On August 28, Meituan (03690.HK) released its second quarter and half-year performance report for 2024. In the second quarter of this year, Meituan achieved revenue of 82.3 billion yuan, a year-on-year increase of 21%, and adjusted net profit of 13.6 billion yuan, a year-on-year increase of 77.6%. Based on the profit of 13.6 billion yuan in the second quarter, Meituan’s average daily profit in the second quarter of this year was 149 million yuan.

Meituan (03690.HK)’s revenue in the first half of the year was 155.527 billion yuan, a year-on-year increase of 22.9%, and its adjusted net profit was 21.1 billion yuan, a year-on-year increase of 60.4%.

Main business income: core local business and new business

core local business

By business, in the second quarter, Meituan’s core local business revenue increased by 18.5% year-on-year to 60.682 billion yuan. The operating profit of this business was 15.233 billion yuan, a year-on-year increase of 36.8%.

The increase in core local business revenue was mainly due to the strong growth of other services and sales such as instant delivery, commissions, online marketing services, in-store, hotel and tourism business. Revenue increased by 13%, 20.1%, 19.7%, respectively year-on-year. 51%.

Among them, instant delivery and commission are the two core businesses of Meituan. Their growth is mainly due to the increase in the number of transactions on the Meituan platform. The number of annual transaction users and active merchants hit a record high. The company said it was mainly due to operating models such as "special group buying" that met consumers' demand for deep discounts and drove the growth in the number of transaction users and order volume.

During the period, the "Pinhaofan" business performed strongly, with single-day order volume reaching a new high, exceeding 8 million orders; as of the end of June, Meituan's number of instant delivery transactions reached 6.167 billion in the quarter, a year-on-year increase of 14.2%.

In the conference call, Meituan CFO Chen Shaohui said that he could see that the single-day peak order volume for instant delivery on August 7 reached a record high, and he was very confident to achieve higher order volume in the peak season every year. It is expected that the peak order volume in a single day may exceed 100 million during the peak season next year. “The current growth momentum is very healthy, and I believe it can achieve balanced growth and profitability.”

In addition, in terms of in-store business, thanks to the arrival of the traditional peak consumption season, Meituan’s in-store hotel and travel business order volume increased by more than 60% year-on-year; the number of annual transaction users and annual active merchants both hit record highs. Meituan pointed out that in the current macro environment, despite changes in consumer preferences, demand for local services remains strong, and its new brand "Meituan Group Buying" continues to use the shelf model to meet consumer demand for cost-effective products.

New business

New business revenue in the second quarter was 21.569 billion yuan, a year-on-year increase of 28.7%; operating losses narrowed 74.7% year-on-year to 1.314 billion yuan, and the operating loss rate improved by 8.7 percentage points quarter-on-quarter to 6.1%. This is mainly due to Meituan’s revenue growth in merchandise retail business and improved operational efficiency. The performance of this part of the new business may be the biggest financial surprise this quarter.

Last quarter, Meituan improved the operating efficiency of Meituan Select by improving product quality and strengthening supplier cooperation, thereby increasing the average unit price and product markup rate. Other new businesses include B2B catering supply chain services, catering management systems, shared bicycles and power banks, etc., all of which have achieved healthy growth and improved efficiency, and are expected to release more financial value in the future.

Regarding the turnaround of new businesses, Meituan executives said frankly that they remain optimistic about long-term growth, especially the long-term growth potential of China's online grocery market. "But we are patient and not in a hurry. We have our financial self-discipline. We will." Dynamic analysis to see how to achieve the best balance in resource allocation.”

Stock repurchase program

Meituan only started stock repurchases this year. The two rounds of quotas totaling US$3 billion (HK$23.3 billion) have been exhausted. So far, a total of 222 million shares have been repurchased, but all have not been cancelled. Currently, about 116 million shares are listed as inventory share.

Regarding the progress related to stock repurchase, management explained that it hopes to bring long-term value to shareholders through corresponding measures, and the board of directors has approved the company to cancel all repurchased shares.

Meituan executives said that they will optimize the capital allocation strategy, use funds for more investments, and allow the business to grow healthily. They will also make further arrangements for free cash flow to continue to increase free cash flow. The company aims to offset the dispersion effect of infrastructure through share buybacks and will also consider corresponding investment plans. Offshore cash reserves, debt repayments and other aspects will all be considered comprehensively to see whether to implement repurchases. If necessary, comprehensive deployment will be carried out.

The executive said, "The board of directors has just approved another US$1 billion plan. In fact, this further reflects the confidence in business development and long-term target value. We will be very flexible in terms of repurchases and will make timely adjustments according to the situation."As soon as this news came out, Meituan's stock price opened 7% higher and continued to rise.

(Source: uSMART)

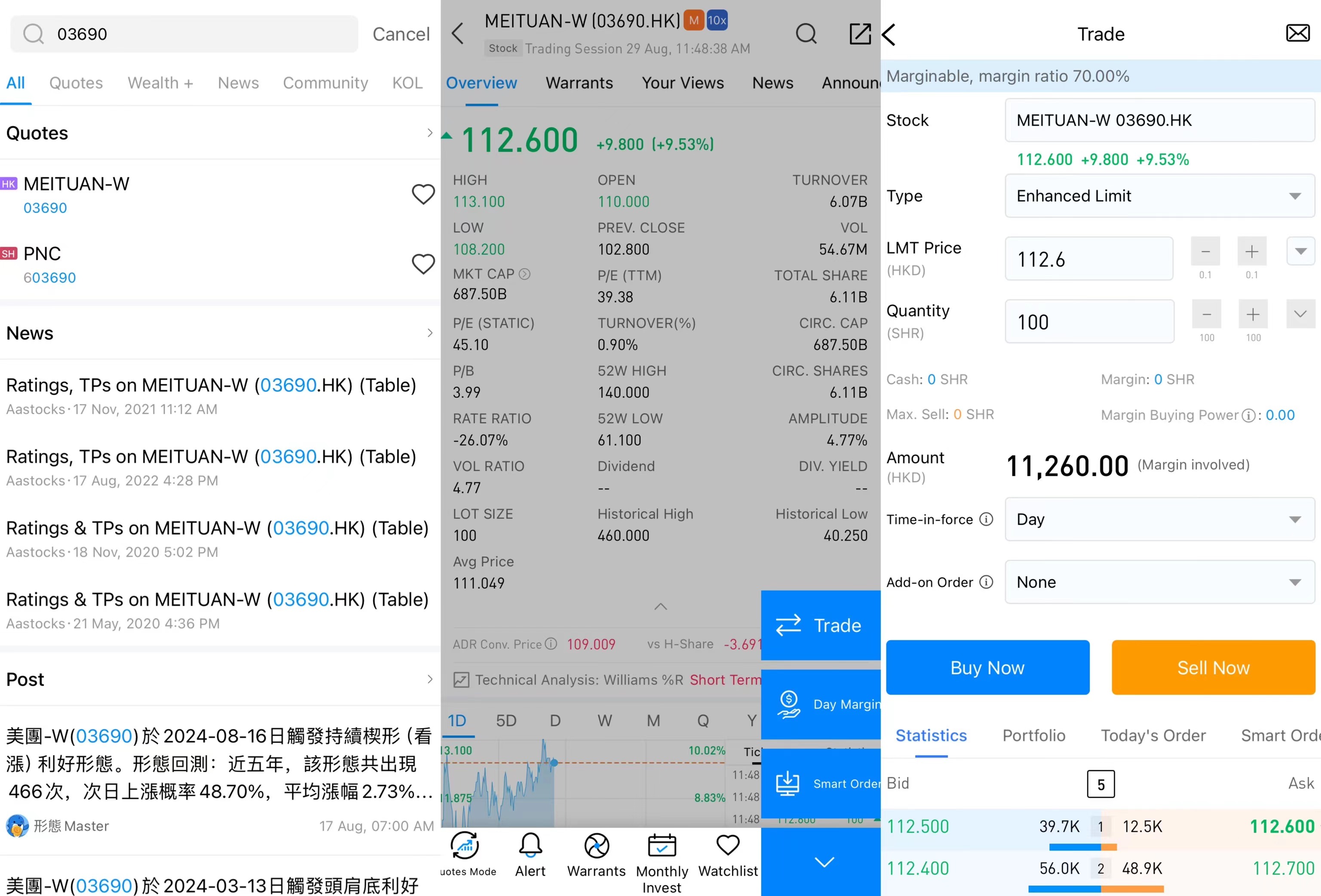

How to invest in Meituan on uSMART?

After logging in to uSMART HK APP, click "Search" from the upper right corner of the page, enter "Meituan" or "03690", you can enter the details page to learn about transaction details and historical trends, click "Trade" in the lower right corner, and select "Buy/ "Sell" function, finally fill in the transaction conditions and send the order; the picture operation instructions are as follows:

This image is for illustrative purposes only

This image is for illustrative purposes only