Amid an increasingly fierce game between the market and the Fed, Federal Reserve Chairman Colin Powell will have a chance to reset financial market expectations at the annual global central bank meeting in Jackson Hole on Friday.

Powell will speak on the economic outlook at 10:00 local time on Friday. Mr. Powell is expected to reaffirm the Fed's determination to continue to raise interest rates to control inflation, although he may not hint at what actions Fed officials will take at next month's meeting.

Laura Rosner-Warburton, senior US economist at MacroPolicy Perspectives, a New York research firm, said: "this is the question that everyone most wants to know, that is, to what extent will Powell micromanage the financial situation? We have reached a point in time when the economy shows signs of slowing down. " "if we do not see a further slowdown but a rebound, then the Fed will have to manage financial conditions more actively."

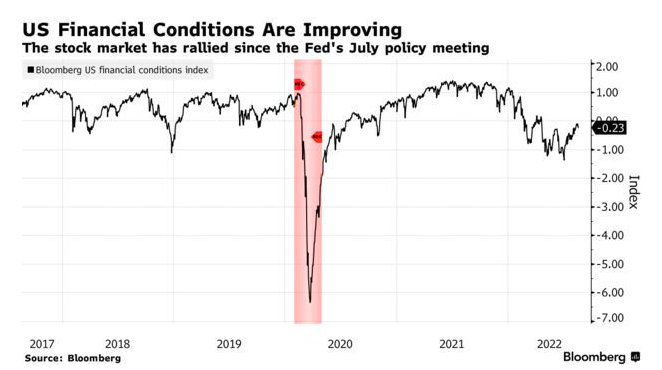

Us stocks have rebounded strongly since the Fed's July meeting. The Fed is expected to end monetary tightening soon and cut interest rates in 2023 in response to the economic slowdown. Meanwhile, the latest July CPI data show signs of a temporary slowdown in inflation. Mr Powell has not spoken since the July meeting, and while several Fed officials insisted that the fight against inflation was far from over, investors were largely unimpressed.

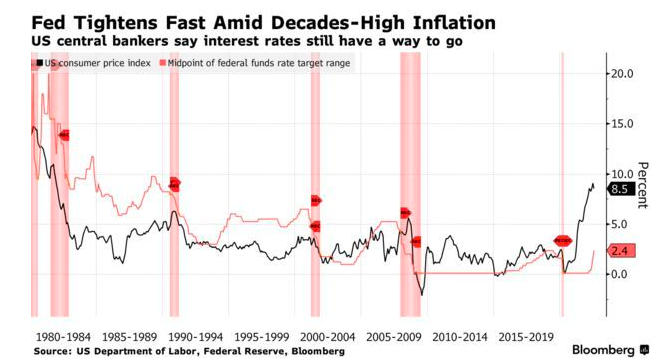

At last year's Jackson Hole annual meeting, Powell asserted that inflation was "likely to be temporary". Now, a year later, inflation in the United States is still close to its highest level in 40 years, and when Powell was officially re-elected chairman of the Federal Reserve in May, he made a rare public admission that the Fed had been slightly slow to raise interest rates. It would have been better to act earlier.

Kevin Cummins, chief US economist at NatWest Markets, said that while the latest CPI data raised some optimism that inflation may have peaked, Powell is likely to stick to a hard line in the current context. "part of the reason [the Fed] is so focused on this is that they screwed up on the 'interim inflation' thing last year," he said. They realise that the only thing they can do now is to tighten monetary policy, which will slow inflation. "

At its July meeting, the Fed raised its benchmark federal interest rate by 75 basis points. This is the second month in a row that the Fed has raised interest rates by 75 basis points, with a cumulative increase of 150 basis points in June and July, the largest consecutive rate hike since Volcker took office in the early 1980s.

For now, investors think it is equally likely that the Fed will raise interest rates by 50 basis points and 75 basis points at its September meeting. Non-farm payrolls and CPI data for August will be released before the September meeting, which could be decisive factors in the Fed's decision to raise interest rates by 50 basis points or 75 basis points.

In addition to Powell, Schnabel, a member of the executive board of the European Central Bank, will also make a speech. In Europe, policymakers are also discussing the extent of the next rate hike. The ECB lags behind other central banks in dealing with record high inflation and has only just begun to raise interest rates in July. After raising interest rates by 50 basis points in July, many policymakers have yet to signal whether they are inclined to raise interest rates by another 50 basis points in September or by a small 25 basis points as the risk of recession rises.

As the only ECB executive board member to attend the Jackson Hole annual meeting, Schnabel's speech will be closely watched. Her speech may reveal how the ECB plans to deal with short-term challenges such as high inflation and economic weakness, as well as long-term challenges, including climate change.

In addition, the level to which the Federal Reserve and the world's major central banks will eventually raise interest rates is also an important question. George, chairman of the Kansas Federal Reserve, which organizes the Jackson Hole annual meeting, said last Thursday that no matter how much policy makers choose to raise interest rates next month, they may have to continue to raise interest rates for some time. Until they are "fully convinced" that inflation is falling.