天工国际:天工工具获战投15亿元,集团财务状况稳中有升

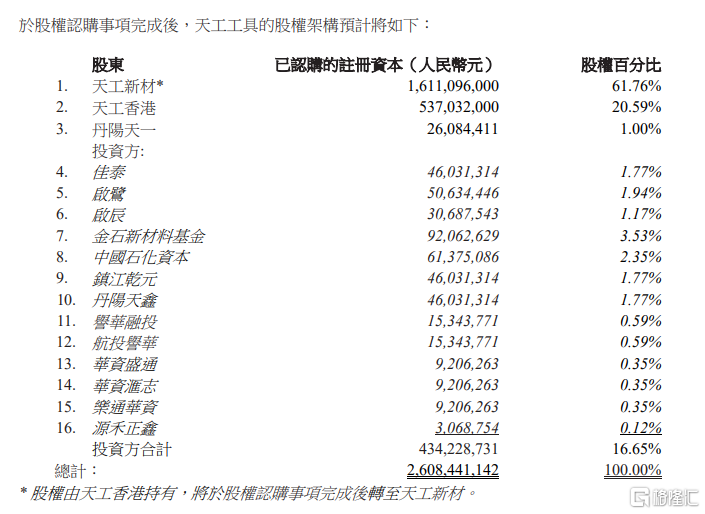

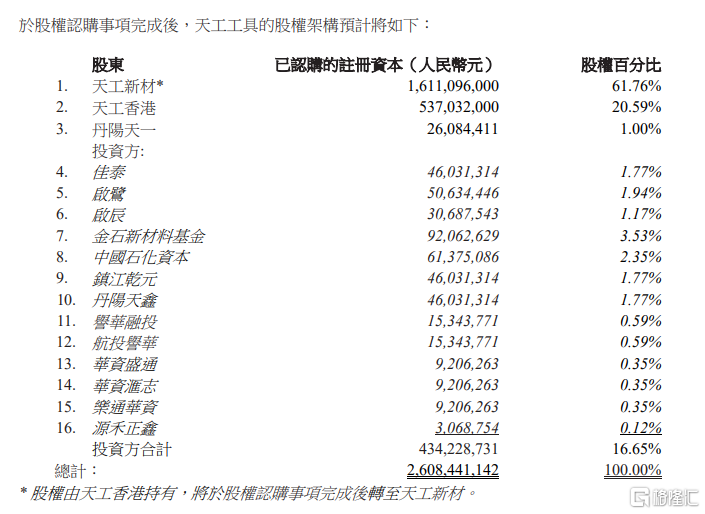

天工国际公告,于2020年12月28日,天工工具,天工新材,天工香港,其他天工方及投资方订立了投资协议,据此,投资方将以人民币14.15亿元的代价,认购总计注册资本人民币4.34亿元,约16.65%天工工具的股权(经投资协议及股权认购协议的认购股权事项而扩大)。

于股权认购事项完成后,公司透过天工香港及天工新材而拥有的股权将由100%下降至82.35%,天工工具将成为公司的间接非全资附属公司。

天工国际表示,由股权认购事项所得的款项将用于偿还天工工具集团日常经营中发生的某些银行贷款,以及用于补充天工工具集团的营运资本及促进其业务发展。

天工工具主要从事制造及销售模具钢、高速钢及切削工具,其于2018年度及2019年度净利润分别为2.24亿元人民币及3.56亿元人民币。

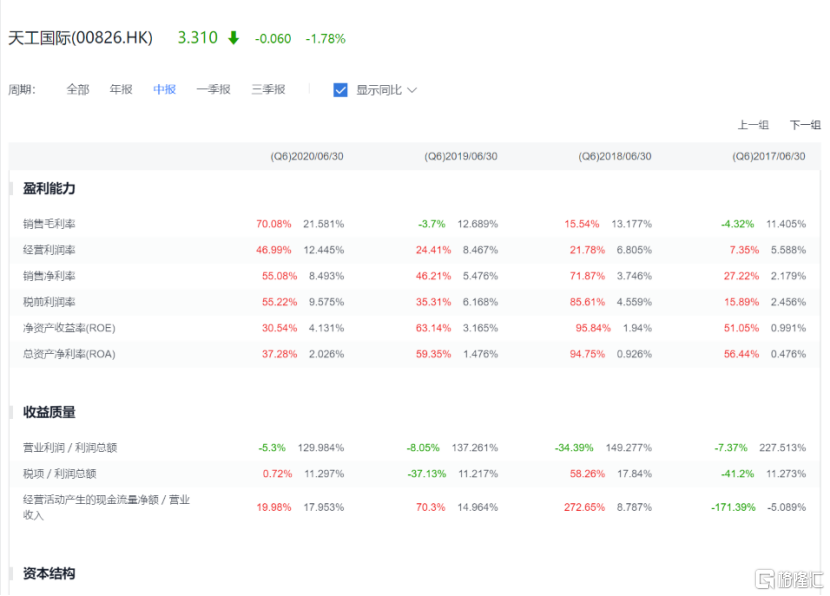

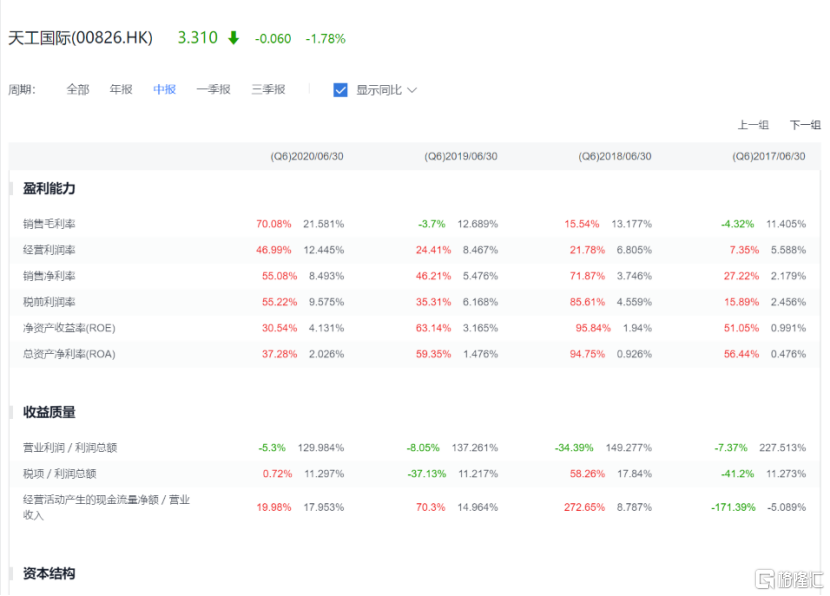

公司财务状况显示,本次股权交易的并非出于经营状况的下滑。

2020Q6,受疫情冲击进出口等因素影响,公司营业额同比下降了10.59%至25.09亿元,但同期毛利率和净利率分别达到21.58%和8.49%,较上年同期分别提升8.89和3.01个百分点。

公司同期经营现金流增加7.27%至4.51亿元,期末现金流净额增加3.02%至5.95亿元,偿债能力指标较上年同期均有所提升。但相比之下,公司应收账款同比增加了14%至27.29亿元,定期存款减少了26.68%至4.22亿元,短期投资减少了24%至314万元。

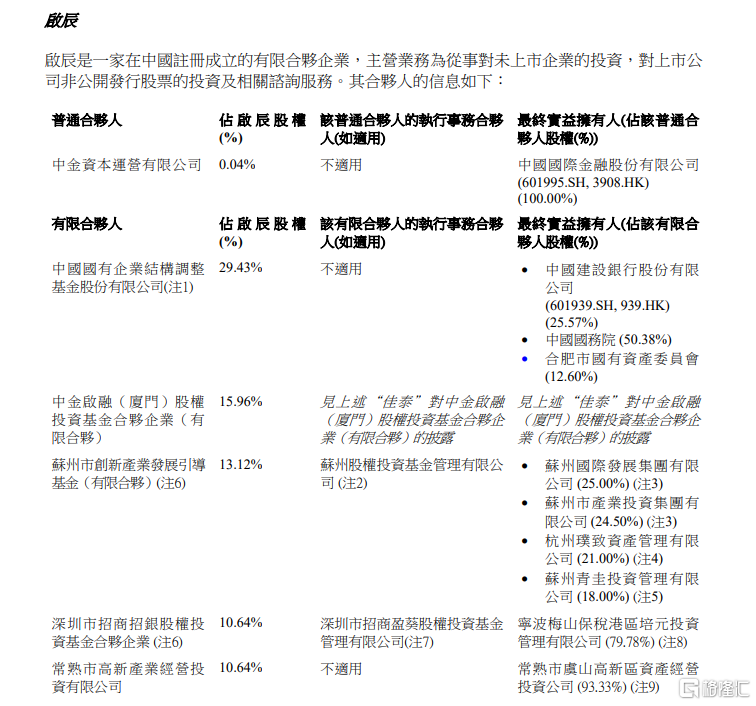

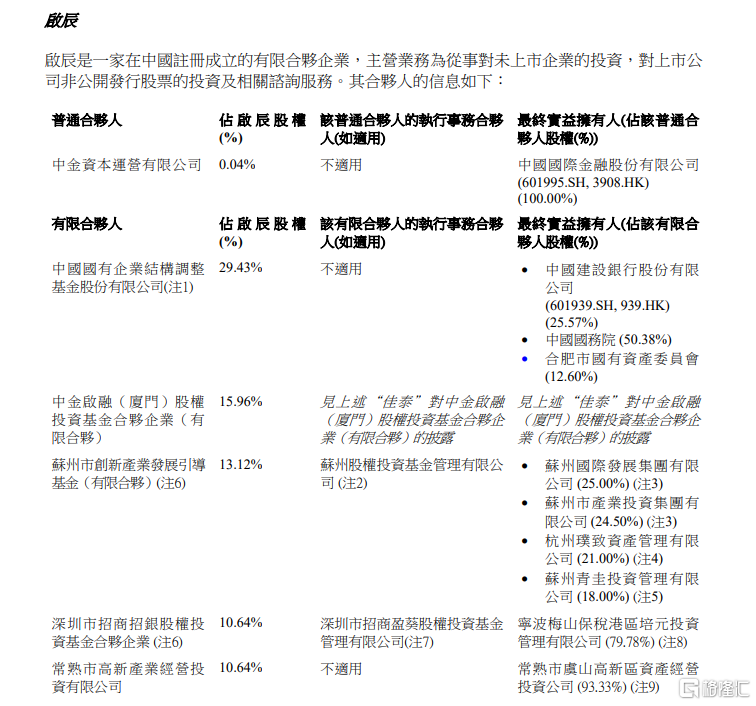

值得注意的是,签署本次协议的投资方由佳泰、启鹭、启辰、金石新材料基金、中国石化资本等共计13家公司机构组成。根据相关信息披露,上述投资方的公司机构具有国资背景。

此外,天工工具与丹阳天一订立了股权认购协议,据此,丹阳天一将以人民币8500万元的代价,认购注册资本人民币2608万元,约1%天工工具的股权(经投资协议及股权认购协议的认购股权事项而扩大)。

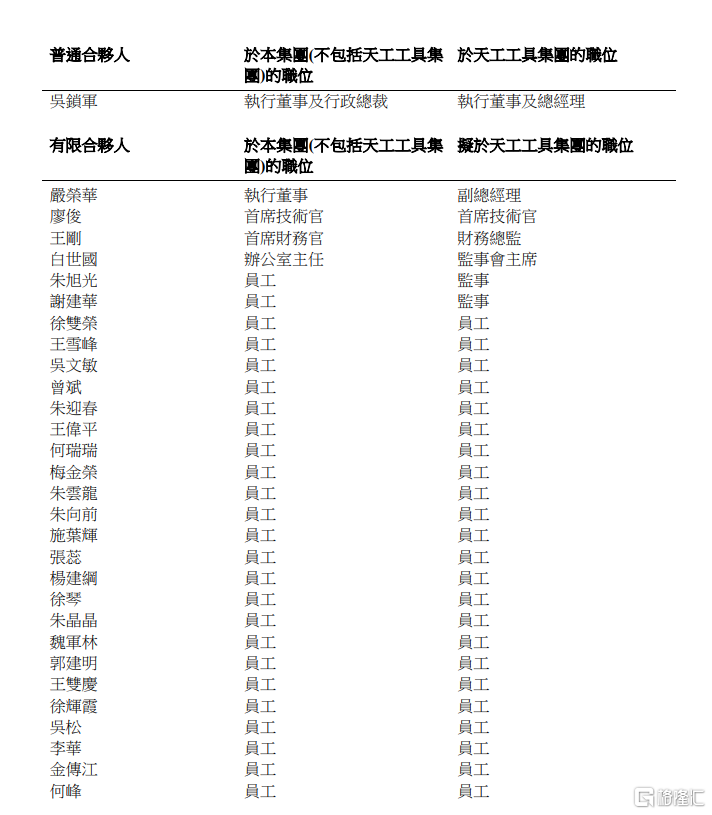

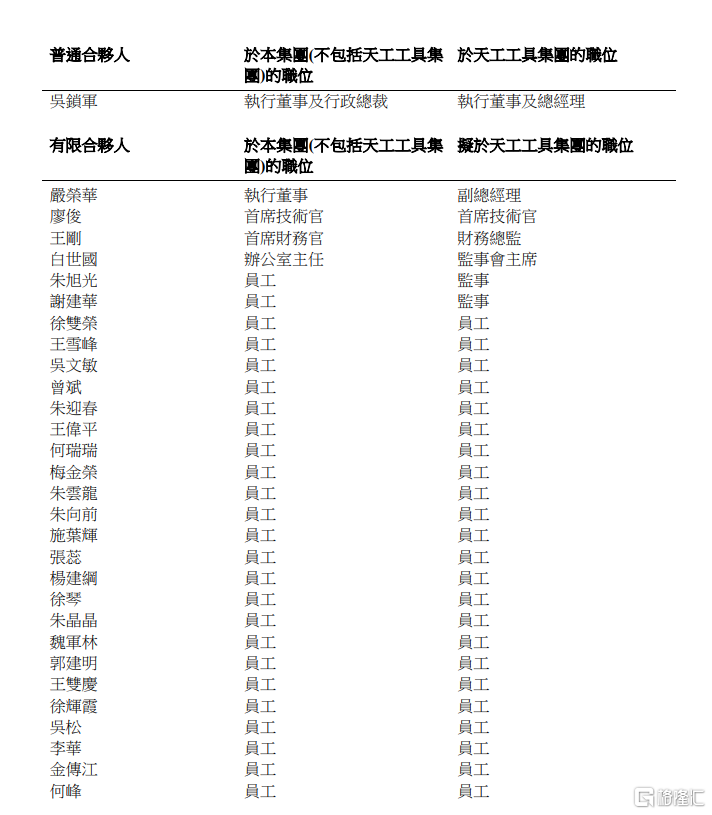

丹阳天一为一家试试员工持股计划为目的投资控股实体,是天工工具某些员工的持股平台,该公司的两名合伙人为丹阳天一的董事,因此本次交易构成天工国际的关联交易。

近6个月以来,天工国际股价较6月份的最低点以上涨近60%。

欧美市场疫情的新一轮冲击,给当地供应和生产带来负面影响。在此背景下,国内制造业细分行业龙头将受益于中国“国产替代”的浪潮,以及部分外国客户需求的增长。

关于天工国际是否赴科创板上市的传言,如今也甚嚣尘上。2019年曾有不少投资者询问公司是否考虑科创板上市。公司虽并未直接证实IPO的有关传闻,但讳莫如深地表示:“公司会综合考虑集团内部发展战略和科创板的发展情况,适时考虑和推进天工股份的转板事宜。”

在A股科创板上市可以通过估值体系靠拢的机制,推动股价上涨,从而扭转公司股价、估值背离的现状,为二级市场投资带来更大的获利空间。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.