美团点评-W(03690.HK):用户/商户数增长超预期,疫情影响收入有所降低,维持“买入”评级,目标价167.31港元

机构:东方证券

评级:买入

目标价:167.31港元

核心观点

整体来看,疫情对短期业绩有冲击,但是长期来看可培养用户习惯并加快商户数字化转型,公司活跃用户和商户同比保持正增长。截至 3/31,公司的年交易用户数同比+8.9%至 4.49 亿人;人均年交易次数同比+5.6%至 26.2次/年;年活跃商家同比+5.3%至 610 万家。20Q1 实现收入 167.5 亿元,yoy-12.6%(佣金 yoy-18%,在线营销服务 yoy+0.1%);经调整净亏损额为 2.16 亿元,利润率同比提升 4.2pct 至-1.3%。

外卖业务:高端商户增加拉高客单,目前恢复速度较块。 20Q1 日单量 1,51万笔,yoy-18.2%;疫情期间品牌/连锁餐饮的订单占比提升,单位订单金额同比增加 6.6 元至52 元/单;外卖 GTV 同比微降 5.4%至 715亿元。由于疫情冲击和 KA 商户占比提升,变现率有所降低, 外卖业务收入同比降 11.4%外卖业务恢复速度较块,至 3月末日单量已经恢复至疫情前 75%的水平。

到店和酒旅业务:受冲击最大,恢复速度较慢。20Q1 酒店间夜量同比降45.5%至 4,280 万,其中本地住宿及低线城市的商旅住宿恢复速度更快,因此美团相比同行有一定结构上的优势。为了加快行业复苏,公司推出“安心住”项目,但相比外卖业务,到店和酒店的恢复速度相对较慢;20Q1 到店收入同比降 31%至 31 亿元(佣金降 50.6%,广告降 8.2%);营业利润率为 22%,同比降13.5pct。

新业务:今年投入力度不减。新业务收入 20Q1 同比+4.9%至 41.7 亿元,营业利润率同比提 32.3pct。网约车及 B2B 业务收入有所减少,美团闪购和小额贷款收入增加。公司管理层在公开业绩交流会上表示,今年仍然会从长期战略角度出发,保持对共享单车、闪购、美团买菜、B2B 业务的持续投入。

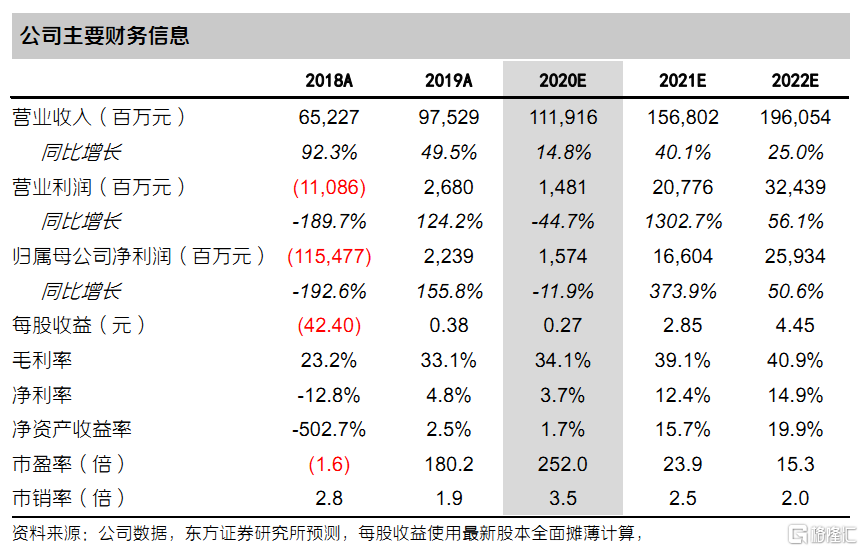

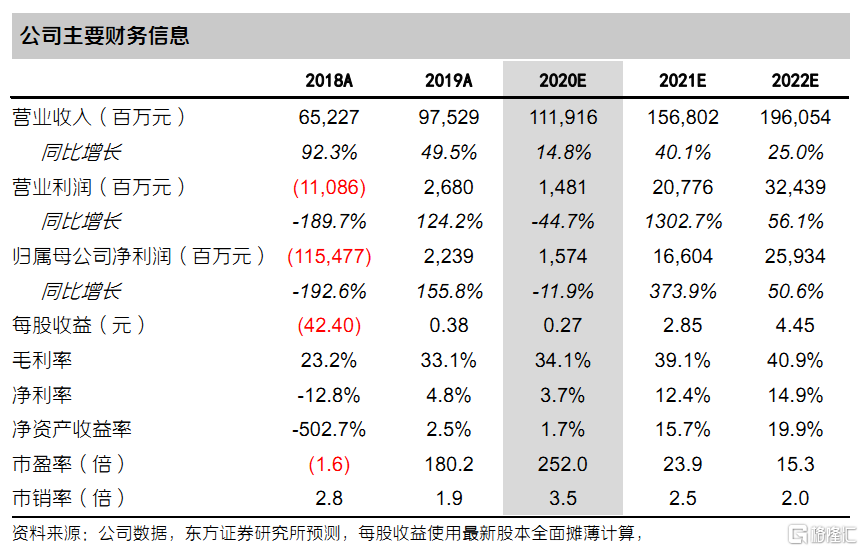

财务预测与投资建议

我们预测公司 20-22 年 EPS 分别为 0.27/2.85/4.45 元.。采取分部估值,参考可比公司,给予外卖业务 4.8x PS,预计 21 年收入 917 亿CNY;到店及酒旅给予 31x PE,预计 21 年实现利润 146亿 CNY;不考虑新业务的估值公司合理估值为 9749 亿 HKD,目标价 167.31 元,维持“买入”评级。

风险提示:市场竞争加剧,佣金率提升水平不及预期,到店业务恢复缓慢。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.