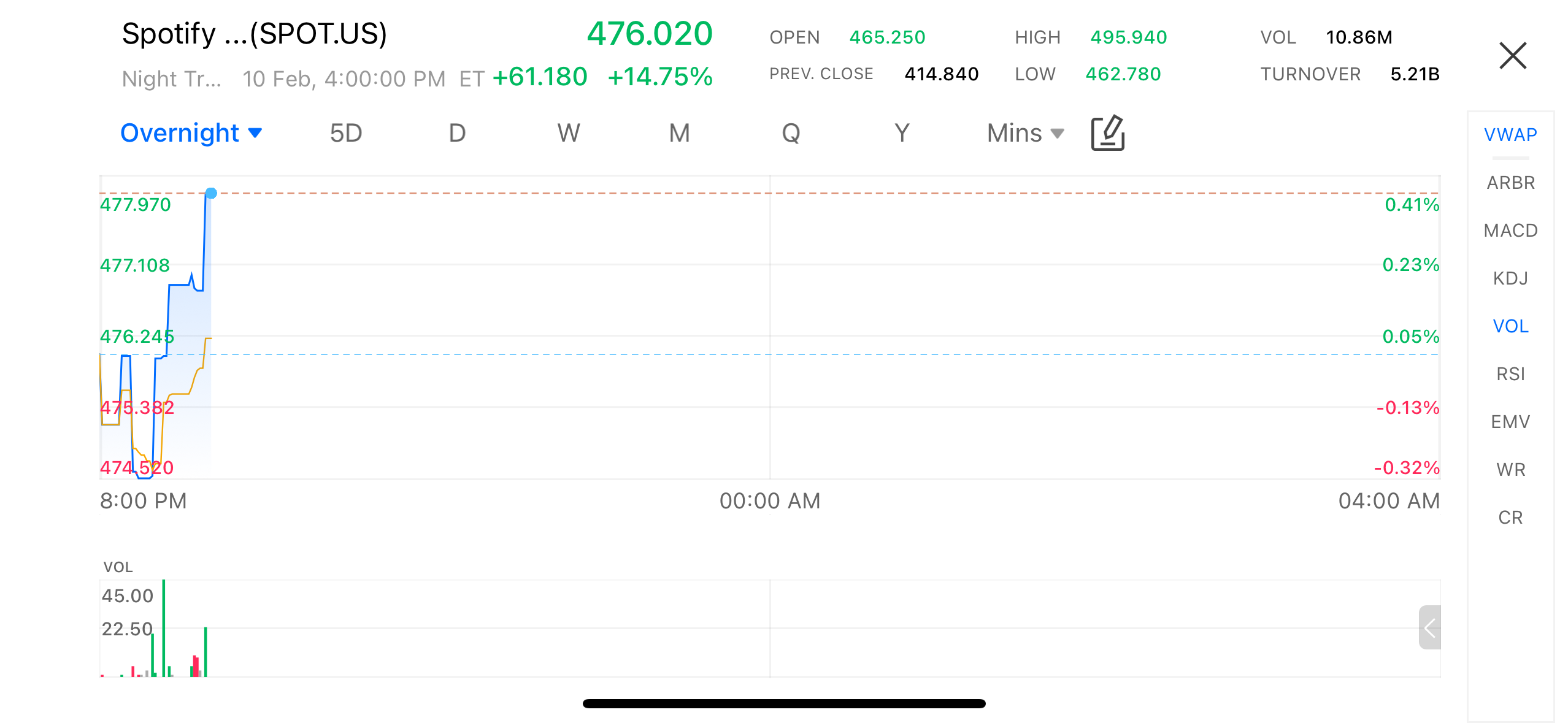

In after-hours trading on February 10 (U.S. Eastern Time), global music streaming platform Spotify (SPOT.US) rallied sharply in the U.S. market, with shares jumping nearly 15% at one point and approaching the USD 480 level intraday, ranking among the top gainers in the media and internet sector for the session.

(Image Source: uSMART HK app)

Fourth-Quarter Profit More Than Doubles, Marking a Turning Point in Profitability

According to the company’s latest earnings release, Spotify reported fourth-quarter revenue of approximately EUR 4.5 billion, representing a year-on-year increase of around 7%, indicating steady top-line growth.

Profitability, however, stood out as the key highlight. Net profit for the quarter reached EUR 1.17 billion, significantly higher than EUR 367 million in the same period last year, representing a more than twofold increase. Earnings per share came in at EUR 4.43, well above market expectations. Improvements in gross margin and operating efficiency suggest that earlier initiatives focused on content cost control, workforce optimization, and platform efficiency are beginning to deliver tangible results.

User Growth Remains Strong Despite Price Hikes

Against the backdrop of subscription price increases, user metrics emerged as another major positive surprise. As of the end of the fourth quarter, Spotify’s global monthly active users reached 751 million, with a net increase of 38 million during the quarter, setting a new record. Paid subscribers rose to 290 million, up approximately 9 million quarter-on-quarter, also exceeding the company’s prior guidance.

These figures indicate that higher subscription prices have not materially dampened user growth. Instead, user momentum continued to accelerate, underscoring the strong stickiness and resilience of music subscription demand.

Latest U.S. Price Increase Yet to Be Fully Reflected

It is worth noting that Spotify’s most recent price increase in the U.S. market only took effect recently and has not yet been fully reflected in the current quarter’s financial results.

As the company’s largest revenue market, rising average revenue per user (ARPU) in the U.S. is expected to gradually flow through to revenue and earnings in coming quarters, offering additional upside potential. Globally, Spotify is leveraging differentiated pricing strategies and tiered subscription plans to enhance monetization while mitigating user churn.

Music Streaming Enters a Phase of Pricing Power Validation

From an industry perspective, Spotify’s results carry broader signaling value. Amid intensifying competition and rising content costs in video streaming, music streaming platforms—benefiting from longer content lifecycles and higher reuse efficiency—are increasingly demonstrating more stable and scalable profit models.

As several platforms have adjusted subscription prices in recent quarters, Spotify’s performance provides concrete evidence that price increases do not necessarily come at the expense of user growth.

Management Sets Long-Term Growth Agenda as Valuation Framework Shifts

On the management front, the newly appointed co-CEOs delivered an earnings beat in their first full quarter at the helm and have positioned the coming year as a phase of deeper strategic execution.

With profitability improving and cash flow quality strengthening, investors are reassessing Spotify’s valuation framework. The company is increasingly viewed not merely as a high-growth but loss-prone platform, but as a content-driven technology company with sustainable earnings potential. Overall, this earnings release not only fueled a sharp near-term share price reaction, but also contributed to a broader reassessment of the long-term value of the music streaming business model.

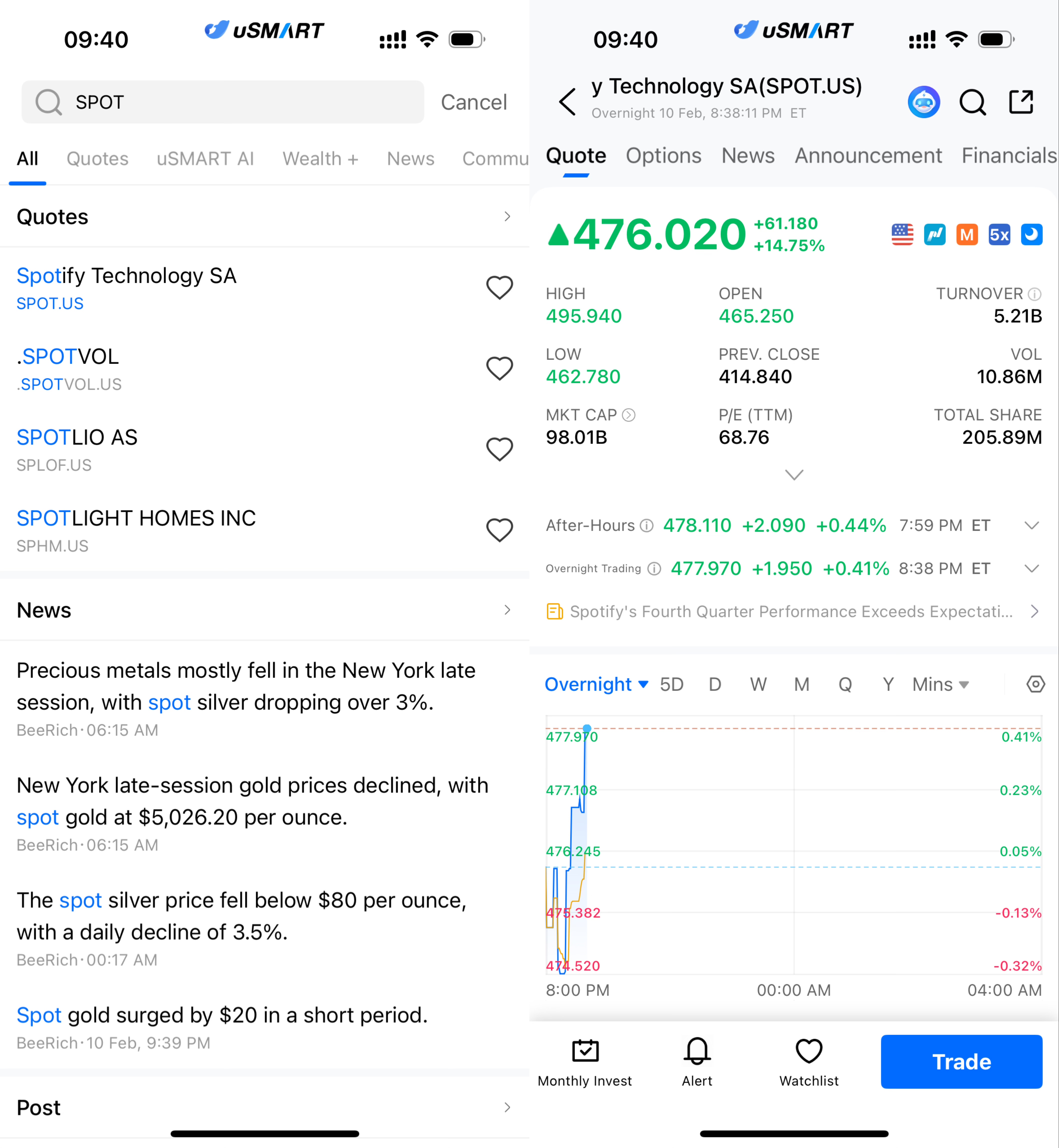

How to Buy Spotify via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (SPOT.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)