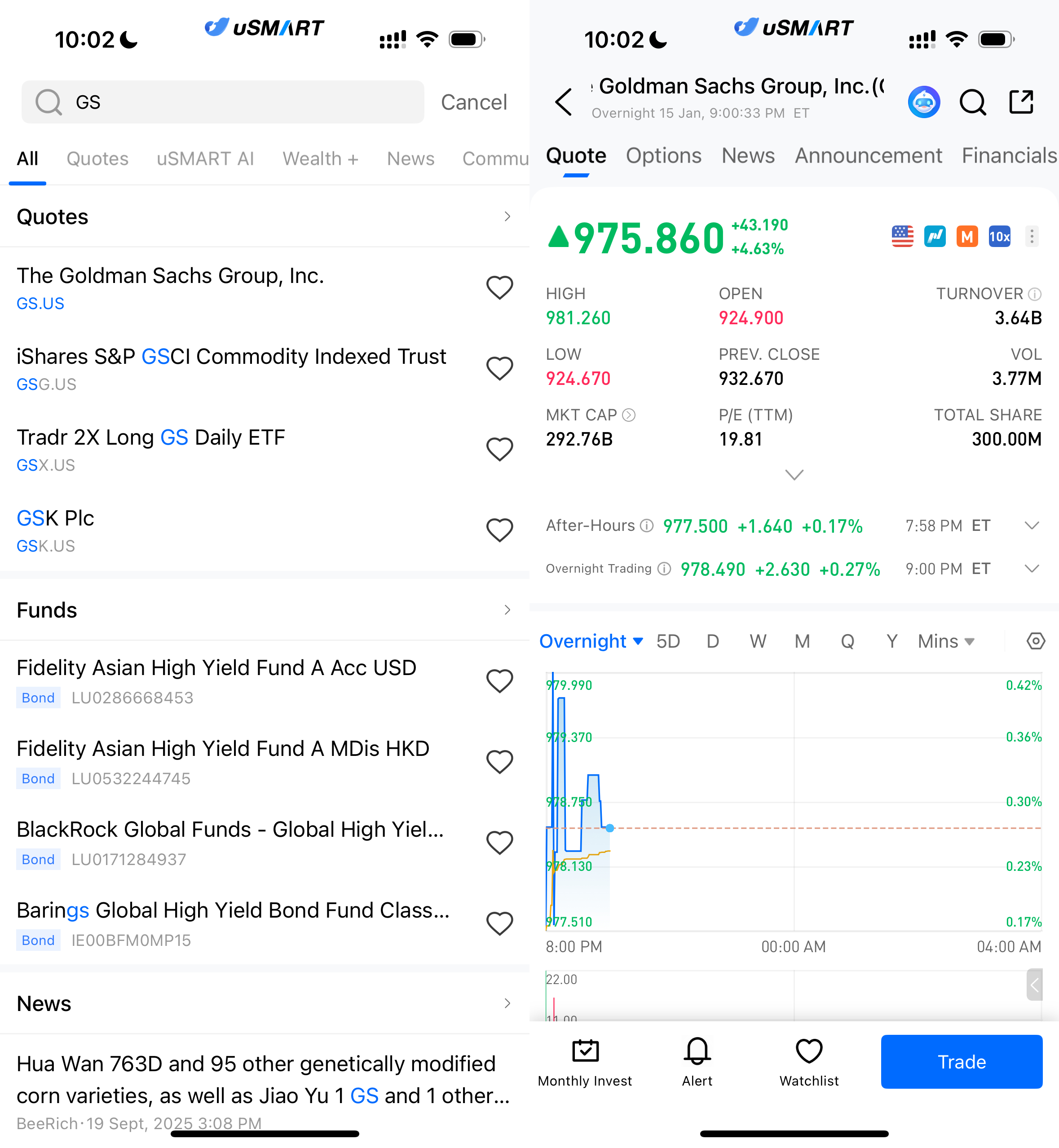

On January 15, 2026, Goldman Sachs Group (GS.US) saw a significant surge in its stock price, closing at $975.86, up 4.63%. The stock price climbed from an opening price of $924.90, reaching a high of $981.26, reflecting the market's positive reaction to the company's Q4 2025 earnings report. This rise in stock price not only reflects the impressive financial performance but also signals strong market confidence in Goldman Sachs' future growth prospects.

(Image source: uSMART HK app)

Q4 2025 Earnings Highlights: Goldman Sachs Achieves New Milestones

Goldman Sachs' Q4 2025 earnings report exceeded market expectations, particularly with its excellent performance in investment banking and asset management. The company’s total revenue reached $11 billion, an 8% year-over-year increase. Net income amounted to $2.5 billion, a 10% growth from the previous year. Earnings per share (EPS) stood at $8.25, significantly surpassing the expected $7.90, demonstrating Goldman Sachs' ability to maintain strong profitability even in challenging environments.

Notably, Goldman Sachs' investment banking division performed exceptionally well, with strong growth in M&A advisory and equity capital financing, which were key drivers behind the revenue growth. Additionally, the stability of wealth management and risk management businesses provided solid financial support for the company. Goldman Sachs’ ability to maintain strong growth in its core business amid market volatility reinforces its solid position in the global financial market.

Goldman Sachs Q4 2025 Earnings: Key Data Breakdown

Goldman Sachs' Q4 2025 earnings report reveals significant growth across several key business segments. Here’s a detailed look at the financial data for the quarter:

|

Financial Metric |

Data |

YoY Growth |

|

Total Revenue |

$11 billion |

+8% |

|

Net Income |

$2.5 billion |

+10% |

|

Earnings Per Share (EPS) |

$8.25 |

Exceeded expectations |

|

Investment Banking Revenue |

$4 billion |

+12% |

|

Wealth Management Revenue |

$1.5 billion |

+6% |

|

Asset Management Revenue |

$2 billion |

+7% |

|

Total Assets Under Management |

$2.5 trillion |

+5% |

(Source: Goldman Sachs Q4 2025 Earnings Report)

From the above data, it’s clear that Goldman Sachs achieved strong growth across multiple business areas, particularly in investment banking, which saw a notable increase due to the company’s exceptional performance in M&A and equity financing. Asset and wealth management businesses also grew steadily, demonstrating Goldman Sachs’ ability to maintain its leadership position in a volatile market environment.

Stock Performance: Earnings Spark Positive Market Reaction

Goldman Sachs’ stock price performed strongly following the earnings report. The stock rose over 4% during the day, closing at $975.86. This surge reflects the positive impact of the better-than-expected earnings, highlighting Goldman Sachs' deep-rooted position in the capital markets. After the disruptions caused by the pandemic and its aftermath, the company’s stable financial performance has undoubtedly instilled confidence in the market.

This stock price increase is not only a response to the current earnings but also reflects expectations that Goldman Sachs will continue to see strong growth in the future. The stock continued to show strength in after-hours trading, indicating high market anticipation for its future development.

Market Recovery and Strategic Transformation: Goldman Sachs Sees Future Growth Opportunities

As the global economy gradually recovers from post-pandemic challenges, investors remain optimistic about Goldman Sachs' outlook. The company anticipates more growth opportunities in 2026, driven by the recovery of global financial markets and increased capital market activities, especially in M&A, debt financing, and equity trading.

Goldman Sachs is accelerating its digital transformation to enhance business efficiency and global competitiveness. As its digital strategy progresses, the company is expected to strengthen its position in the financial technology sector in the future.

Looking Ahead: Goldman Sachs' Growth Engines Set to Drive Continued Success

Goldman Sachs demonstrated strong business growth in its Q4 2025 earnings and reinforced market confidence in its long-term development. In 2026, the company plans to further expand its leadership in investment banking and wealth management, increasing market share. At the same time, digital transformation will provide new growth momentum, helping Goldman Sachs adapt to the ever-changing global financial market.

How to Buy Goldman Sachs via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (GS.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)