港股通丨雷军持股数无变动,小米获7亿加仓

北水总结

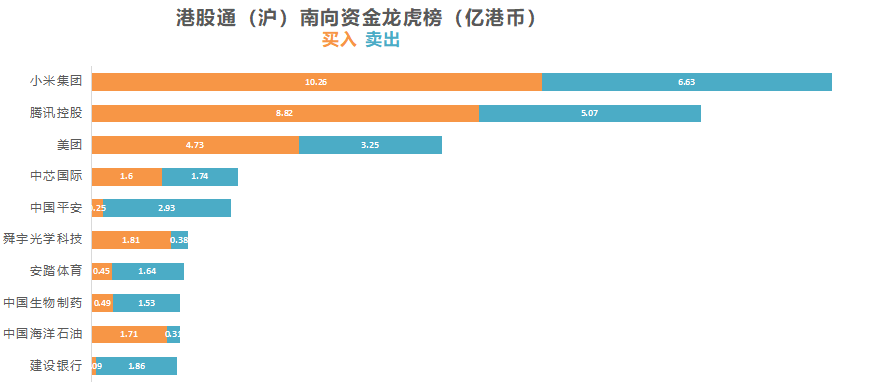

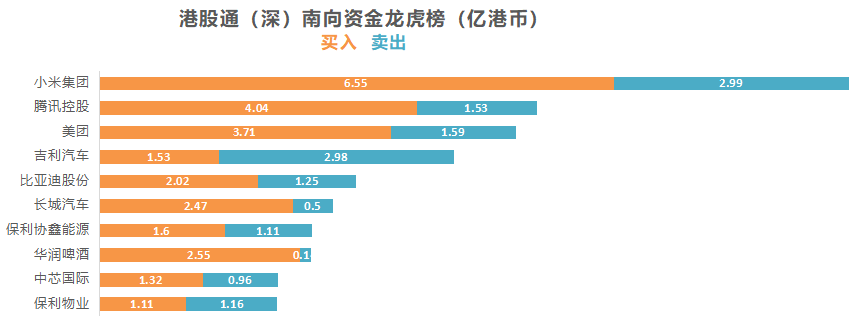

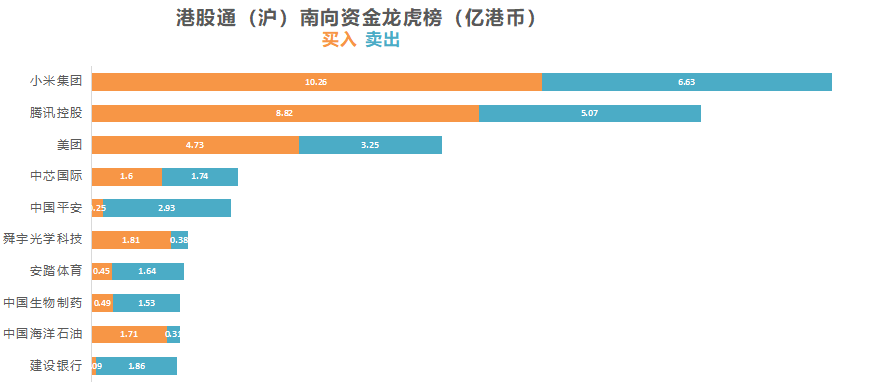

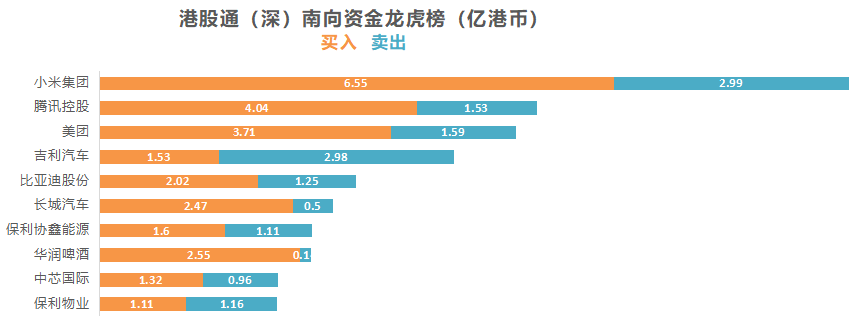

12月8日港股市场,北水净流入30.81亿,其中港股通(沪)净流入10.48亿港元,港股通(深)净流入20.33亿港元。

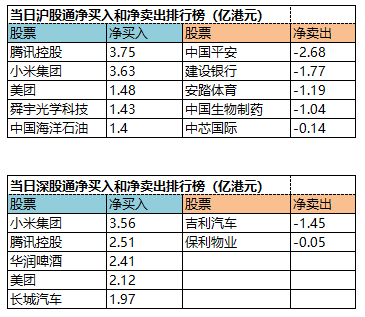

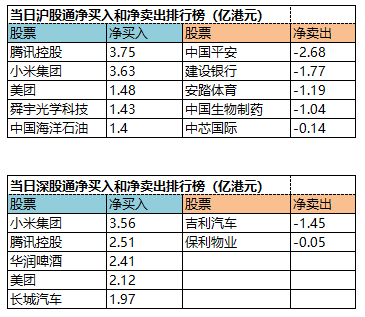

北水净买入最多的个股是小米集团-W(01810)、腾讯(00700)、美团-W(03690)。北水净卖出最多的个股是建设银行(00939)、安踏体育(02020)、中生制药(01177)。

十大成交活跃股

个股点评

汽车股重获北水资金追捧。长城汽车(02333)、比亚迪股份(01211)分别获净买入1.97亿、7714万港元。瑞信发布研究报告称,长城汽车今年11月的批发量达14.5万辆,同比增长26%,按月增长7%,为四年来的高位,大致符合市场预期。而集团11月的销售增长,业高于行业乘用车销售预计同比上升9.3%的预测。

小米集团-W(01810)获净买入7.18亿港元。根据港交所披露显示,小米集团近日披露董事长雷军的股份权益变动,雷军以相同价格进行卖出和认购10亿股。据了解,这是由于小米集团之前采用先旧后新的方式进行增发,雷军的股份变动系为配合增发而进行的相应操作,并不涉及其本人股份的任何减持或增持。

腾讯(00700)获净买入6.26亿港元。小摩称,腾讯控股是全球收入规模第一的线上游戏企业,估计公司游戏业务有强劲增长潜力,相信海外市场属“蓝海市场”,公司可进一步抢占市场份额。

美团-W(03690)获净买入3.59亿港元。据媒体报道,近日,美团关联公司北京三快科技有限公司新增多条商标申请信息,新申请商标包括“美团智慧厨房”、“美团优选便宜有好货”、“小美果园”等。商标国际分类涉及广告销售、教育娱乐、餐饮住宿、科学仪器等。

保利协鑫能源(03800)获净买入4921万港元。交银国际表示,公司FBR(硅烷流床法)伙粒硅项目已具备大规模生产的技术条件。公司当前颗粒硅产能约年产1万吨,公司预计明年下半年有望扩张至年产3万吨,完全达产后年产能达到5.4万吨。

中芯国际(00981)获净买入2183万港元。12月4日,中芯国际发布公告,称中芯控股、国家集成电路基金II和亦庄国投将共同成立合资企业,注册资本50亿美元,准备投资76亿美元,大概折合500亿人民币巨额资金生产12寸集成电路晶圆及集成电路封装系列等。

建设银行(00939)遭净卖出1.76亿港元。12月3日央行、银保监会发布《系统重要性银行评估办法》。花旗发表报告指,今年9月30日,中国人民银行与中银监会发布关于“总损失吸收能力”标准实施的咨询文件,要求中国具有全球系统重要性的银行要实施“总损失吸收能力”的相关标准及要求。

此外,华润啤酒(00291)、舜宇光学(02382)、中海油(00883)分别获净买入2.4亿、1.42亿、1.4亿港元。而中生制药(01177)、安踏体育(02020)分别遭净卖出1.04亿、1.18亿港元。

当日港股通净买入和净卖出排行榜

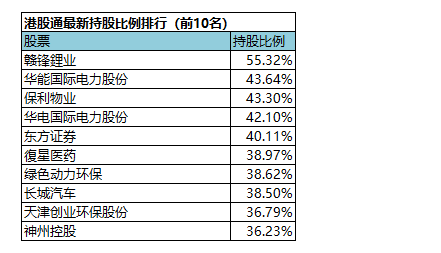

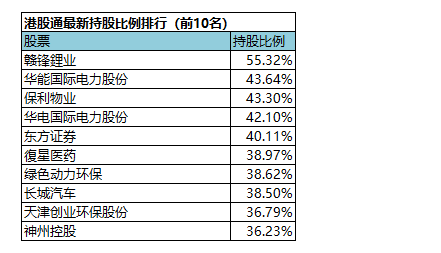

(港股通持股比例排行,交易所数据T+2日结算)

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.