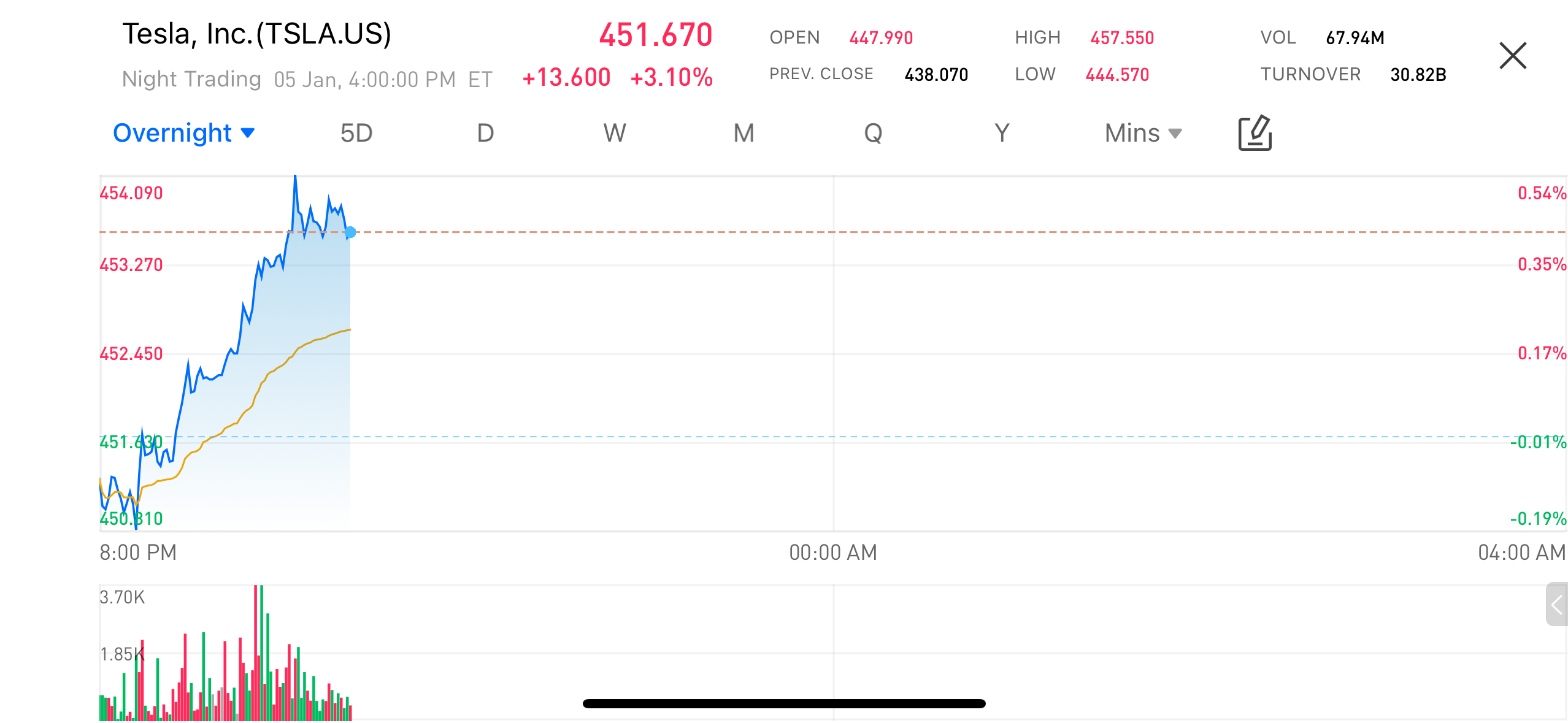

In after-hours trading, Tesla (TSLA.US) continued its upward momentum. As of 1:00 AM Eastern Time on January 5, the stock closed at approximately $451.67, up 3.1% from the previous day’s close. At one point, it touched a high of $457.55, with trading volume remaining active, signaling a significant increase in after-hours participation.

(Image Source: uSMART HK App)

Autonomous Driving and AI Narrative Heats Up, Tech Giant Attracts Incremental Capital

The core driver behind Tesla’s rebound in stock price appears to be the renewed focus on autonomous driving and artificial intelligence (AI) expectations. Recently, the market has been engaged in intense discussions around Tesla's Full Self-Driving (FSD) system, including its technical progress, commercialization path, and potential profit models.

Some institutions believe that with improvements in algorithm capabilities, computing efficiency, and the increasing intelligence of individual vehicles, the feasibility of transforming FSD from a testing feature into a scalable, monetizable product in the coming years is on the rise. This has strengthened the market’s perception of Tesla’s potential in AI applications.

Against the backdrop of a broader recovery in the US tech sector, Tesla is once again seen by the market as a core asset that combines growth potential and liquidity advantages, attracting capital inflows.

Delivery Pressure Temporarily Eased, Market Focus Shifts Forward

From a fundamental perspective, the delivery data previously released by Tesla sparked some market divergence, but its effects have been fully reflected in the earlier stock price adjustments. Investors are now increasingly focusing on mid-to-long-term technology paths and business structure upgrades, shifting their attention away from short-term delivery fluctuations.

In addition to revenue from self-driving subscriptions, expansion in the energy business and potential growth from humanoid robots are seen as important variables influencing Tesla’s long-term valuation. In this context, the market’s sensitivity to short-term sales data has decreased, while tolerance for the pace of technological progress has increased.

Risk Appetite Recovers, Tech Sector Rally Boosts Stock Price

Moreover, the recent recovery in risk appetite across the US stock market has provided external support for Tesla’s stock price. As large tech stocks strengthen, funds are being reallocated to high-growth, high-flexibility assets, with Tesla being one of the first to see a positive response in after-hours trading, driving its stock price higher. The strength in after-hours trading is also seen by some market participants as a sign of early positioning for future market movements.

Outlook: Focus on FSD Progress and Earnings Guidance

Looking ahead, Tesla’s stock price will likely remain focused on the pace of autonomous driving commercialization, upcoming earnings guidance, and macro liquidity changes. As the AI narrative continues to strengthen, short-term volatility may increase. However, in the medium to long term, its valuation anchor will depend on the ability to execute on technology and business structure upgrades.

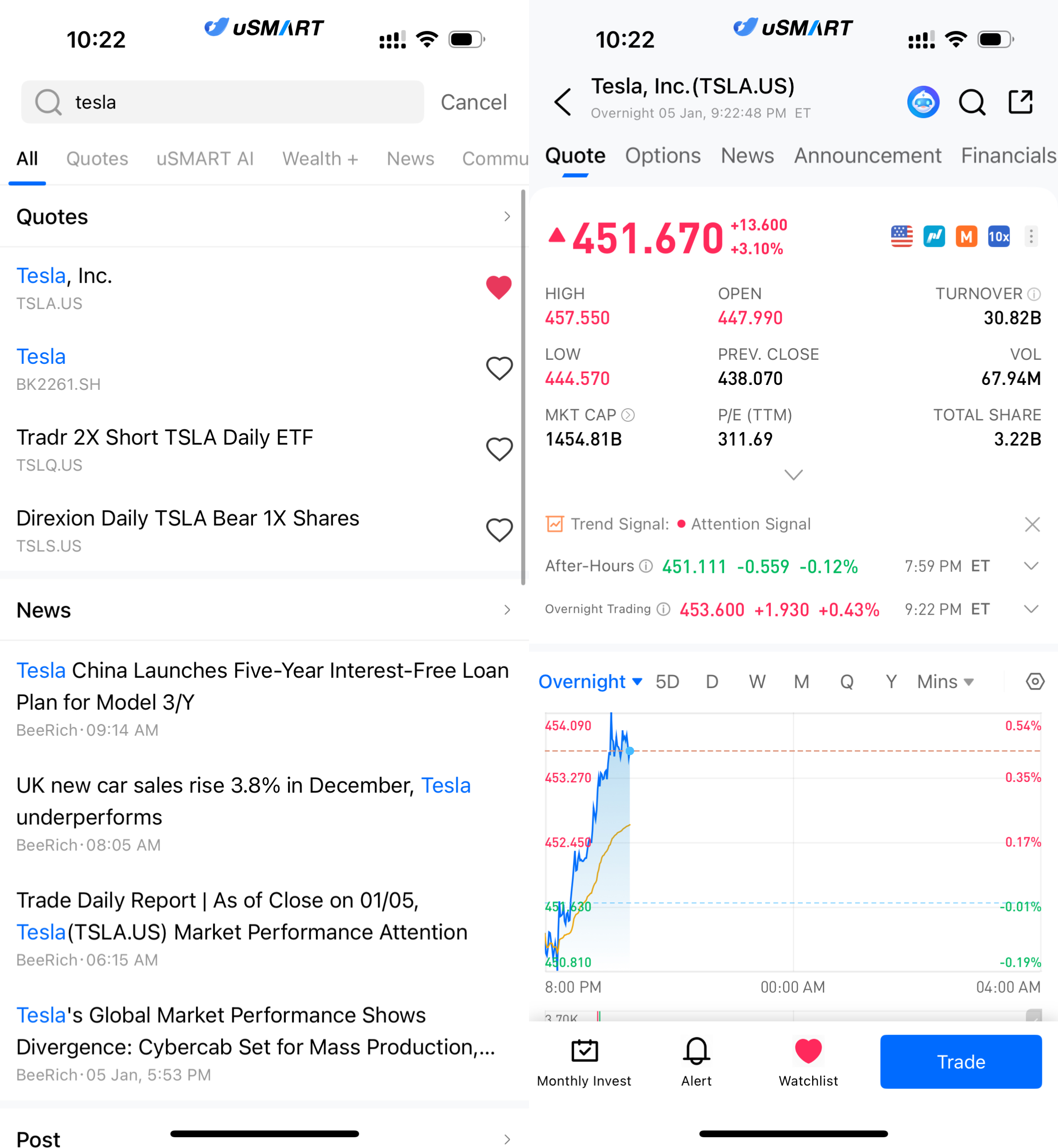

How to Buy Tesla via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (TSLA.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)