网格智能单

什么是网格智能条件单?

不管市场价格如何上下波动,不外乎3种形态:上涨,盘整,下跌。

网格智能条件单作为程序行为,不依赖人为思考,像渔网一样,利用行情的波动在网格区间内低买高卖,可以合理控制仓位,避免追涨杀跌,拥有较强的抗风险能力,网格交易的优点是在盘整行情中可以获得可观的收益。

网格智能条件单适合具有基础持仓,且愿意履行网格化交易理念的客户。

操作说明

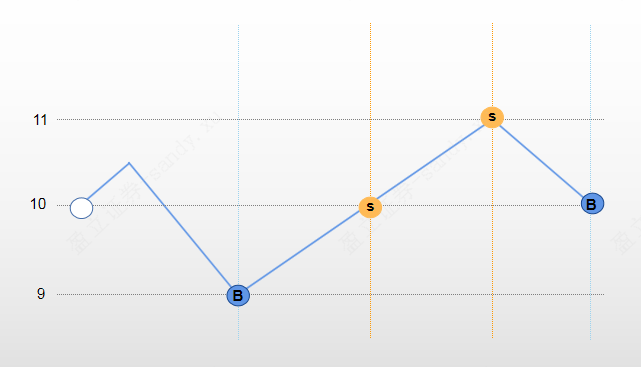

你判断某只股票未来将在一定区间内横盘震荡,希望通过高抛低吸赚取中间的波动,这时可以通过【智能条件单】-【网格订单】设置一定条件,下跌时买入,上涨时卖出,赚取差价。

让我们来看看具体操作步骤:

STEP 1 选择股票

输入想要进行网格交易的股票,一般选择基本面较好,价格连续波动且较少发生跳价现象的证券。

STEP 2 设置触发条件

输入初始基准价,一般为建底仓的价格,不宜设置过高。

选择触发类型,可选择触发价差或触发百分比。根据对股票的涨跌分析,填写适当的价差。当基准价上涨指定价差或百分比,将触发执行卖出方向的委托,当基准价下跌指定价差或百分比,将触发执行买入方向的委托。

*价差和百分比不宜填写过小,考虑到交易存在交易费用成本,设置能够盈利的数值。

填写价格区间,输入触发价格上限及下限后,系统将自动计算出向上及向下的网格数。

*当股价超过上限或下限后,网格智能条件单将进入休眠状态。

STEP 3 设置委托条件

输入卖出价格及买入价格。目前港股支持最新价、买卖盘一档及五档委托下单,美股支持最新价、买卖盘一档委托下单。

输入每笔数量,无论是买入或者卖出,每次委托时,均委托相同的数量。

点击更多设置,可设置最大持仓,最小持仓,及倍数委托。

*倍数委托代表若行情发生跳空高开或者低开时,按照跳跃的网格数成倍委托相应的委托数量。

STEP 4 选择有效期并提交订单

选择有效期,目前可选择当天/2天/3天/1周/2周/30天/60天/90天,可通过改单延续有效期。

点击解锁交易,提交订单。已提交的订单可在智能订单页面下查看,可以根据需要对订单进行修改。

*若网格智能条件单已经触发,则不能进行修改,但您可以终止网格策略。

可下单时间

任何时间

订单有效期

目前可选择当天/2天/3天/1周/2周/30天/60天/90天,可通过改单延续有效期。