It is believed that most people have been shocked by pinduoduo's financial report released a week ago-it is rare to be able to make such a profit in such a macroeconomic environment. In the past earnings season for Chinese stocks, such a truly eye-catching financial report is unique; the so-called "exceeding expectations" of other companies are mostly just a trick of "lowering expectations first and then exceeding expectations".

What I want to discuss today is not pinduoduo's financial report, but the more essential thing reflected behind it:Over the next six months, some Internet companies will be able to copy its path and achieve a sharp rebound in performance, while others will be even worse. The answer isControl of sales and marketing costs.

Last quarter, Punduo's revenue rose 36% from a year earlier, while sales and marketing expenses (Selling & Marketing Expense) increased by only 9%, resulting in huge "operating leverage" and a rapid rise in profits. According to pinduoduo's management, this operating leverage may be temporary because "many promotions and new projects have been postponed" in the second quarter and expense rates will rise again in the second half of the year. Management did not give specific guidance on the expense rate, saying only that "the competition is still fierce" and that money should be spent where it should be spent.

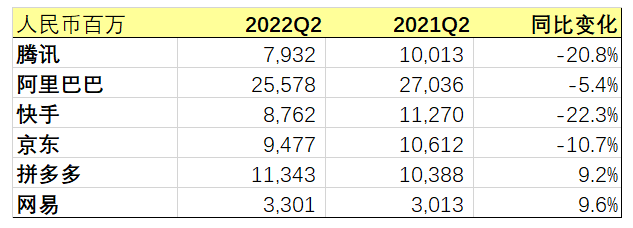

However, we can observe: in the second quarter of this year, the sales expenses of mainstream Internet companies generally decreased significantly. Among them, the biggest year-on-year declines were Kuaishou (- 22.3%) and Tencent (- 20.8%). Among the mainstream big companies, only pinduoduo and NetEase's sales expenses are still growing, but the growth rates are also lower than double digits.

Sales and marketing expenses of large Internet companies in the second quarter of 2022

(note: Baidu does not disclose sales expenses and administrative expenses separately in its quarterly report, but "sales and administrative expenses" generally show a significant downward trend, so we can estimate that Baidu's sales expenses are also declining. )

The above phenomenon is easy to understand: the overall environment of the industry is not very good, large factories are shrinking through the winter, investment in new business is reduced, and marketing activities can be saved as well. In the capital markets, user data such as MAU/DAU/AAC are no longer the focus of investors, even though the status of operating income in their minds has declined; now they are most concerned about deducting non-profit (Non-GAAP Earnings), the hardest financial indicator.

In two or three quarters, large Internet companies can control sales expenses while allowing business income to grow inertia. For example, games like "Arena of Valor" and "Game for Peace" will not drop sharply just because they are not put on the market in a quarter (regardless of purchase volume or product promotion). Pinduoduo APP is already a nationwide shopping platform, and GMV will not shrink sharply because there is less market activity in a quarter. If they continue not to put in, life cycle value (LTV) may decline, but this will not be reflected in the current quarterly report.

This is especially true for new businesses-they are meant for the future. If Internet companies scale back their investment in community group buying and overseas business, investors will welcome it, because they are not focusing on the future in five or ten years' time, but to get through the recent winter. The contraction of new business will correspond to the overall contraction of costs, but sales and marketing expenses will certainly account for a very large proportion.

-

Internet advertising revenue will continue to decline in the coming quarters. Because Internet companies (called "web service customers" in advertising jargon) are already the largest Internet advertisers, their shrinking spending means a decline in Internet advertising revenue. This momentum has been clear over the past two quarters and will continue. -

Advertisers will tend to retain those that are "immediate" or "must stay" and shrink everything else. For example, live streaming is an "instant" launch; a large-scale head event is a "must-stay" launch. Among all kinds of platforms or advertising forms, only those with high conversion rate and withstand short-term market testing can be retained.

-

There is a serious bottleneck in game companies, and that is the version number. Originally, game companies are faced with product cycle factors, and the overlay of version number factors is even more unpredictable. Only the head companies like Tencent and NetEase, which have a large number of "evergreen" products, can ignore the bottleneck of version numbers. -

Head consumer brands can ignore the economic cycle to a certain extent, but most "new domestic" brands are not brands at all. It is a collection of a series of "big items"-their product development, sales and promotion completely follow the idea of "big items". In the stage of consumption contraction, these "big items" will face the pressure of head brand and white brand at the same time, and will be in a dilemma.

-

If you can convert, it is best to sell something directly, or to facilitate a deal with a chain as short as possible. In other words,Certainty. There are deterministic forms of promotion not only live with goods, but also other content e-commerce, social e-commerce, and interesting e-commerce platform promotions. -

Under the premise of meeting the first article, if it can still have a certain long-term effect and form the so-called "integration of quality and effect", so much the better. Even if you can't, at least don't have any negatives. after all, no one wants to be scolded by their own on-screen comments for their advertisements. -

Save energy and save energy for the future and for the long term. From the management of the company to the investors, everyone wants immediate and immediate results. It is purely a performance art in the current environment to make forward-looking investments for people who have the spending power (in doubt) ten years later.