滯。本次民主黨的財政刺激規模較爲折中,財政部長姆努欽在週四早些時候也表示希望重啓談判。我們預期本次財政刺激方案有望達成一致,屆時美國經濟或會展現強勁復甦態勢。但我們仍然提醒投資者關注近期再度加重的歐洲疫情和美國大選不確定性對資本市場的不利衝擊。

海外基金動態

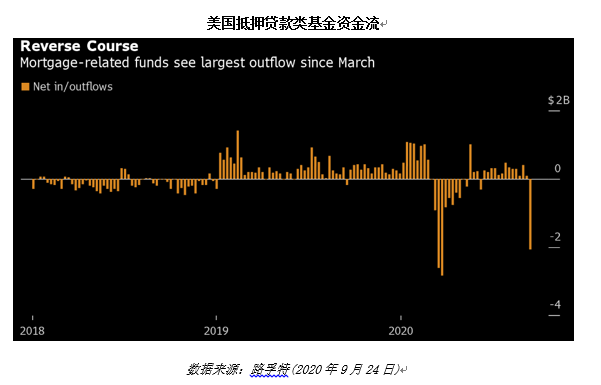

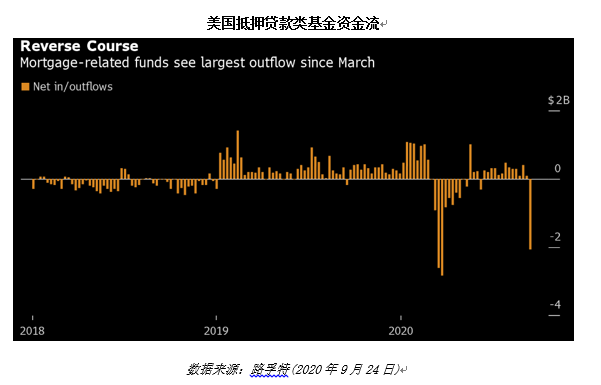

近日,據路孚特統計數據顯示,截至9月16日當週,美國抵押貸款類基金遭遇21億美元資金淨流出。這是在經歷連續14周資金淨流入後,該類基金首次發生資金大規模退出。同時導致今年以來,抵押貸款類基金錄得5.74億美元的累積淨流出。

抵押貸款類基金主要投資於住房抵押貸款證券(MBS)。 住房抵押貸款證券的投資收益與抵押貸款利率密切相關,利率下行將會降低住房抵押貸款證券的收益率,因此導致這類基金喪失投資吸引力。美國抵押貸款利率在三月份美聯儲開始一項債券購買計劃之後暴跌至創紀錄的低點。房地美(Freddie Mac)最新數據顯示,爲期30年的固定利率抵押貸款創下了歷史新低,本週平均爲2.86%。這可能是引發本次大規模資金流出的主要誘因之一。

國內基金動態

國家外匯管理局本週三數據顯示,共18家金融機構獲得33.6億美元QDII額度,其中11家基金公司合計新增22.3億美元投資額度。目前國內已有157家QDII機構共獲得1073.43億美元投資額度,涵蓋基金、證券、理財公司等多類型金融機構。

QDII全稱合格境內機構投資者,該制度允許符合條件的境內金融機構在一定額度內投資境外資本市場。業內人士認爲,本次新一輪額度發放可促進國內國外“雙循環”格局的形成,有利於推動金融市場高水平開放。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.