The outbreak of the Russia-Ukraine war, the escalating conflict between Palestine and Israel, and the Bank of Japan raising interest rates. These sensational events have contributed to the intensification of global uncertainty, which in turn has had a significant impact on financial markets.

In times like these, when uncertainty increases and risk intensifies, investors tend to flock to so-called "safe haven assets." But what are safe-haven assets? Why invest in safe-haven assets? What are the safe-haven assets?

In this article, we will explain what safe-haven assets are, provide some examples of what are considered the best safe-haven investments, and demonstrate how to get started with uSMART for safe-haven investing.

What are safe-haven assets?

Safe-haven assets are assets that investors turn to to protect their capital when market volatility or economic uncertainty increases. These assets usually have lower risks and higher stability, and can provide better value preservation and risk resistance in times of market panic or economic crisis.

However, it is important to note that not every safe-haven investment is suitable for every market downturn, and assets classified as safe-haven will also vary depending on the broader economic environment.

Therefore, in order to find the best safe-haven investment, investors must conduct their own research and ensure that the investment in question is suitable for the goals they want to achieve.

Why invest in safe haven assets?

Investing in safe-haven assets can protect capital when economic uncertainty increases.

Market volatility, economic recessions, geopolitical risks and other uncertainties can all negatively impact an investment portfolio.

By holding safe-haven assets, investors can reduce risk, balance their portfolios, and preserve the value of their assets during market downturns.

Safe-haven assets: safe-haven investments

It's not always smooth sailing in financial markets; periods of downturn and volatility are normal.

Therefore, to prevent excessive losses in asset value, investors would do well to prepare for such periods and understand the impact that market downturns can have on different asset classes.

In the following sections, we'll take a look at some of the most popular safe-haven investments to withstand market volatility.

But remember, this is not an exact science and the price of any asset is determined by supply and demand levels in the market and will not always react in a preset way.

Additionally, popular safe-haven assets change over time, so you should make sure you understand current market trends before considering safe-haven investments.

Safe-haven assets are mainly divided into the following categories:

Gold

Gold is considered the ultimate safe-haven asset as it has historically demonstrated a strong ability to store value. Whether it’s inflation, economic crisis or geopolitical risk, gold provides a sense of security.

Historically, gold has proven time and time again to maintain and even increase its value during periods of uncertainty and market downturns, although much of this depends on psychological factors.

As mentioned before, prices are driven by market supply and demand. When uncertainty increases or global markets fall, the first reaction of many investors is to rush to gold, as for many it is the first safe-haven investment that comes to mind. This leads to an increase in the demand for gold and therefore its price due to the limited supply of gold globally.

During the 2008 financial crisis, global stock markets plummeted, but gold prices rose significantly. Gold's safe-haven properties make it the first choice for investors in times of crisis.

Safe haven currency

U.S. Dollar: The U.S. dollar, like gold, usually comes up in any conversation about the most popular safe-haven investments. In fact, the dollar's status as the world's reserve currency and the fact that most commodities are priced in dollars make it popular as a safe-haven asset during times of market turmoil. Additionally, it is the most liquid currency on the foreign exchange market, meaning investors can easily convert assets into U.S. dollars.

Swiss Franc: The Swiss franc is also viewed by many as a safe-haven currency due to its strong economy, political neutrality, historically low inflation, and banking sector, and demand for the Swiss franc tends to increase during periods of stock market volatility.

Japanese Yen: The Bank of Japan has maintained ultra-low interest rate policies for a long time and even implemented negative interest rate policies. This makes borrowing yen cheaper, and under normal market conditions, investors typically borrow yen to invest in high-yielding assets. However, when market volatility intensifies, investors will liquidate these risky assets and repay yen loans, leading to increased demand for the yen, thereby pushing up its exchange rate.

The Bank of Japan is considering raising short-term interest rates to around 0.25% from the current range of 0-0.1% at a two-day policy meeting that ends on Wednesday, Jiji News Agency reported. According to Japan's NHK, citing people familiar with the matter, some board members believe that the Bank of Japan must be wary of the risk that a weak yen may push up inflation. Within the Bank of Japan, more and more people believe that the country's inflation is accelerating, in line with their expectations. Under such circumstances, the Bank of Japan will consider raising interest rates at its July meeting. Japan's interest rate hike will make the yen stronger, which will invalidate the interest rate carry trade.

Government Bonds

Bonds are like "IOUs" that pay interest. When an investor purchases a bond, he or she essentially borrows money from the bond issuer, who promises to repay the original loan amount, or principal, in full at a specified future date, as well as any applicable interest (called a coupon payment) during that time.

Government bonds, which serve as safe-haven assets, typically have high credit ratings, low default risk, and stable returns. Globally, some government bonds are widely regarded as safe-haven assets due to their credibility and safety. Here are several major safe-haven government bonds:

U.S. Treasuries: U.S. Treasuries are considered one of the safest haven assets in the world. Because the U.S. government has an extremely high credit rating and the U.S. dollar serves as the global reserve currency, U.S. Treasury bonds are often the first choice for investors during times of market turmoil. Especially for long-term Treasury bonds (such as 10-year and 30-year Treasury bonds), when market uncertainty increases, demand usually rises, prices rise, and yields fall.

German Bunds (Bunds): German Bunds are also considered a safe-haven option due to the soundness of the German economy and political stability. Germany is the core of the Eurozone economy, and its government bonds often represent safe-haven assets during times of European market turmoil or economic crises.

Swiss Government Bonds: Switzerland is known for its political and economic stability, and the Swiss franc is also a safe-haven currency. Swiss government bonds attract a large amount of safe-haven funds when global markets are volatile due to their safety and low risk.

Defensive stocks

Consumer staples industry stocks: stocks in industries such as food and pharmaceuticals have relatively stable demand during economic recessions. For example, companies that make consumer goods like Procter & Gamble (PG.US), utility companies like NextEra Energy (NEE.US), and certain so-called "sin stocks" like British American Tobacco or Diageo. Demand for the goods sold by these companies is generally not greatly affected by economic downturns, so they can perform reliably in tough economic times.

Investing in safe-haven assets is not only a strategy for hedging risk and preserving value, it is also an effective means of maintaining capital when market uncertainty increases. By appropriately allocating to safe-haven assets, investors can reduce overall portfolio risk while maintaining a relatively stable financial position in unpredictable market environments.

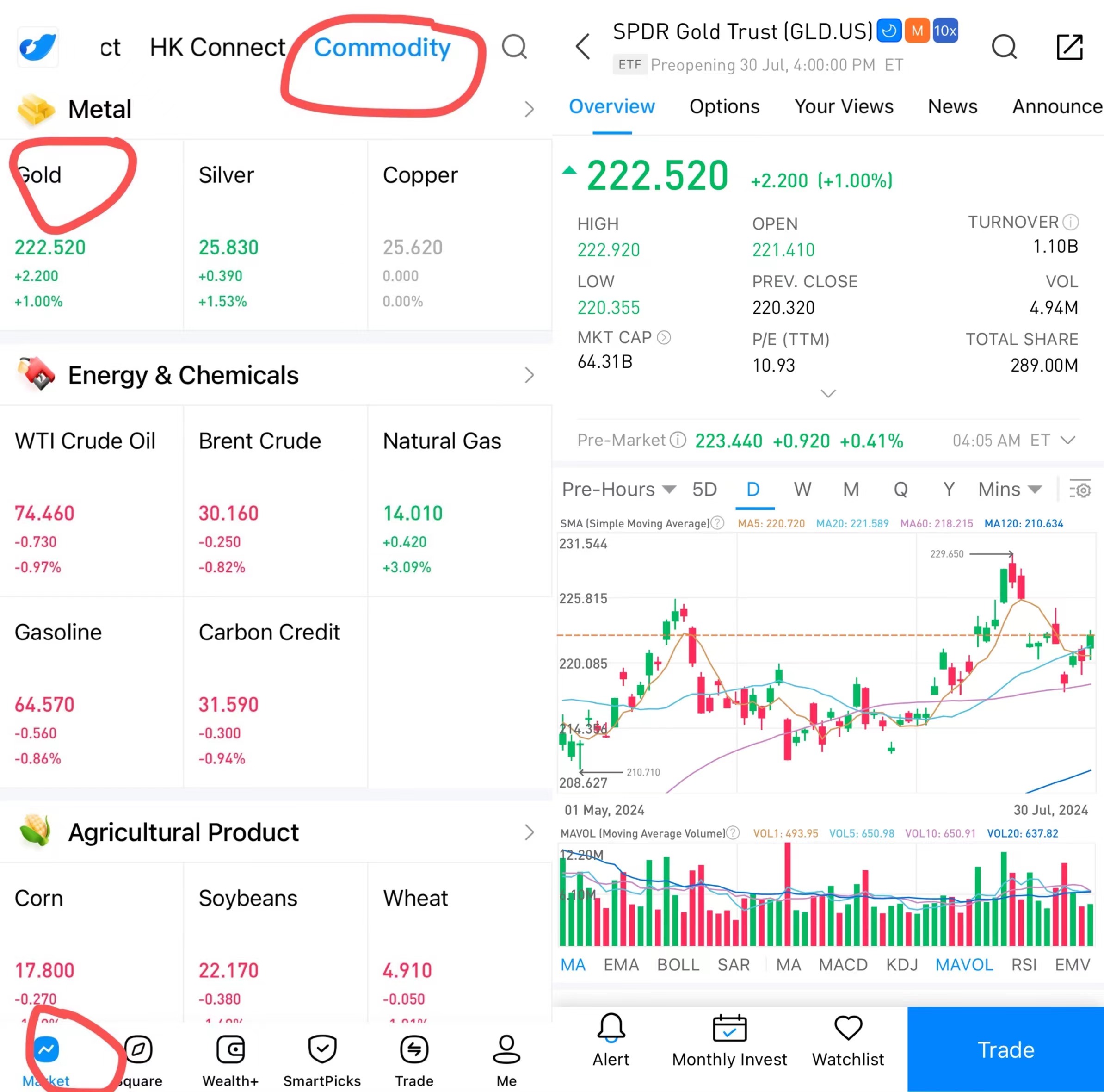

How to buy safe-haven gold ETF on uSMART?

*After opening the APP, select the [Commodity] page above.*Then click [Gold] to trade.

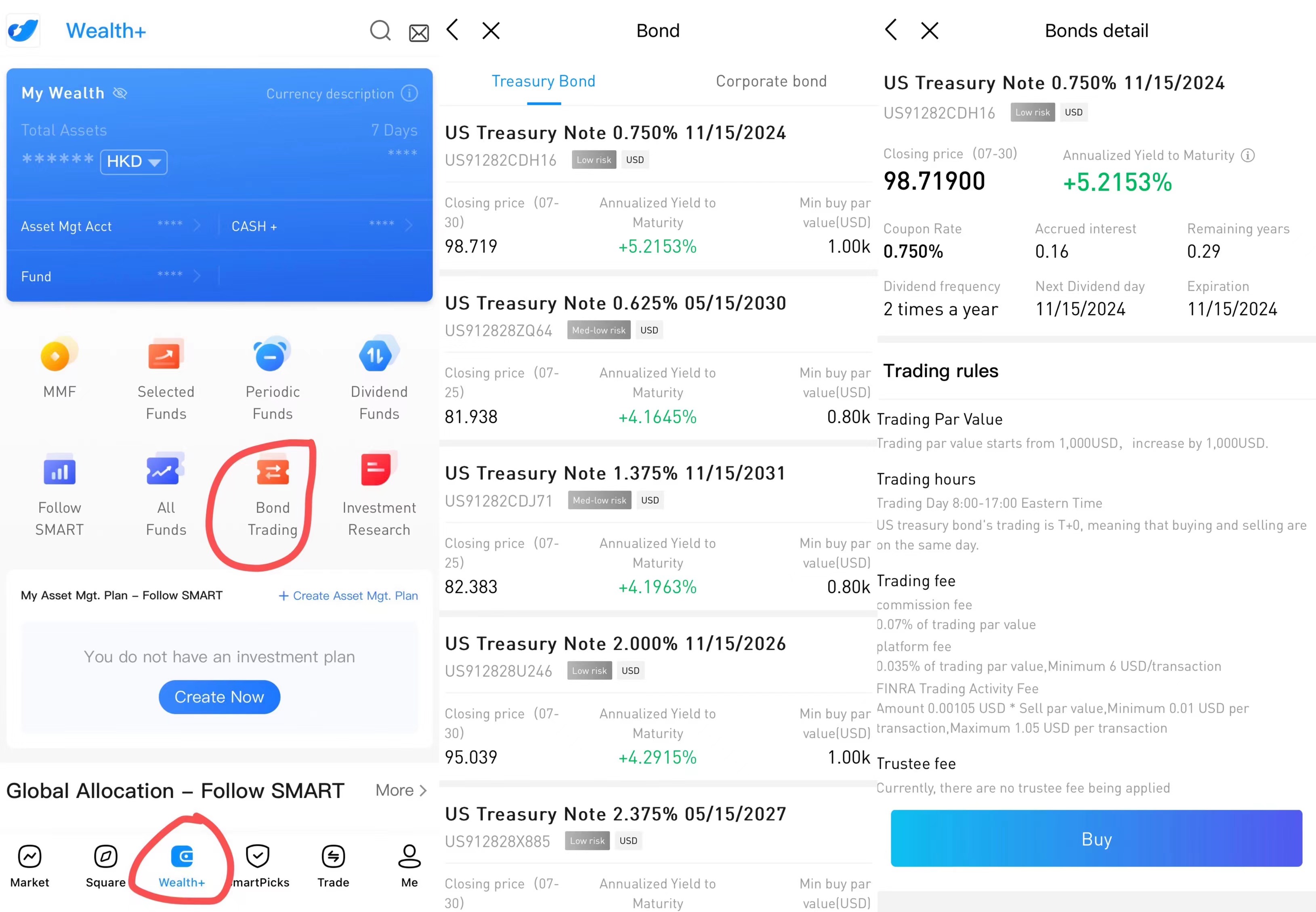

How to buy US bonds on uSMART?

*After opening the APP, select the [Wealth+] page at the bottom of the page and click [Bond Trading].*Click on the bond you want to buy on the page.*Click buy to trade.