网龙(00777.HK):游戏继续高增长,教育变现多元化,维持“买入”评级

机构:广发证券

评级:买入

核心观点:

公司披露2019年业绩公告,业绩实现高增长。收入和归母净利分别实现57.93亿元(+15%)和8.07亿元(+48%)。受益于游戏强劲增长,毛利率同比提升6.1pct;销售费用率同比略增,管理费用率和研发费用率同比略减。

游戏收入和业绩均高增长。19年收入和经营性分类利润分别实现33亿(+39.4%)和19.23亿(+51.3%),毛利率略升至95.9%,销售费用率同比提高1.9pct,管理费用率和研发费用率分别下降3.2pct和2.5pct。端游和手游收入分别同比+38.3%和46.8%。《魔域》IP游戏收入同比+39.2%,《英魂之刃》和《征服》收入同比+32.5%和66.3%。储备多款有版号手游,《终焉誓约》由B站独代,预计暑期上线,《魔域传说》H5、《英魂王座》、《英魂之刃战略版》预计20H2上线;另外,《魔域2》、《决战巨神峰》等手游在版号审批中。

教育:19年收入同比-6.6%至23.95亿,剔除18Q2莫斯科订单收入的高基数影响,收入同比+12%;经营性分类亏损5.24亿,同比扩大主要是普米18Q2高基数+Edmodo全年并表+贸易战加税;毛利率基本持平29.8%。普米:19Q2新产品推出驱动19H2收入环比+20%,埃及项目首批试点订单正在部署中。国内:SaaS开始变现,普米国内订单开始落地,101PPT月活设备数达100万。

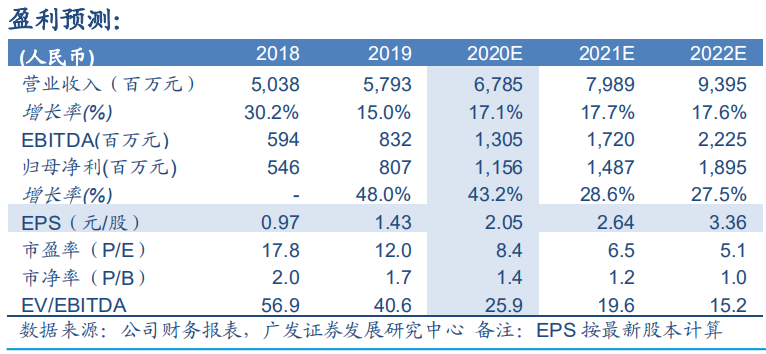

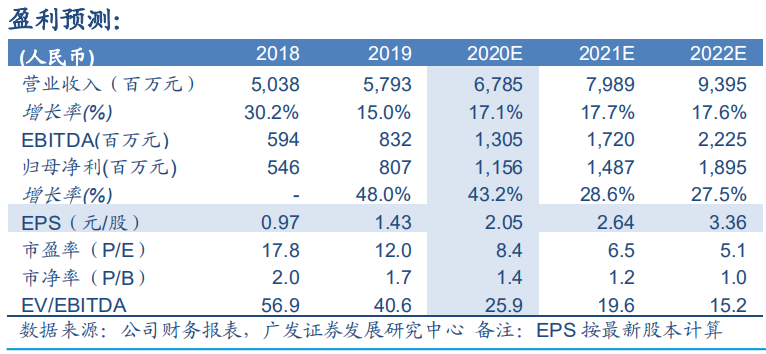

维持“买入”评级。预计20~21年归母净利分别为11.56亿元、14.87亿元,当前股价对应PE分别为8.4倍、6.5倍。根据SoTP,游戏业务给予20年10倍PE,国内教育给予20年10倍PE,普米给予20年15倍PE,Edmodo按此前收购估值的70%估值,得到合理价值37.7港元/股。核心游戏仍增长,多款新游待上线,在线教育行业需求激增,公司教育开始多点变现,融资为新项目落地及潜在投资并购提供弹药。

风险提示:老游戏增长放缓,新游表现不达预期;普米新项目落地及收入确认时间导致收入波动,国内教育业务进展不达预期,亏损扩大。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.