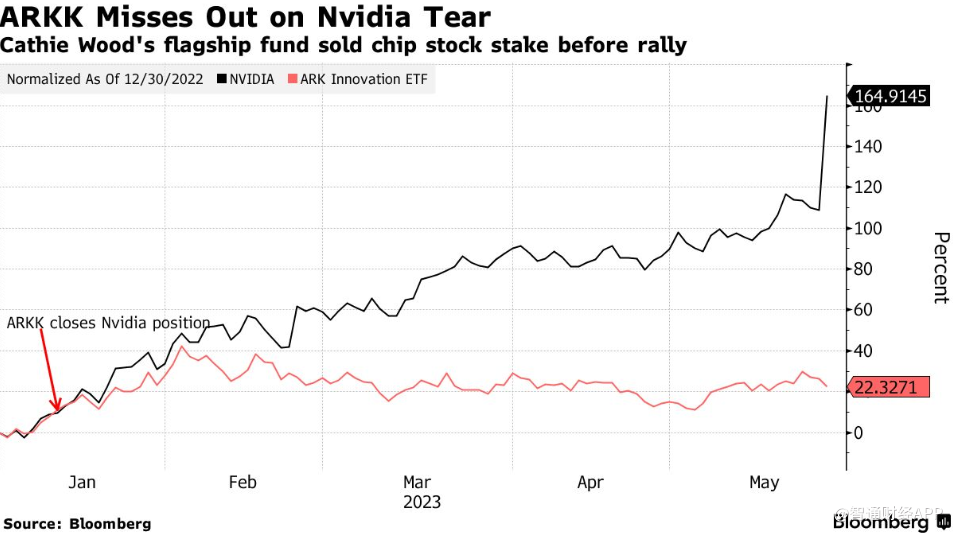

The flagship exchange traded fund of Cathy Wood, founder of ARK Investment Management and "wooden Sister", liquidated its shares in NVDA.US in early January. Then came the artificial intelligence boom, pushing up the share price of the stock and other large technology stocks. Since Wood sold Nvidia shares, the chipmaker's market capitalization has increased by about $560 billion, of which $200 billion soared overnight after the company reported better-than-expected results.

While several of Mr Wood's smaller funds hold Nvidia shares, investors in its flagship product, ARK Innovation ETF (ARKK), mostly did not benefit from Nvidia's 159.90 per cent jump this year.

In February, when Nvidia's shares were trading at $234, or about 50 times forward earnings, Mr Wood said the valuation was "very high".

"We are bullish on Nvidia and we think it will be a good stock," Wood said in an interview on Feb. 27. Nvidia has been priced-it is an artificial intelligence company. " "our flagship fund has been consolidating our favorite stocks, which has something to do with valuations."

Wood has been bullish on Nvidia for a long time, but her confidence in the stock sometimes shakes.

When ARKK was founded in 2014, Nvidia was one of the fund's main holdings. The data show that Nvidia has contributed 13 per cent of the fund's 112 per cent total return since its inception, second only to Tesla (TSLA.US), Grayscale Bitcoin Trust (GBTC.US) and Invitae (NVTA.US).

Last October, when Nvidia began to rebound from its lowest level since August 2020, ARKK held more than 750000 Nvidia shares, according to the data. Mr Wood reduced the position to just under 39000 shares at the end of November and to zero by mid-January.

While ARK focuses on disruptive innovation, its flagship fund holds few AI-related stocks that have soared this year. On Thursday, ARKK funds fell 3 per cent, while Nvidia surged 25 per cent and the Nasdaq 100 index rose 2.4 per cent.

"this is a risk for centralized active fund managers-they miss a theme or the right stocks in that theme," says Todd Sohn, a strategist at Strategas ETF.