新能源汽车动力电池行业投资策略:全球电动化浪潮,优质供应链受益

格隆汇 09-10 15:14

机构:中信证券

目录:

一、国内:疫情影响减弱,景气已触底回升二、海外:欧洲电动化高速增长,特斯拉继续引领全球三、供应链:海外配套高增长,优质供应链受益四、投资机会五、风险因素

国内电动车:疫情影响,短期承压

国内电动车短期受补贴退坡和疫情影响导致销量下滑

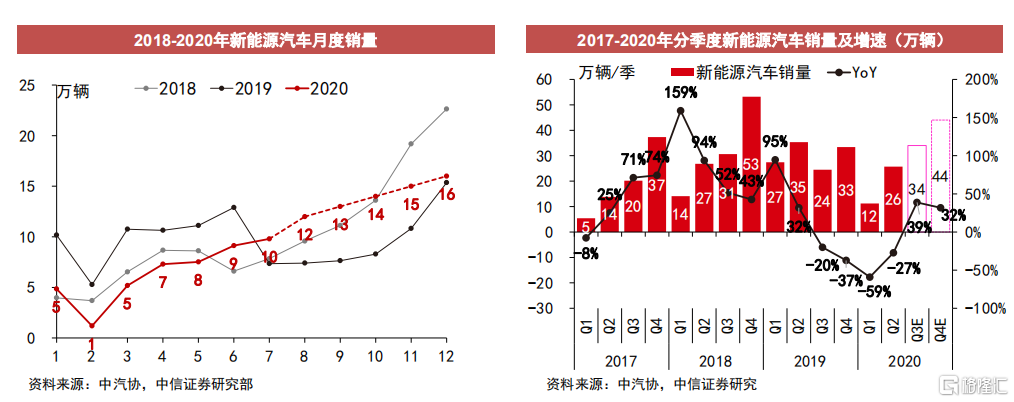

2020年1-6月同比-52%/-76%/-58%/-26%/-21%/-32%,其中2020年Q1销售12万辆(-59%),Q2销售26万辆(-27%)

预计全年销量前低后高:1)政策预期回暖,地方出台消费支持政策(财政补贴、限购指标放开);2)疫情后私家车购买需求提升;3)下半年新车型投放加速。

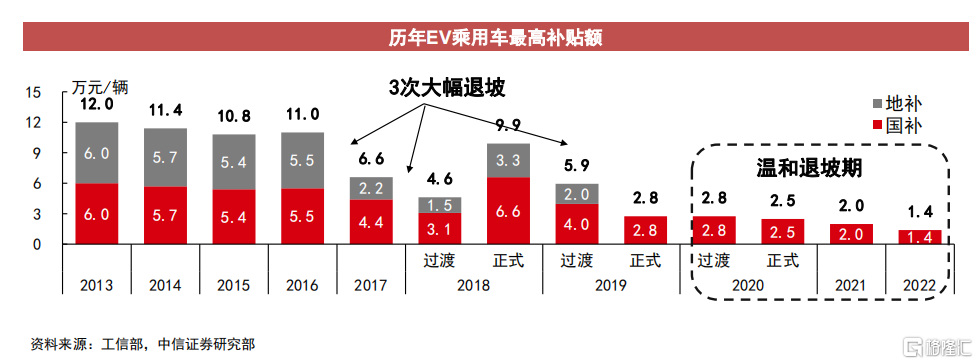

财政补贴被延长,进入温和退坡期

原定2020年底到期的补贴政策延长到2022年底

2020/21/22年退坡10%、20%、30%,节奏平缓

公交、出租网约车等退坡0%、10%、20%

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.