Draw the key points

1. China's leading genetic testing platform company has a far higher market share than its competitors.

2. As an emerging market, genetic testing is expected to maintain high growth in the future.

3. Mei Nien Health is the main incubator and shareholder.

4. Cornerstone investors include Nanchang Finance, Nanchang Industrial Control Park and Mike Biology.

IPO information

06667.HK, China's leading genetic testing platform, will issue 11.9618 million shares from June 10 to 15, including a public offering of 1.1962 million shares and an international offering of 10.7656 million shares at an issue price of HK $18-22 per share, with an admission fee of HK $4444.35. Yingli Open 12big 15 times financing, cash subscription fee-free, is expected to be listed on June 22, 2022.

China's leading genetic testing platform companyMarket share far exceeds that of competitors

The Main gene isChina's leading genetic testing platform company, focusing onConsumer genetic testing and cancer screening services. As of December 31, 2021, since its inception in 2016, the company has conducted more than 12 million genetic tests, with an average of more than 246000 tests per month in 2020. According to Frost Sullivan, in 2020, in terms of the number of tests carried out, the market share of Maines in China's consumer-grade genetic testing market exceeded 60%, more than 10 times that of the nearest competitor.In terms of revenue generated in 2020, Maine's market share is 34.2%, ranking first in China's consumer-grade genetic testing market, higher than the combined market share of the five nearest competitors.

At present, the testing services provided by Main Gene for consumers mainly includePopular general type testing, mid-range affordable testing and distinguished customized testing. In addition to routine testing services, in response to novel coronavirus's epidemic situation, Maines developed novel coronavirus nucleic acid testing based on PCR technology on the molecular detection technology platform, and began to provide novel coronavirus testing services in May 2020.

General public testing includes ApoE genetic testing package (a service to assess the risk of a variety of related diseases), folate metabolism assessment (a service to assess the risk of hyperhomocysteinemia), Parkinson's disease risk assessment, comprehensive cancer risk assessment, cardiovascular and cerebrovascular risk assessment services.

The mid-range benefit type includes hereditary breast cancer ovarian oncogene testing (a service to assess the risk of breast and ovarian cancer), Septin9 colorectal cancer screening, and RNF180/Septin9 gastric cancer screening.

Premium customization includes individual genome-wide testing of Plus (an assessment of the risk of multiple types of disease It also provides interpretation of various individual characteristics and recommended services for medication for some common diseases), adult full exon sequencing package (a service to assess the risk of suffering from a variety of high-risk diseases, hereditary cancer, recessive genetic diseases and complex diseases, as well as multiple drug use, dietary nutrition programs, and exercise and fitness programs).

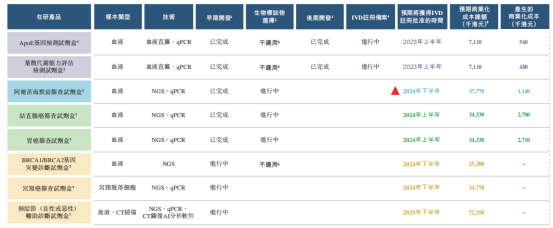

In addition to genetic testing services, Main Gene is also developing a variety of test kits, as shown in the following figure.

Source: prospectus, Yingli Securities

As an emerging market, genetic testing is expected to continue to grow rapidly in the future.

The US consumer genetic testing market was established around 1991. After going through the initial period and observation period, the market entered the development period rapidly in 2019, and continued to show rapid growth. At the same time, leading American enterprises continue to expand and further increase their market share. By contrast, China's consumer genetic testing market was established relatively late, was established around 2013, and is now in its early stages of development.

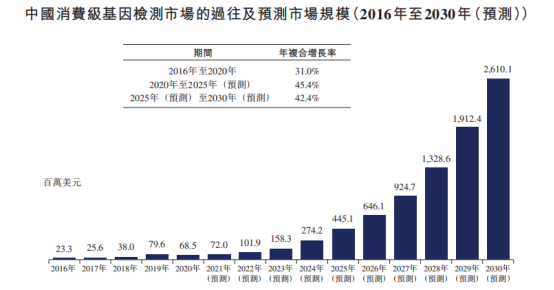

China's consumer genetic testing market reached US $68.5 million in 2020, with a compound annual growth rate of 31.0% from 2016 to 2020.

According to Frost Sullivan's forecast, China's consumer genetic testing market is expected to grow to $445.1 million in 2025, with a compound annual growth rate of 45.4% from 2020 to 2025 and further to $2.6 billion in 2030, with a compound annual growth rate of 42.4% from 2025 to 2030, outpacing the growth rate of the US market.

Source: prospectus, Yingli Securities

For three consecutive years of profits, the proportion of cancer testing business has gradually increased.

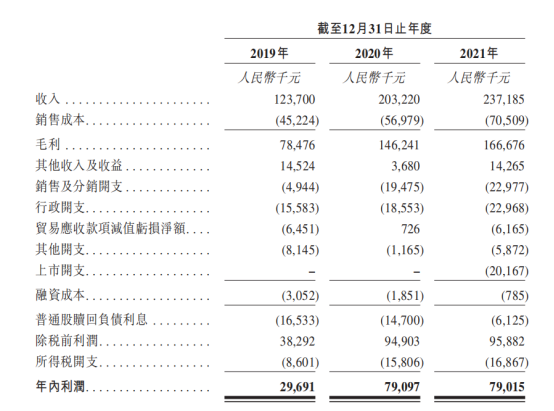

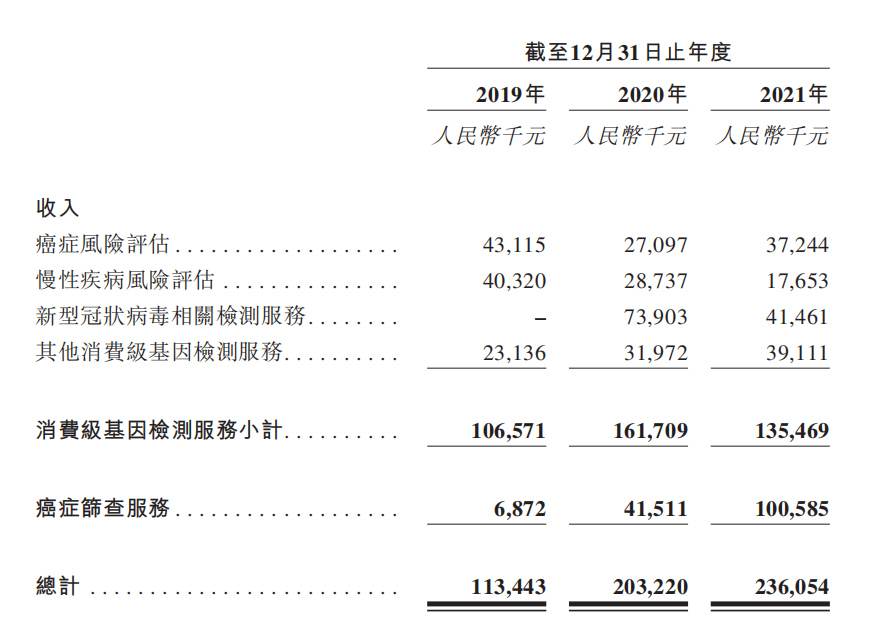

Financially, the company generated total income of 124 million yuan, 203 million yuan and 237 million yuan respectively from 2019 to 2021. For the same period, net profits were 30 million yuan, 79 million yuan and 79 million yuan respectively, and gross profits were 78 million yuan, 146 million yuan and 167 million yuan respectively.

Source: prospectus, Yingli Securities

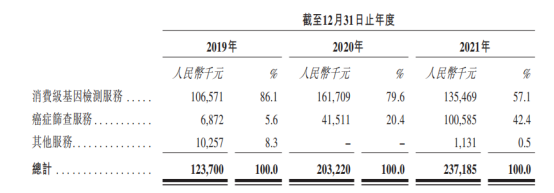

Consumer genetic testing services have been the largest revenue-generating segment, accounting for 86.1%, 79.6% and 57.1% of total revenue for the year ended December 31, 2019, 2020 and 2021, respectively.Cancer screening services have been the fastest-growing revenue-generating segment, accounting for 5.6%, 20.4% and 42.4% of total revenue for the years ended 31 December 2019, 2020 and 2021, respectively.Other services mainly provide genetic research and analysis services to third-party research institutions.

Source: prospectus, Yingli Securities

As of the last practical date, about 3.4 million novel coronavirus tests had been completed for Main gene. In 2020 and 2021, novel coronavirus's income from related testing services was 73.9 million yuan and 41.5 million yuan respectively.

In 2020 and 2021, the gross profit of novel coronavirus's related testing services was 50.8 million yuan and 24.3 million yuan respectively, and the gross profit margin was 68.7% and 58.7% respectively. The decrease in gross profit margin was mainly due to a compulsory reduction in the average unit price in accordance with government regulations. Due to the uncertainty of novel coronavirus's epidemic situation, there is also some uncertainty about the income scale of novel coronavirus's related testing services.

Source: prospectus, Yingli Securities

Mei Nien Health is a shareholderFinancing is mainly used for R & D and commercialization.

As for cornerstone investors, the prospectus shows that the company has entered into cornerstone investment agreements with Nanchang Finance, Nanchang Industrial Control Park and Mike Biology. Nanchang Finance, Nanchang Industrial Control Park and Mike Bio will subscribe for 1.787 million shares, 4.1696 million shares and 2.9782 million shares respectively.

In terms of fund-raising purposes, the company intends to use the proceeds collected from the global sale for the following purposes: 30% will be used for the sales, marketing and commercialization of consumer genetic testing and cancer screening services and products, about 25% will be invested in R & D companies' services and products, and about 20% will be used to increase or expand testing capacity and production capacity. 15% will be used to finance the company's expansion in the industry value chain by investing or acquiring attractive technology or testing-related companies that complement and collaborate with the company's existing business. About 10% is expected to be used for working capital and other general corporate purposes.