石药集团(01093.HK):肿瘤产品高增长,疫情影响有限,维持“增持”评级,目标价23.74港元

机构:国泰君安

评级:增持

目标价:23.74港元

本报告导读:

公司公告 2020年一季报,疫情影响有限,业绩符合预期。肿瘤板块销售维持高景气,研发成果丰富,有望驱动业绩保持快速增长,维持公司增持评级。

摘要:

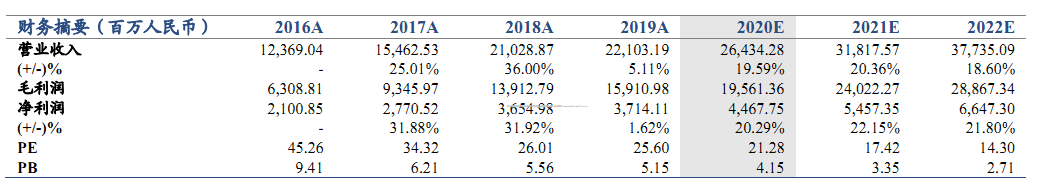

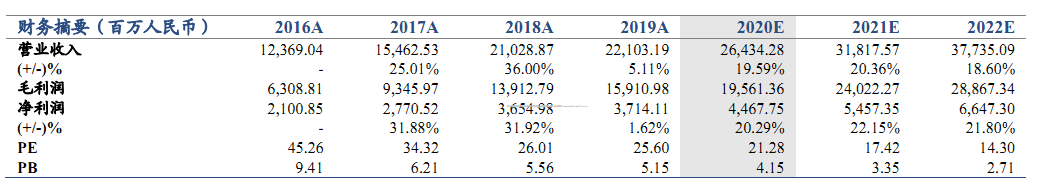

维持“增持”评级。公司发布 2020年一季报,报告期内公司实现营业收入 61.25 亿元,毛利 45.29 亿元,股东应占溢利 11.59 亿元,分别同比增长11.5%、17.9%、21.8%。其中成药销售50.22亿元,同比增长18.3%。疫情影响有限,业绩增长符合预期。维持 2020-2022年 EPS预测为0.72元、0.88 元、1.07元,维持目标价 23.74港元,维持“增持”评级。

核心品种维持高增长,拉动公司业绩。Q1核心板块抗肿瘤药物销售收入15.52亿元,同比增长 53.7%,其中克艾力(白紫)和津优力由于用药的便利性,销售受疫情影响较小,销售收入分别增长 114.0%、64.5%。各省份从4 月底基本推进了白紫的集采,虽然降价较多,但预计6月份销售额可以恢复到 19年12 月的水平,白紫全年 30亿元销售目标仍有望实现。恩必普 Q1 销售额同比增长 18.1%。基于药物经济学和临床指南,预计恩必普独家品种谈判的降价幅度可控,随着自费市场的开拓和县级医院的销售下沉,维持恩必普 100 亿销售峰值的预测。受集采中标驱动,心血管药物 Q1 销售额 5.82 亿元,同比增长 66.5%,主要依赖 2019 年恩存集采中标,而玄宁(马来酸左旋氨氯地平)销售收入增长也达到 25.8%,全年增速预计较高。

研发维持高投入,核心品种进展顺利。Q1研发费用达5.68 亿元,同比增长23.2%,研发投入没有受到疫情的影响,仍保持较高增长,预计全年研发投入25亿元。两性霉素 B复合物预计6月份现场核查,预计Q3获批;米托蒽醌即将报产;RANKL、奥马珠单抗进入临床 III期。预计2021年后公司有望每年 2-3个新药和新制剂获批上市,创新转型更进一步。公司目前规划科创板上市,有望募集资金进一步加大研发投入,推动制药业务发展。

催化剂:重要产品获批上市销售,核心产品销售放量超预期,在研创新药临床数据超预期。

风险提示:产品研发不及预期,行业政策风险,新冠疫情影响程度超预期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.