信义光能(0968.HK):稳健基本面支持股价反弹潜力,重申买入评级,目标价6.62 港元

机构:招商银行

评级:买入

目标价:6.62 港元

我们与公司就新型冠状肺炎所造成的影响进行了沟通。信义光能因节后复工延迟 至 2 月 10 号所造成的生产影响有限,公司在春节假期依然维持光伏玻璃正常生 产。在下游需求方面,目前阶段我们看到光伏玻璃价格维持稳定,同时公司仍有 空间通过建立库存方式吸收控疫期间的短期影响,我们认为下游需求扰动相对较 小。新增产能投放或将因此略微延期,料将影响 2020 年上半年新增供应。总的 来说,我们认为公司的基本面大致稳定,较强的基本面有望支持股价反弹。

春节期间维持生产。根据安徽省政府对于疫情控制的指引,公司将春假假期复 工的时间延迟至 2 月 10 号。基于光伏玻璃窑炉生产的连续性要求以及公司较 高的自动化生产水平,公司在春节假期维持正常生产。根据管理层信息,二月 份光伏玻璃的定价将在复工后确定,但在目前阶段公司预期价格维持稳定。参 考卓创资讯信息,2月3日一家江苏的光伏玻璃生产企业提供报价显示3.2/2.02.5 毫米规格的光伏玻璃价格分别为人民币 29.5/28 元/平方米,尽管受疫情影 响,价格展望依旧稳定。

下游需求影响较小。公司目前对下游需求波动并不特别担心,因 1)部分下游 组件厂商在春节期间维持生产,以及 2)多数组件厂商在 2 月 3 号及 10 号开 始恢复生产。管理层透露节前行业平均的库存水平在 1-2 周,隐含供应仍处于 偏紧态势。我们认为信义光能及同业仍有空间通过建立库存方式来消化 10-15 天的产出,同时在目前阶段我们认为疫情对于下游需求的影响较小。

新建产能或将略微延迟。公司将在 2020 年第二及第三季度投产四条日熔量 1,000 吨的新建产能。我们认为这几条新的生产线或将因延期复工及交通管制 等原因略微延期。我们同时观察到部分厂商将冷修点火的时间推迟到 4 月。我 们认为 2020 年上半年新增产能释放将非常有限,从而使光伏玻璃供应维持偏 紧局面。

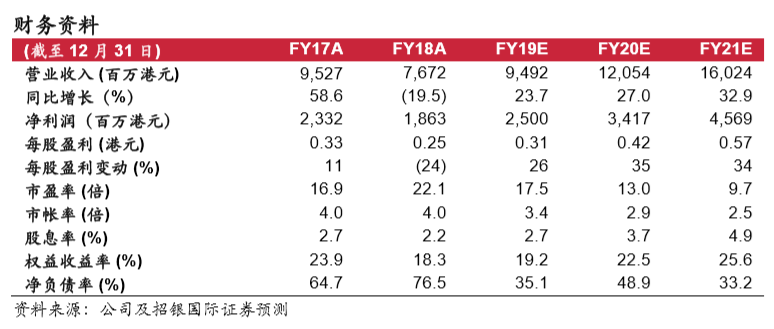

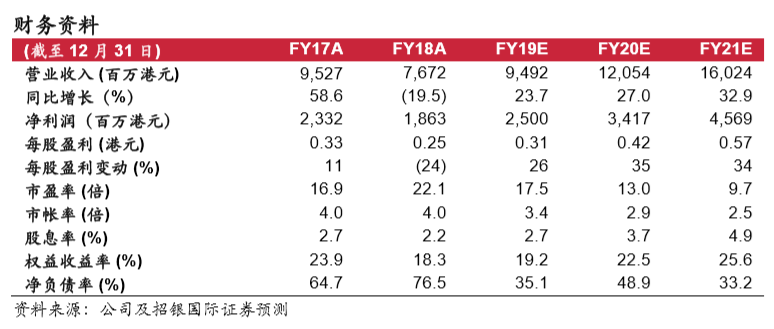

基本面大致维持稳定,重申买入评级。公司股价自春节前每股 6.32 港元历史 高位因新冠病毒疫情而回落 8.7%。我们相信光伏玻璃行业及信义光能的基本 面在目前阶段仍旧稳健,股价回落创造了较好的买入时机。我们对公司重申买 入评级,目标价维持每股 6.62 港元不变。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.