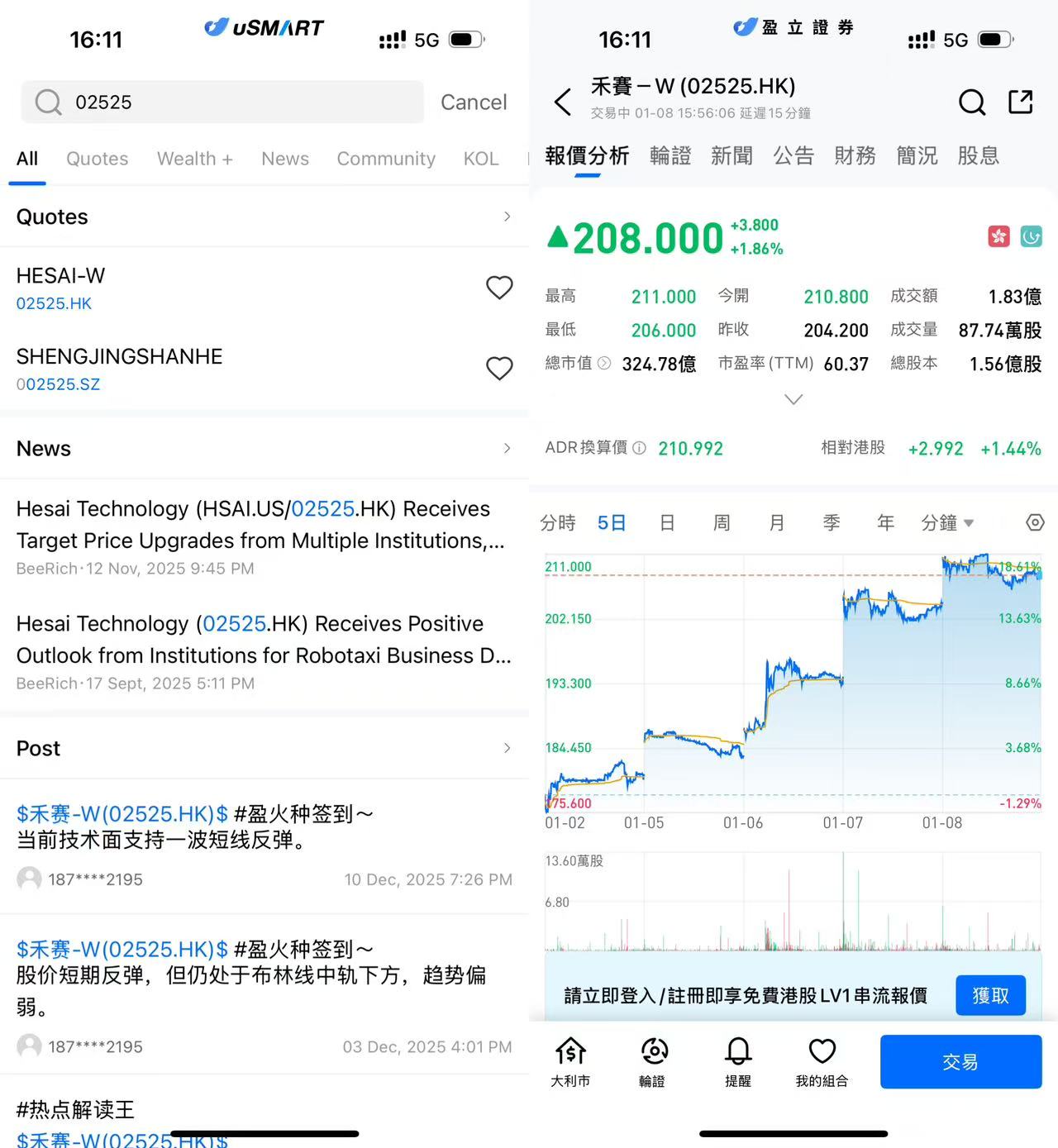

January 8, 2025 — Shares of Hesai Technology-W (02525.HK), a leading lidar manufacturer, have continued to trade strongly in recent sessions, drawing heightened market attention. As of the latest close, the stock extended its recent upward trend, at one point approaching a short-term high, accompanied by increased trading volume—signaling renewed capital allocation toward technology growth stocks.

(Image source: uSMART HK app)

NVIDIA Selects Hesai as Lidar Partner, Boosting Market Confidence

One of the most closely watched developments this week was the announcement that global technology giant NVIDIA has selected Hesai as a core lidar partner. According to industry sources, NVIDIA will collaborate closely with Hesai in its next-generation autonomous driving and Robotaxi solutions, jointly advancing the industrialization of high-performance perception systems.

The news quickly became a market focal point, lifting investor expectations for Hesai’s future order growth and overseas market expansion. As a key provider of computing platforms for autonomous driving, NVIDIA’s endorsement is widely viewed as strong validation of Hesai’s technological capabilities and competitive positioning.

Autonomous Driving and Robotaxi Momentum Lifts Industry Chain Attention

As autonomous driving technologies move toward broader real-world deployment and Robotaxi pilot operations continue to expand globally, lidar—an essential sensor for high-level autonomous driving—has seen its strategic importance rise further. Market participants note that amid medium- to long-term constraints in perception hardware supply, companies with proven mass-production capabilities and solid technological foundations are more likely to attract capital.

Supported by progress among leading autonomous driving players, lidar-related stocks, including Hesai, have shown increased market activity recently, with clear signs of capital inflows.

Overseas Order Expansion Seen as Key to Valuation Re-Rating

Hesai has previously established partnerships across multiple autonomous driving and intelligent mobility projects in Europe, North America, and the Asia-Pacific region, steadily expanding its international footprint. With the NVIDIA partnership now taking shape, the market broadly expects Hesai to further strengthen its presence within the Robotaxi solution ecosystem and enhance the visibility of its overseas orders.

Analysts believe that such developments could improve Hesai’s revenue flexibility over time while reinforcing its strategic position within the global lidar competitive landscape.

Sector Rotation Brings Renewed Focus on Technology Growth Stocks

From a broader market perspective, recent trading has shown signs of sector rotation in Hong Kong equities, with capital gradually shifting away from traditional sectors toward growth themes linked to future technologies and intelligent mobility. Hesai’s active share price performance reflects improving market expectations for the autonomous driving value chain and a gradual recovery in growth sentiment.

While near-term market volatility remains a factor, continued progress in industry deployment and deeper international cooperation are expected to sustain investor interest in the lidar sector.

How to Buy Google via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (GOOG.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)