面值退市警报再响!8.4万股东能否出逃?

作者:卢丹

来源: 上海证券报

临近岁末,有两只“破面股”再次陷入退市危机:一只是*ST刚泰,至今日已经连续13个交易日收盘价低于1元;一只是*ST金钰,至今日已经连续12个交易日收盘价低于1元。

根据沪深交易所的规则,连续20个交易日收盘价低于1元,上市公司股票将触及终止上市情形。由此可见,两只个股的上市地位已经岌岌可危。

回顾历史,*ST刚泰和*ST金钰均多次打赢过“退市保卫战”。这次,他们俩是依然能起死回生,还是就此挥手告别?

*ST刚泰和*ST金钰危险了!

今日开盘,*ST刚泰一字跌停,至收盘卖一位置仍有24.7万手未消化卖单。至此,*ST刚泰已经连续13个交易日收盘价低于1元面值。

*ST刚泰今日收于0.72元/股,如果该股可以在接下来的7个交易日连续收获涨停,则能够在连续的第20个交易日股价恢复1元以上。

但是,连续7个涨停的难度大家可想而知,今日,*ST刚泰的股吧里已经有不少投资者开始担忧、悔过和懊恼了。

与*ST刚泰相比,*ST金钰的处境相对安全一点。

至今日收盘,*ST金钰收于0.91元/股,连续12个交易日收盘价低于1元。股价恢复至1元以上尚有很高概率。

追溯*ST刚泰和*ST金钰的历史走势,*ST刚泰曾在今年4月份连续13个交易日收盘价低于1元面值,随后连拉涨停得以暂时解除退市危机;*ST金钰则在今年7月份连续12个交易日收盘价低于1元面值,同样借助一波连续涨停脱险。

8.4万户股东 能否出逃尚且未知

根据*ST刚泰2020年三季报披露的股东户数,尚有2.62万户股东持有该股。

根据*ST金钰今年三季报数据,虽然三季度较二季度股东户数明显下降,降幅达33%,但截至三季度末持有*ST金钰的股东户数仍然高达5.76万户。

某大型券商高级投资顾问告诉记者:“今年有不少客户遇到了持仓个股面临退市的情况,基本上是连续挂跌停板价格尽量卖出,不过好在他们持有退市股的市值仅占持仓市值的极小部分,没有遇到炒作退市股的客户。”

年内已有12只个股破面退市

值得一提的是,今年以来已有12只个股触发“面值退市”,数量超过此前历年的案例总和。

若以多年前的眼光来“审美”,这些“面值退市”股基本都符合股价低、市值小、基本面差的“性感指标”。然而时至今日,“性感指标”已成致命缺陷,即便不少个股在首次面对“面值退市危机”时能够化险为夷,然而逃得了一时,逃不了一世,市场的眼睛是雪亮的,等待这些个股下场往往都是退市。

近期,监管层频繁发声提及退市制度改革。业内人士认为,这一重要制度改革将会提高资本市场运行效率,进一步发挥资本市场优胜劣汰、合理配置资源的功能。

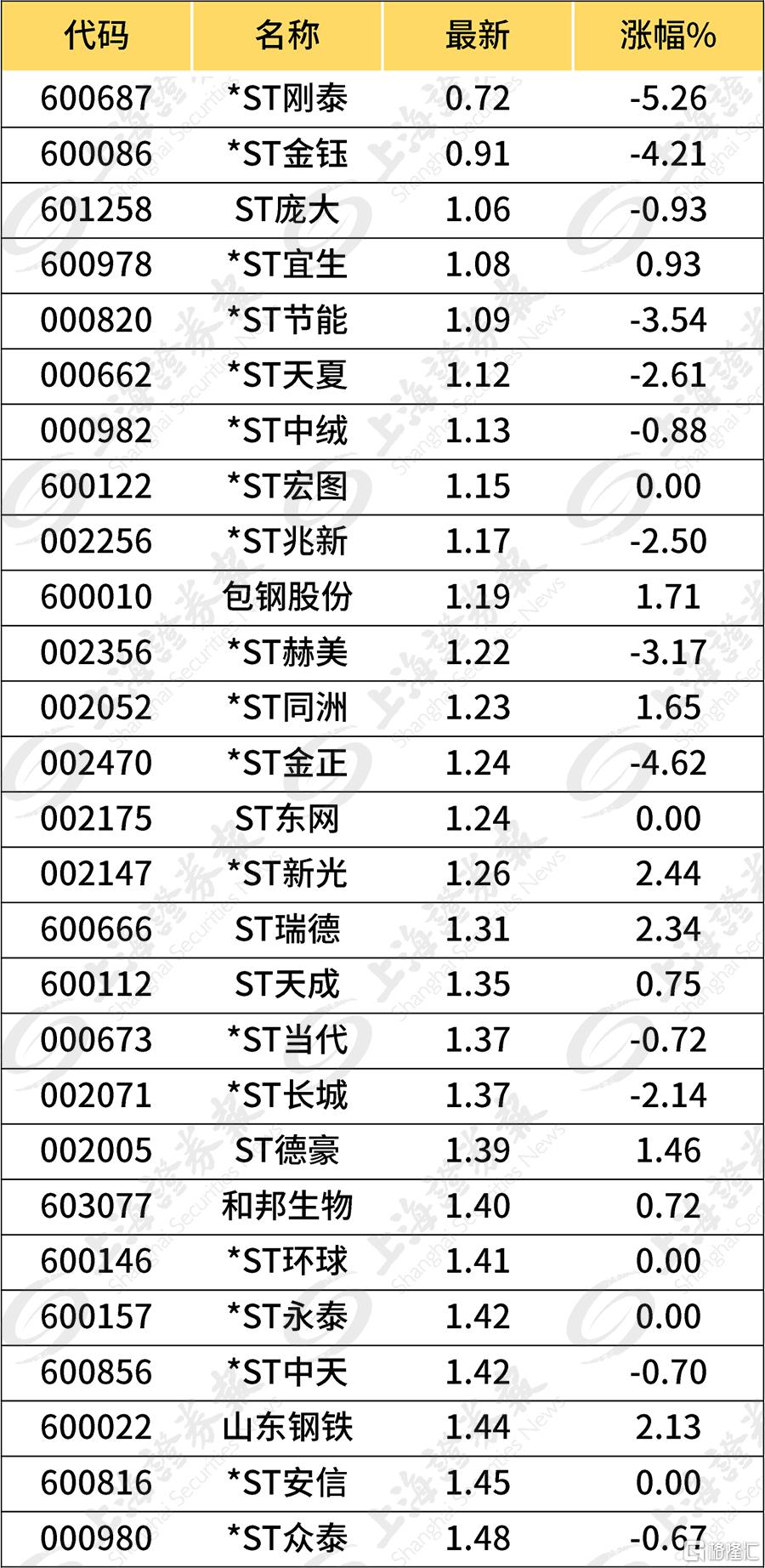

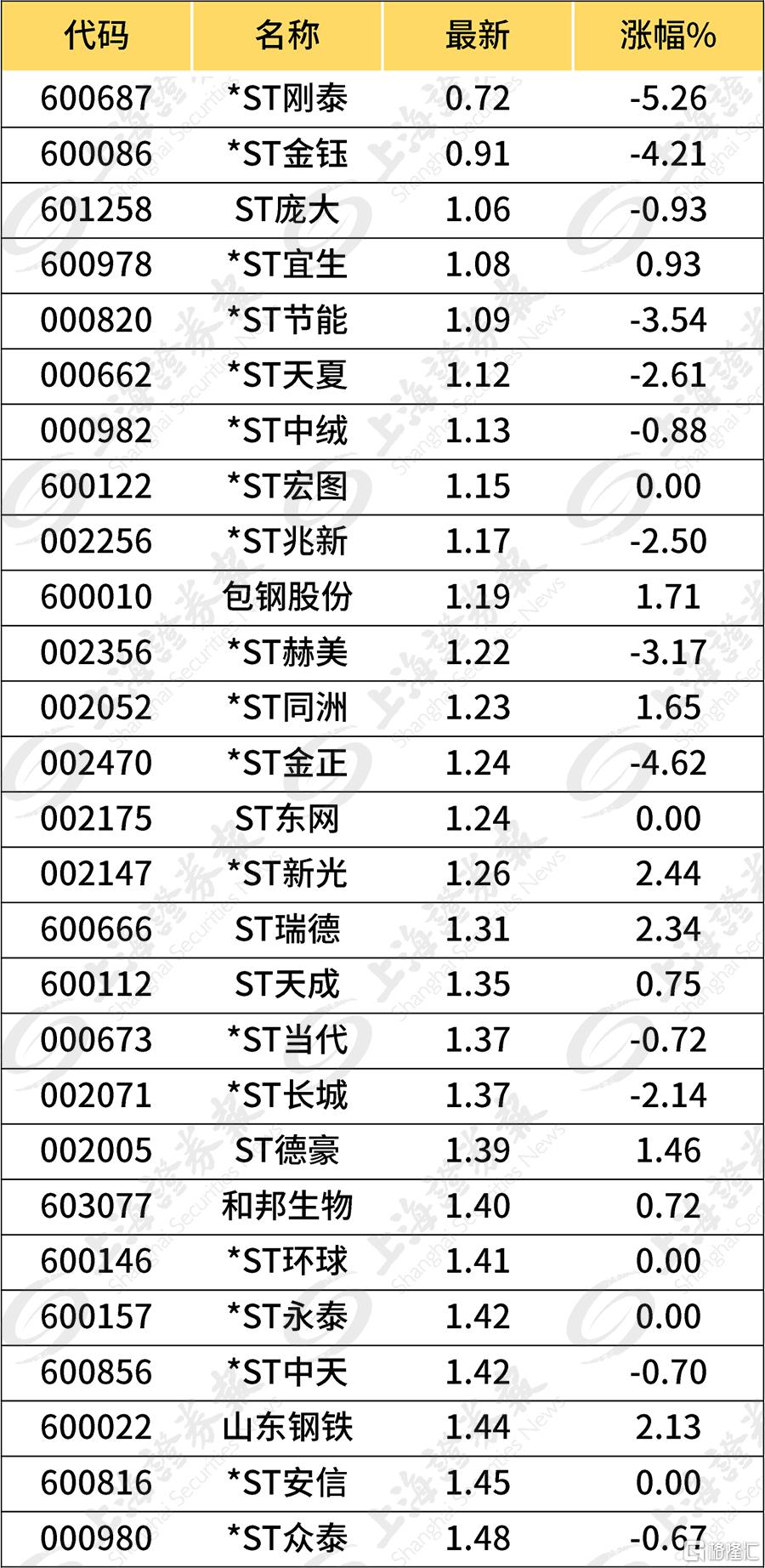

截至今日收盘,根据东方财富Choice数据统计,尚有27只个股收盘价不足1.5元(剔除已进入退市整理期的个股),其中ST和*ST个股数量占比高达88.9%。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.