During after-hours trading on January 6 (U.S. time), shares of storage manufacturer SanDisk (SNDK.US) rallied sharply, rising more than 27% at one point. The stock became one of the most closely watched names in the U.S. technology sector that day. At the same time, several other storage-related stocks also posted strong gains, suggesting that investor enthusiasm was not confined to a single company but rather reflected renewed interest in the broader segment.

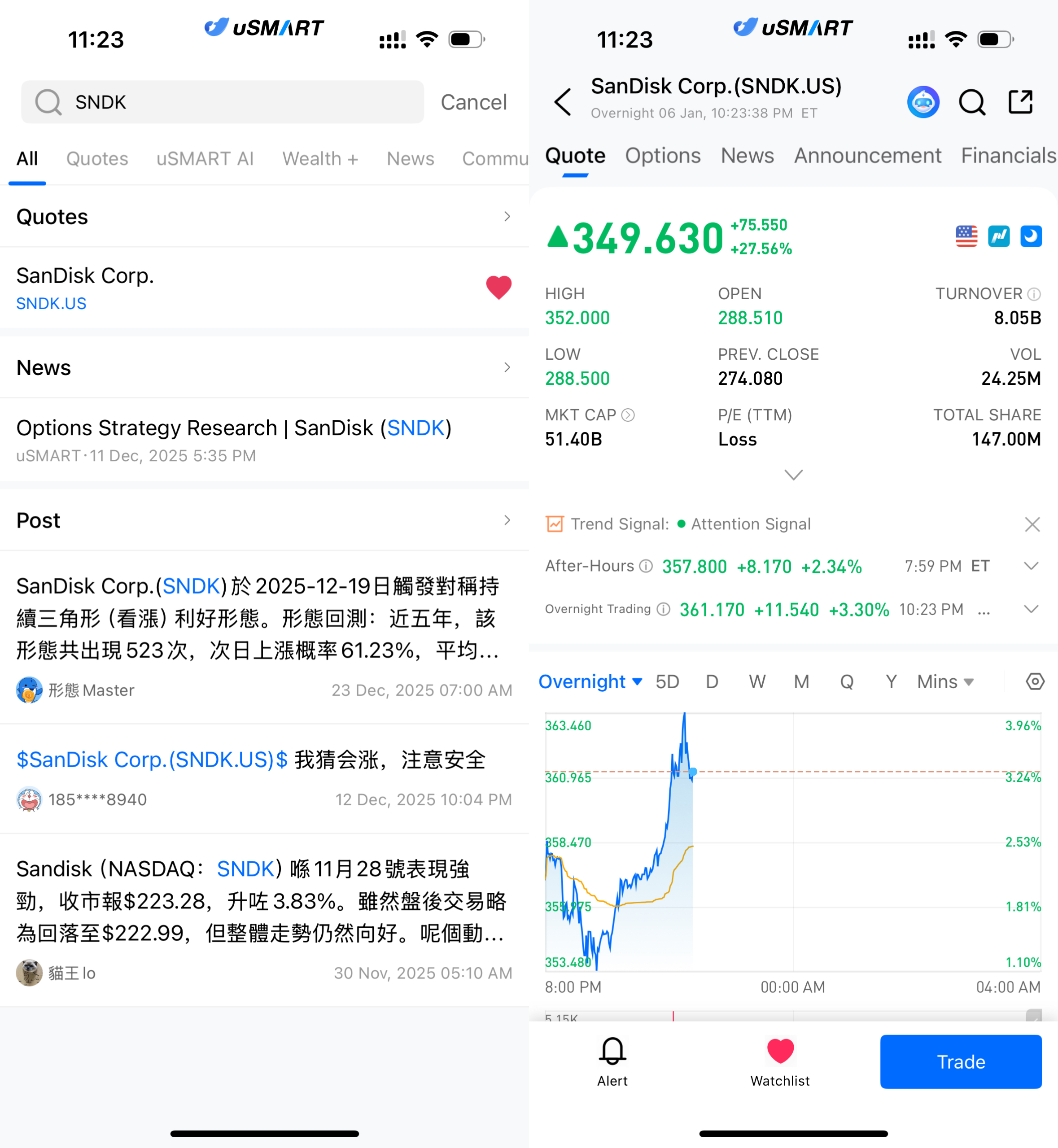

(Image source: uSMART HK app)

From “Compute-First” to “Data-First”: A Shift in AI Infrastructure Logic

Over the past two years, AI investment has been overwhelmingly centered on computing power. GPUs were widely viewed as scarce strategic assets, and market attention focused on who could deliver greater training capacity and ever-larger model scale. However, as large language models move from development into real-world deployment, the operational focus of AI systems is beginning to change.

AI growth is no longer determined solely by whether models can be trained, but increasingly by whether they can be run efficiently, accessed continuously, and perform repeated inference at scale. In this process, data storage, retrieval, and real-time interaction are emerging as critical bottlenecks.

In other words, AI is evolving from a one-off compute-intensive project into a long-running system that depends heavily on sustained data throughput and low-latency response. This transition is pushing storage out of a purely backend role and into the core of AI computing workflows.

Inference and Multimodal AI Amplify “Data Pressure,” Driving a Re-rating of Storage

Compared with the training phase, AI inference places more complex demands on data infrastructure. Models must frequently read historical information, contextual data, and external databases, while continuously writing logs, feedback, and validation records. The rise of multimodal AI further intensifies these demands, as images, video, and audio—forms of unstructured data—expand both data volume and access frequency.

As a result, storage is no longer evaluated solely on capacity. Speed, latency, reliability, and energy efficiency are now equally important. This shift lies at the heart of the market’s reassessment of storage’s strategic value.

Recent commentary from multiple institutions suggests that as AI moves from centralized training toward distributed inference, data will no longer reside only in the cloud. Instead, it will be spread across data centers, edge infrastructure, and end-user devices—extending the storage demand cycle and broadening its reach.

SanDisk’s Position: A Key Link Between Data Centers and Edge Devices

Within this transition, SanDisk occupies a position that many investors view as representative. Unlike vendors focused primarily on hyperscale data centers, SanDisk has built deep expertise in embedded storage, high-performance flash memory, and end-device applications.

As AI capabilities increasingly extend into smartphones, PCs, vehicles, and industrial equipment, demand for low-latency, high-reliability local storage is rising sharply. Running AI models locally means large volumes of data must be processed on-device rather than relying entirely on the cloud—driving simultaneous upgrades in storage capacity and performance at the device level.

Market participants believe this structural shift places SanDisk not only among the beneficiaries of an industry recovery, but also at the intersection of AI inference expansion and edge computing growth.

Sector-Wide Gains Signal Storage’s Return to Center Stage

Notably, SanDisk’s surge was not an isolated move. Shares of mechanical hard-drive and flash-memory companies broadly advanced during the session, reflecting a reallocation of capital toward the storage segment as a whole.

From a macro perspective, AI investment themes are evolving from single-point breakthroughs toward system-level construction. If the earlier phase of AI development was dominated by computing power, the current phase increasingly emphasizes who can support ever-expanding data volumes and sustain high-frequency, long-duration AI operations.

Beneath Short-Term Volatility, a Longer-Term Narrative Is Taking Shape

While after-hours trading tends to magnify price movements and short-term gains do not guarantee a confirmed trend, the collective market response suggests a deeper reassessment is underway. Investors are reconsidering which layers of infrastructure are truly indispensable as AI scales toward mass adoption.

In this repricing cycle, storage is gradually shifting from a long-overlooked foundational component to a critical pillar of the AI ecosystem. SanDisk’s overnight surge appears to be a concentrated reflection of this broader change in market perception.

How to Buy SanDisk via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (SanDisk.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)